1Department of Management, Brainware University, Kolkata, West Bengal, India

2Adamas University, Kolkata, West Bengal, India

3Aligarh Muslim University, Murshidabad Centre, Murshidabad, West Bengal, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

The Indian stock market and the investors’ confidence level was affected badly by COVID-19 crisis. World Business Council for Sustainable Development (2020) had stated that investor decision-making at the present time is influenced by the sustainability orientation of the companies. In the context of COVID-19 crisis, it is important to project investor behaviour in the post-lockdown phase to understand the stock market potential. This research has attempted to perceive the status of economic resurgence with respect to two Bombay Stock Exchange (BSE) green indices, that is, CARBONEX and GREENEX. A comparative analysis of such indices has been performed over the lockdown and unlockdown phases until 20 July 2021. This research attempted to find if the indices were significantly different in lockdown and unlockdown phases. A significant mean variance would indicate development in sustainable business operations since lockdown period and an increment in such values would draw better investment in Indian stock market in future, even amid further mild COVID waves with partial lockdowns. One-way between-the-groups ANOVA has been performed to see if the means of CARBONEX and GREENEX indices are significantly varying in the aforementioned phases. A significant variance will help the Indian investors to look forward to the post-COVID economic reinstatement.

COVID-19, BSE CARBONEX, BSE GREENEX, lockdown, unlockdown, investor behavior

Introduction

The concept of sustainability in business emerged in 1987 as it was documented in UN World Commission on Environment and Development (Brundtland Commission Report). The essence of sustainability lies within environmental and social goals along with economic development. The concept of sustainability is equally applicable in a lower-middle income country like India. In recent days, traders across the world are thinking of going green and are trying to align their benevolent perspectives with strategic excellence (Martensen & Dahlgaard, 2009). Business houses are experiencing a swing nowadays from mere profit maximisation to socio-economic value addition (Kootanaee, 2014).

As mentioned, the consciousness about the values of sustainable practices in the business domain is growing. Business practices like decreasing pollution, enhancing energy efficiency, waste reductions, and so on, are being considered by organisations as cost-saving measures (Shields, 2015). The goal is obtained through the introduction of new products, increasing market share, retention of assets, and other forms of value creations (Sacuia & Dumitru, 2013). The sustainability initiatives which create value for the organisations are worth being nurtured by the corporate sector over a long period of time.

The world is going through an unprecedented crisis related to coronavirus disease that originated in 2019 (COVID-19) in China. The entire world had witnessed an economic slowdown due to the ‘lockdown’ process to minimise the contagious and virulent effects of the deadly pathogen.

The environmental quality had improved worldwide during the lockdown period. Reports from various countries confirm the significant reduction in NOx (nitrogen oxides) and particulate matter (the dust particles) (Sicard et al., 2020). Air quality in the Indian capital New Delhi improved remarkably during this lockdown period (Mahato et al., 2020). In northern India, air pollution reached the 20-year minimum (Gautam, 2020) during the lockdown phase due to the first wave of coronavirus.

The development of air quality could be a result of the reduction of pollutants from transport sources as well as industrial sources. As a result of surface transport cessation during the lockdown period, it is quite evident that air quality improvement was a direct impact of reduced air pollutant emission from vehicles. In addition to that, reduced industrial activities had brought down the impact across 22 cities in India ‘around 43, 31, 10, and 18% decrease’ in particulate matter, carbon dioxide, and nitrogen dioxide—the major air pollutants (Sharma et al., 2020, p. 1).

This environmental quality improvement is, however, a temporary phenomenon attributed to an unprecedented economic deadlock situation and cannot be attributed to the green performance of manufacturing units all over India. As the major manufacturing companies were either closed or reduced their scale of operation, the green business performance was affected during this lockdown phase.

At the same time, the COVID-19 crisis had a telling impact upon the stock market and investors’ confidence level. Since the beginning of March 2020, the downslide both in SENSEX and NIFTY had been remarkable and worrisome for the Indian economy (Singh & Neog, 2020). However, the revival in these market capitalisation indices has been observed of late since the effect of COVID-19 has faded away to some extent on Indian economy due to progress in vaccination programs (Thomas, 2022).

It is noteworthy that investor decision-making at the present time is influenced by the sustainability orientation of the companies (World Business Council for Sustainable Development, 2020). Investors across the world are more focused on sustainability reporting to understand the sustainable behaviour of the companies (McKinsey & Company, 2019).

