1Department of Commerce, Aligarh Muslim University, Aligarh, Uttar Pradesh, India

2Department of Agricultural Economics and Business Management, Aligarh Muslim University, Aligarh, Uttar Pradesh, India

The present study investigates the determinants contributing to the continuous usage intentions of existing m-wallet users. The current study’s conceptual framework is based on the notion of stimulus organism response. Data from existing m-wallet users were collected using a carefully designed questionnaire. Once the data’s authenticity and reliability were confirmed, structural equation modelling (SEM) analysis was executed. The findings of the SEM analysis indicated that the users’ attitudes towards the m-wallet platform are positively influenced by cybersecurity knowledge, perceived usefulness, compatibility, facilitating conditions, convenience and touch-free transactions. Moreover, it has been shown that attitude has a beneficial influence on users’ intentions to continue using the m-wallet platform. The current study provides practical consequences and recommendations for m-wallet service providers and marketers. These suggestions can assist in developing strategies for m-wallet usage, holding onto current users and influencing potential users on the platform.

Mobile wallets, touch-free transactions, stimulus organism response model, cybersecurity knowledge, consumer attitude, continuous usage intention

Abawajy, J. (2014). User preference of cyber security awareness delivery methods. Behaviour & Information Technology, 33(3), 237–248. https://doi.org/10.1080/0144929X.2012.708787

Afzal, M., Ansari, Mohd. S., Ahmad, N., Shahid, M., & Shoeb, Mohd. (2024). Cyberfraud, usage intention, and cybersecurity awareness among e-banking users in India: An integrated model approach. Journal of Financial Services Marketing, 29(4), 1503–1523. https://doi.org/10.1057/s41264-024-00279-3

Anderson, J. C., & Gerbing, D. W. (1988). Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin, 103(3), 411.

Auer, R., Cornelli, G., & Frost, J. (2020). Covid-19, cash, and the future of payments. Bank for International Settlements.

Baabdullah, A. M., Alalwan, A. A., Rana, N. P., Kizgin, H., & Patil, P. (2019). Consumer use of mobile banking (m-banking) in Saudi Arabia: Towards an integrated model. International Journal of Information Management, 44, 38–52.

Chawla, D., & Joshi, H. (2019). Consumer attitude and intention to adopt mobile wallet in India–An empirical study. International Journal of Bank Marketing, 37(7), 1590–1618.

Chawla, D., & Joshi, H. (2020). The moderating role of gender and age in the adoption of mobile wallet. Foresight, 22(4), 483–504.

Chawla, D., & Joshi, H. (2021). Importance-performance map analysis to enhance the performance of attitude towards mobile wallet adoption among Indian consumer segments. Aslib Journal of Information Management, 73(6), 946–966.

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3), 319–340.

Esawe, A. T. (2022). Understanding mobile e-wallet consumers’ intentions and user behavior. Spanish Journal of Marketing-ESIC, 26(3), 363–384.

Fahad, & Shahid, M. (2022). Exploring the determinants of adoption of Unified Payment Interface (UPI) in India: A study based on diffusion of innovation theory. Digital Business, 2(2), 100040. https://doi.org/10.1016/j.digbus.2022.100040

Fornell, C., & Bookstein, F. L. (1982). Two structural equation models: LISREL and PLS applied to consumer exit-voice theory. Journal of Marketing Research, 19(4), 440–452.

George, A., & Sunny, P. (2021). Developing a research model for mobile wallet adoption and usage. IIM Kozhikode Society & Management Review, 10(1), 82–98.

Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2006). Multivariate data analysis

(6th ed.). Pearson Prentice Hall.

Hameed, S., & Nigam, A. (2023). Exploring India’s generation Z perspective on AI enabled internet banking services. Foresight, 25(2), 287–302.

Hasan, A., & Gupta, S. K. (2020). Exploring tourists’ behavioural intentions towards use of select mobile wallets for digital payments. Paradigm, 24(2), 177–194.

Hu, L., & Bentler, P. M. (1999). Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modeling: A Multidisciplinary Journal, 6(1), 1–55.