This research has attempted to explore the performance of CARBONEX and GREENEX—the green and socially responsible indicators of stock performance. A comparative analysis of these indices has been performed across the three phases until July 2021—the lockdown, unlockdown as well as partial state-wise lockdown, to see if any change has happened in investment patterns over these phases of environmental quality changes.

Review of Literature

The review of literature tries to address the research problems mentioned in the preceding section of this article.

If the positive environmental practices increase in an organisation, then higher economic advantage will also be attained (Wagner, 2013). Hence, the enhanced environmental contribution by the Indian organisations may lead to long-term economic benefit superseding the detrimental effect of COVID-19 debacle.

Investors in India are well guided by the index providing an idea about environmental risk mitigation—the S&P BSE CARBONEX that helps in understanding the risk associated with climate-changing performance of the companies. This is as efficient as BSE SENSEX for investor decision making (Bhandari et al., 2020). Similarly, BSE GREENEX—the greenhouse gas-emission performance indicator of BSE-listed companies also guides the investors to invest in the companies posing lesser threat to the environment (Bhattacharya, 2013). There have been some criticisms for these indices as well. GREENEX and CARBONEX have been referred as the immature indices still in its nascence (Sharma & Jasuja, 2020). However, due to the low volatility of GREENEX, the environment-conscious investors are more focused on this index (Choudhary & Jain, 2018). Most significantly, these socially inclined indices have drawn better investment in Indian economy compared to its market-capitalisation-based counterparts like SENSEX and NIFTY during previous stock market crisis periods (Tripathi & Bhandari, 2015).

Identified Research Gap

In the context of COVID-19 crisis, it is important to understand the investor behaviour in the post-lockdown phase as well as repeated partial lockdown phase of COVID second wave. The post-lockdown phase is characterised by 10 unlockdown phases (June 2020 to March 2021) right before the COVID second wave. Further implementation of first state-wise lockdown in April 2021 during the second wave was observed in the state of Maharashtra and National Capital Region (NCR) of Delhi (The Indian Express, 2021). It was expected that the positive change in capital investment would take place during the unlockdown phases. However, it is essential to understand the alternate patterns of the recovery or downturn in Indian economy during pandemic. This research has made an attempt to identify the trend of economic journey with respect to CARBONEX and GREENEX during this COVID turmoil and the future of equity investment influenced by green indices over the conventional market capitalisation indices.

Problem Statement and Research Question

In consideration of the above factors, that is, the investor orientation towards the sustainability practices as well as the ill effect of COVID-19 on Indian stock market, the research question has emerged whether the green and sustainable business practices could possibly raise the investors’ confidence level in the post-lockdown phase after the first wave?

There was a second wave of COVID-19 in India which started gearing up since March 2021 and finally attained a horrific peak in May 2021. Amid huge loss of lives, many Indian state governments had to take the ‘lockdown’ measure to control the pandemic breakout. Therefore, the research question further focuses if the green business performance could retain the investors’ confidence during COVID-19 resurgence.

Research Design and Methodology

On the basis of research problem as well as identified research gap, this study is designed to identify if the sustainable business indices are regaining their health effectively since the COVID-19 lockdown in March 2020 or not. A comparative analysis of such indices has been performed across the lockdown, unlockdown as well as partial state-wise lockdown phases until July 2021. The variances of the mean indices values have been observed and are tested to see if the variance is significant or not. A significant variance would indicate substantial development in sustainable business practices across the various COVID-19 restrictive phases and an increment in such values would potentially draw better investment in Indian stock market with a possibility of resurgence of Indian stock market scenario.

Data Analysis and Interpretations

Pattern of CARBONEX in Lockdown, Unlockdown, and Partial Lockdown Phases

One-way between-the groups ANOVA has been used to identify if the means of CARBONEX Index are significantly varying in lockdown and unlockdown phases. Through the analysis, it has been attempted to ascertain whether the change is CARBONEX values over the aforementioned time frames are just happening due to chance and whether the change is statistically significant or not. Moreover, if happening by chance, this type of change cannot motivate the investors to invest in the Indian stock market in anticipation of resurgence from the ongoing crisis period, hence leading towards further economic stagnation or slowdown. However, if CARBONEX shows a significant change along with the lockdown–unlockdown–partial lockdown phases, the investors can expect a better carbon-emission performance of the Indian manufactures when the pandemic situation will improve, hence, ascertaining better investment by the sustainability-conscious investors of India.

In this context, the null hypothesis (H0) is assumed as,

H0: The variance of CARBONEX value is not significant in lockdown, unlockdown, and partially lockdown phases in India.

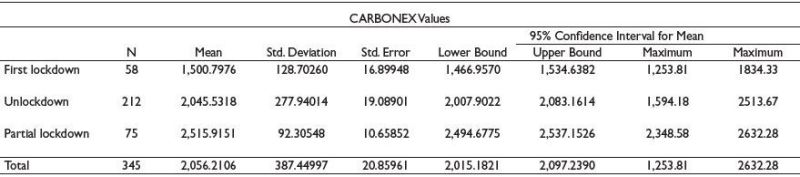

The descriptive statistics are listed in Table 1.

The maximum mean value is observed in partial lockdown phase (data obtained since April 1, 2021). The lowest index value is observed in lockdown phase as expected due to crippled industrial operations. The standard deviation is maximum during unlockdown period as the industries were not operating in full capacity (were operating in phases) and carbon emission control protocols might not have been implemented as per the standards. The standard deviation is fairly low at the later stages with clear indication of operational recovery and consistency even amid the partial lockdown.

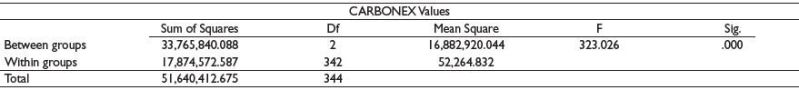

Table 2 shows that our calculated F ratio (323.026) is significant with p = .000 at the 0.05 alpha level. Therefore, the null hypothesis that sates that ‘the variance of CARBONEX value is not significant both in lockdown and unlockdown phases in India’ is not accepted. This research thus identifies that the mean CARBONEX values varied significantly according to the change in the lockdown status.

Table 1. Descriptive Statistics.

Source: The authors.

Table 2. ANOVA.

Source: The authors.

Source: The authors.

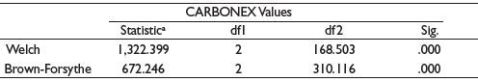

Table 3. Robust Tests of Equality of Means.

Source: The authors.

Note: aAsymptotically F distributed.

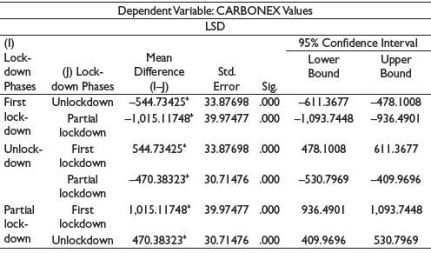

Table 4. Multiple Comparisons.

Source: The authors.

Note: *The mean difference is significant at the 0.05 level.

Both the Welch and Brown-Forsythe Tests (the tests that check homogeneity of variance and confirm robustness in ANOVA) are statistically significant at p>.05 (Table 3); hence, the null hypothesis that there is no statistically significant difference in the means is not accepted. Therefore, it can be concluded that the mean difference is statistically significant.

Table 4 shows the mean difference of CARBONEX values between all phases (lockdown, unlockdown, and partial lockdown). Of note, the mean differences have been significant in case of all phases—between unlockdown (June 2020 to March 2021) and partial lockdown (April 2021 to July 2021); first lockdown and unlockdown; as well as first lockdown and unlockdown at 95% confidence level.

Pattern of GREENEX in Lockdown, Unlockdown, and Partial Lockdown Phases

The same method has been applied in case of another sustainability index, that is, GREENEX. The null hypothesis (H0) is assumed,

H0: the variance of GREENEX value is not significant in lockdown, unlockdown, and partially lockdown phases in India.