Islam, J. U., Shahid, S., Rasool, A., Rahman, Z., Khan, I., & Rather, R. A. (2020). Impact of website attributes on customer engagement in banking: A solicitation of stimulus-organism-response theory. International Journal of Bank Marketing, 38(6), 1279–1303. https://doi.org/10.1108/IJBM-12-2019-0460

Kapoor, A., Sindwani, R., Goel, M., & Shankar, A. (2022). Mobile wallet adoption intention amid COVID-19 pandemic outbreak: A novel conceptual framework. Computers & Industrial Engineering, 172, 108646. https://doi.org/10.1016/j.cie.2022.108646

Karjaluoto, H., Glavee-Geo, R., Ramdhony, D., Shaikh, A. A., & Hurpaul, A. (2021). Consumption values and mobile banking services: Understanding the urban–rural dichotomy in a developing economy. International Journal of Bank Marketing, 39(2), 272–293. https://doi.org/10.1108/IJBM-03-2020-0129

Kaur, P., Dhir, A., Bodhi, R., Singh, T., & Almotairi, M. (2020). Why do people use and recommend m-wallets? Journal of Retailing and Consumer Services, 56, 102091. https://doi.org/10.1016/j.jretconser.2020.102091

Kim, J., & Lennon, S. J. (2013). Effects of reputation and website quality on online consumers’ emotion, perceived risk and purchase intention: Based on the stimulus-organism-response model. Journal of Research in Interactive Marketing, 7(1), 33–56. https://doi.org/10.1108/17505931311316734

Kim, M. J., Lee, C.-K., & Jung, T. (2020). Exploring consumer behavior in virtual reality tourism using an extended stimulus-organism-response model. Journal of Travel Research, 59(1), 69–89. https://doi.org/10.1177/0047287518818915

Le, X. C. (2021). The diffusion of mobile QR-code payment: An empirical evaluation for a pandemic. Asia-Pacific Journal of Business Administration, 14(4), 617–636. https://doi.org/10.1108/APJBA-07-2021-0329

Limna, P., Kraiwanit, T., & Siripipattanakul, S. (2023). The relationship between cyber security knowledge, awareness and behavioural choice protection among mobile banking users in Thailand. International Journal of Computing Sciences Research, 7, 1133–1151.

Lin, R.-R., & Lee, J.-C. (2023). The supports provided by artificial intelligence to continuous usage intention of mobile banking: Evidence from China. Aslib Journal of Information Management, 76(1). https://doi.org/10.1108/AJIM-07-2022-0337

Madan, K., & Yadav, R. (2016). Behavioural intention to adopt mobile wallet: A developing country perspective. Journal of Indian Business Research, 8(3), 227–244.

Mallat, N. (2007). Exploring consumer adoption of mobile payments: A qualitative study. The Journal of Strategic Information Systems, 16(4), 413–432. https://doi.org/10.1016/j.jsis.2007.08.001

Mehrabian, A., & Russell, J. A. (1974). An approach to environmental psychology. The MIT Press.

Mohd Thas Thaker, H., Subramaniam, N. R., Qoyum, A., & Iqbal Hussain, H. (2023). Cashless society, e-wallets and continuous adoption. International Journal of Finance & Economics, 28(3), 3349–3369.

Mombeuil, C. (2020). An exploratory investigation of factors affecting and best predicting the renewed adoption of mobile wallets. Journal of Retailing and Consumer Services, 55, 102127. https://doi.org/10.1016/j.jretconser.2020.102127

Ng, S. L., Rezaei, S., Valaei, N., & Iranmanesh, M. (2024). Modelling services continuance intention: Evidence from apps stores. Asia-Pacific Journal of Business Administration, 16(2), 256–281. https://doi.org/10.1108/APJBA-08-2021-0408

Oliveira, T., Thomas, M., Baptista, G., & Campos, F. (2016). Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Computers in Human Behavior, 61, 404–414. https://doi.org/10.1016/j.chb.2016.03.030

Pattnaik, P. N., & Shukla, M. K. (2021). Examining the impact of relational benefits on continuance intention of PBS services: Mediating roles of user satisfaction and engagement. Asia-Pacific Journal of Business Administration, 14(4), 637–657. https://doi.org/10.1108/APJBA-03-2021-0123

Podsakoff, P. M., MacKenzie, S. B., Lee, J.-Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879–903. https://doi.org/10.1037/0021-9010.88.5.879

Podsakoff, P. M., & Organ, D. W. (1986). Self-reports in organisational research: Problems and prospects. Journal of Management, 12(4), 531–544.