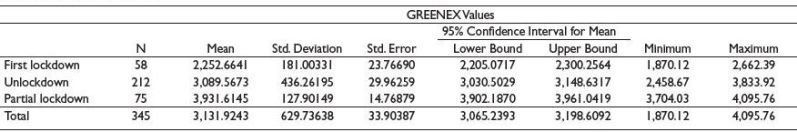

The descriptive statistics are illustrated in Table 5. The maximum mean value is found in partial lockdown phase (data obtained since April 1, 2021). The lowest index value is found in lockdown phase as expected due to lack of industrial operations. The standard deviation is maximum during unlockdown period as the industries were operating in suboptimal capacity (were operating in sequential phases) and carbon emission control protocols were not practiced to the optimum level. The standard deviation is fairly low at present with clear indication of operational recovery and consistency amid the partial lockdown in many industrially developed states.

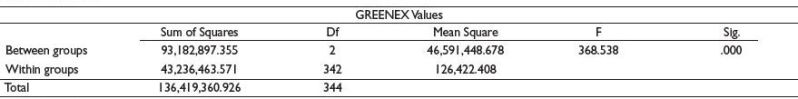

Our calculated F ratio (368.538) (Table 6) is significant with p = .000 at the 0.05 alpha level. Therefore, the null hypothesis is not accepted. This research therefore concludes that the mean GREENEX values varied significantly across the change in lockdown stages. Hence, the unlockdown process has rejuvenated the greenhouse gas emission management status of Indian industries.

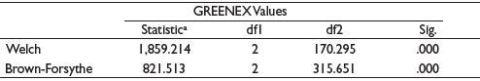

Both the Welch and Brown-Forsythe Tests are statistically significant at p>.05 (Table 7); hence, the null hypothesis that there is no statistically significant difference in the means is not accepted. Therefore, it can be concluded finally that the mean difference is statistically significant.

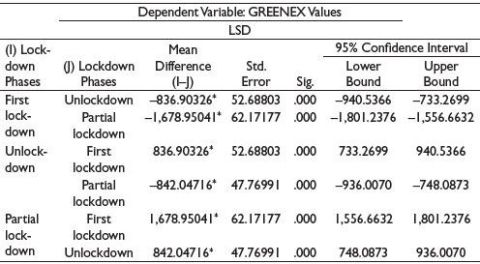

Table 8 shows the mean difference of GREENEX values between all phases (lockdown, unlockdown, and partial lockdown). Of note, the mean differences have been significant in case of all phases at 95% confidence level.

Conclusion

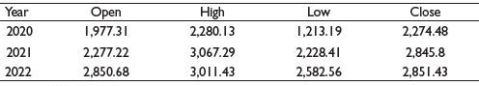

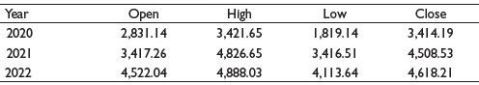

The significant changes in CARBONEX and GREENEX over the consecutive post-lockdown phases (unlockdown and partial lockdown) had brought a silver line for Indian economy, which had been badly affected by the COVID-19 crisis. The pattern shown in this research will probably draw environment-conscious investor attention towards capital investment in India as the investors will be prone to invest if they find that the companies are practising sustainability. Carbon emission reduction and green business practices had evidently influenced investor decision as shown in this research with the varied values of green indices. However, the other control variables like third wave of Omicron COVID (January 2022) as well as Government’s decision on borrowings of the listed companies might have played a significant role in moderating the investor behaviour in reality. Nevertheless, the scenario with respect to the environment-friendly indices has definitely been encouraging as shown in Tables 9 and 10.

This research outcome has another dimension as well. If any further wave of COVID-19 becomes even more detrimental with ‘complete lockdown’, it will have impact on these sustainability equity indices for Indian stock market and can further retard the positive investor behaviour. Otherwise, the partial lockdown will not hinder the green business performance and will not affect Indian economy.

Table 5. Descriptive Statistics.

Source: The authors.

Table 6. ANOVA.

Source: The authors.

Table 7. Robust Tests of Equality of Means.

Source: The authors.

Note: aAsymptotically F distributed.

Table 8. Multiple Comparisons.

Source: The authors.

Note: *The mean difference is significant at the 0.05 level.

Table 9. Index: S&P BSE CARBONEX.

Source: BSE India (2022).

Table 10. Index: S&P BSE GREENEX.

Source: BSE India (2022).

Limitation of the Study and the Scope of Future Research

This study has assumed a linear relationship between green business practices and investors’ response towards the green business practice without considering the effect of the control variables. This study has been performed using a simulated green business scenario using the lockdown and partial lockdown phase data with least industrial pollution. In this study, the green investment indices have been studied for three years 2020 to 2022, mostly the pandemic-stricken period.

The future study should include at least 5 year-time period after COVID-19 to come to a stronger inference on green investment behaviour in the Indian stock market.

In consideration of the aforementioned control variables (e.g., further COVID waves, more industrial automation and digitisation, Government policy, and further change in investor behaviour, etc.), the future study can be designed to project the future trend of investors’ green behaviour in India. The present research lays a foundation for this future research by showing a significant transition of investors’ decision so far towards sustainable business practices. However, comprehensive statistical modelling will help making the projection in the future studies accurately.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

Bhandari, B., Arshdeep, Jindal, K. (2020). Performance evaluation of socially responsible stocks in India –A study on BSE CARBONEX index. Studies in Indian Place Names, 40(1), 1524–1537.

Bhattacharya, R. (2013). Effect of going green on stock prices: A study on BSE-GREENEX. International Journal of Computer Applications. https://research.ijcaonline.org/icgct/number1/icgct1310.pdf

BSE India. (2022, April 30). S&P BSE indices. https://www.bseindia.com/Indices/IndexArchiveData.html

Choudhary, R., & Jain, V. (2018). A study on impact of stock market movements on GREENEX. Journal of Emerging Technologies and Innovative Research. https://www.jetir.org/papers/JETIR1805267.pdf

Gautam, S. (2020). The influence of COVID-19 on air quality in India: A boon or inutile. Bulletin of Environmental Contamination and Toxicology, 104, 724–726.

Kootanaee, A. J. (2014). EVA (economic value added) an evolution in the financial performance measurement. Science & Knowledge Publishing.

Mahato, S., Pal, S., & Ghosh, K. G. (2020). Effect of lockdown amid COVID-19 pandemic on air quality of the megacity Delhi, India. Science of the Total Environment, 730, 1–23.

Martensen, A., & Dahlgaard, J. J. (2009). Strategy and planning for innovation management – a business excellence approach. International Journal of Quality & Reliability Management, 16(8), 734–755.

McKinsey & Company. (2019). More than values: The value-based sustainability reporting that investors want. https://www.mckinsey.com/capabilities/sustainability/our-insights/more-than-values-the-value-based-sustainability-reporting-that-investors-want

Sacuia, V., & Dumitru, F. (2013). Market-based assets. Building value through marketing. Procedia—Social and Behavioral Sciences, 124, 157–164.

Sharma, P., & Jasuja, D. (2020). Socially responsible investing and stock performance: A study on comparison on sustainability indices in India (ARCH & GARCH Approach). Delhi Business Review, 20(1), 85–97.

Sharma, S., Zhang, M., Anshika, Gao, J., Zhang, H., & Kota, S. H. (2020). Effect of restricted emissions during COVID-19 on air quality in India. Science of the Total Environment. https://doi.org/10.1016%2Fj.scitotenv.2020.138878

Shields, M. D. (2015). Effective long-term cost reduction: A strategic perspective. Journal of Cost Management, 6(1), 16–30.

Sicard, P., Marco, A. D., Agathokleous, E., Feng, Z., Xu, X., Paoletti, E., Rodriguez, J. J. D., & Calatayud, V. (2020). Amplified ozone pollution in cities during the COVID-19 lockdown. Science of the Total Environment, 735, 1–10.

Singh, M. K., & Neog, Y. (2020). Contagion effect of COVID-19 outbreak: Another recipe for disaster on Indian economy. Wiley Public Health Emergency Collection.

The Indian Express. (2021, May 9). COVID-19 second wave: Here’s a list of states that have imposed full lockdown. https://indianexpress.com/article/india/covid-19-second-wave-heres-a-list-of-states-that-have-imposed-lockdowns-7306634/

Thomas, C. (2020). Sensex, Nifty end at record high on vaccine progress. Reuters. https://www.reuters.com/article/india-stocks-idINKBN28J0BW

Tripathi, V., & Bhandari, V. (2015). Socially responsible stocks: A boon for investors in India. Journal of Advances in Management Research, 12(2), 209–225.

Wagner, M. (2013). ‘Green’ human resource benefits: Do they matter as determinants of environmental management system implementation? Journal of Business Ethics, 114(3), 443–456.

World Business Council for Sustainable Development. (2020). Investor decision-making. https://www.wbcsd.org