Prasad, S., Gupta, I. C., & Totala, N. K. (2017). Social media usage, electronic word of mouth and purchase-decision involvement. Asia-Pacific Journal of Business Administration, 9(2), 134–145. https://doi.org/10.1108/APJBA-06-2016-0063

Qu, B., Wei, L., & Zhang, Y. (2022). Factors affecting consumer acceptance of electronic cash in China: An empirical study. Financial Innovation, 8(1), 1–19.

Rahman, M., Ismail, I., & Bahri, S. (2020). Analysing consumer adoption of cashless payment in Malaysia. Digital Business, 1(1), 100004. https://doi.org/10.1016/j.digbus.2021.100004

Sankaran, R., & Chakraborty, S. (2022). Factors impacting mobile banking in India: Empirical approach extending UTAUT2 with perceived value and trust. IIM Kozhikode Society & Management Review, 11(1), 7–24. https://doi.org/10.1177/2277975220975219

Sarmah, R., Dhiman, N., & Kanojia, H. (2021). Understanding intentions and actual use of mobile wallets by millennial: An extended TAM model perspective. Journal of Indian Business Research, 13(3), 361–381.

Shankar, A., & Rishi, B. (2020). Convenience matter in mobile banking adoption intention? Australasian Marketing Journal, 28(4), 273–285.

Sharma, A., Dwivedi, Y. K., Arya, V., & Siddiqui, M. Q. (2021). Does SMS advertising still have relevance to increase consumer purchase intention? A hybrid PLS-SEM-neural network modelling approach. Computers in Human Behavior, 124, 106919. https://doi.org/10.1016/j.chb.2021.106919

Shetu, S. N., Islam, Md. M., & Promi, S. I. (2022). An empirical investigation of the continued usage intention of digital wallets: The moderating role of perceived technological innovativeness. Future Business Journal, 8(1), 43. https://doi.org/10.1186/s43093-022-00158-0

Shin, D.-H. (2009). Towards an understanding of the consumer acceptance of mobile wallet. Computers in Human Behavior, 25(6), 1343–1354. https://doi.org/10.1016/j.chb.2009.06.001

Singh, N., Sinha, N., & Liébana-Cabanillas, F. J. (2020). Determining factors in the adoption and recommendation of mobile wallet services in India: Analysis of the effect of innovativeness, stress to use and social influence. International Journal of Information Management, 50, 191–205. https://doi.org/10.1016/j.ijinfomgt.2019.05.022

Singh, N., Srivastava, S., & Sinha, N. (2017). Consumer preference and satisfaction of M-wallets: A study on North Indian consumers. International Journal of Bank Marketing, 35(6), 944–965.

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 27(3), 425–478. https://doi.org/10.2307/30036540

Zhu, B., Kowatthanakul, S., & Satanasavapak, P. (2020). Generation Y consumer online repurchase intention in Bangkok: Based on stimulus-organism-response (SOR) model. International Journal of Retail & Distribution Management, 48(1), 53–69. https://doi.org/10.1108/IJRDM-04-2018-0071

Zwilling, M., Klien, G., Lesjak, D., Wiechetek, .png) ., Cetin, F., & Basim, H. N. (2022). Cyber security awareness, knowledge and behavior: A comparative study. Journal of Computer Information Systems, 62(1), 82–97. https://doi.org/10.1080/08874417.2020.1712269

., Cetin, F., & Basim, H. N. (2022). Cyber security awareness, knowledge and behavior: A comparative study. Journal of Computer Information Systems, 62(1), 82–97. https://doi.org/10.1080/08874417.2020.1712269

Appendix

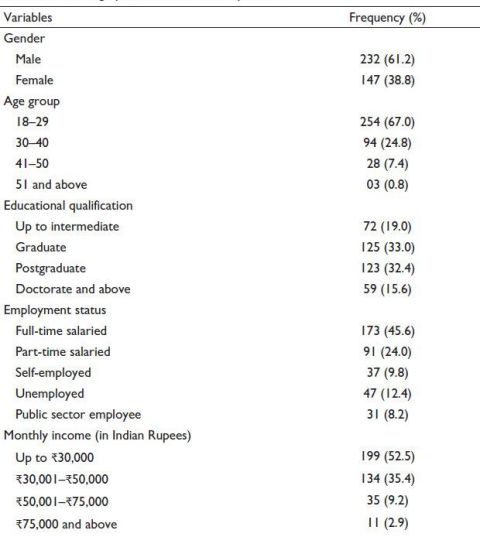

Table A1. Demographic Details of the Respondents.