1 VELS Institute of Science, Technology & Advanced Studies, Chennai, Tamil Nadu, India

2 Department of Commerce, VELS Institute of Science, Technology & Advanced Studies, Pallavaram, Chennai, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

Cryptocurrency is a way of exchanging value over a computer network without having to go through a central authority like a bank or government. Globally, there are more than a thousand different cryptocurrencies. Eventually, cryptocurrency will be used to buy/sell goods and services, just like conventional currency. Crypto-stock exchanges are popular in India, despite cryptocurrencies being illegal. The value of virtual currencies is solely determined by supply and demand, unlike government-backed money. This article studies awareness and perceptions of cryptocurrency among people in Chennai. Convenient sampling is used to collect data from general population through a structured questionnaire. The results of this study are expected to provide valuable insights into the current gaps and challenges in terms of cryptocurrency adoption in Chennai.

Cryptocurrency, blockchain technology, cryptography, Chennai, Bitcoin, crypto market, investments

Introduction

Cultural, Socio-economic Background of Chennai

Chennai is renowned for its strong ties to the Tamil language and literature, as well as its rich cultural heritage, which is reflected in its traditional arts and music (Krishnamurthy & Desouza, 2015). The city is home to a variety of religious communities, including Hindus, Muslims, Christians, and others, which all contribute to the city’s diverse religious landscape. The city is also home to a few traditional industries, such as automobile manufacturing, which have had a positive impact on the economy. Chennai’s IT sector has enabled the city to attract a younger, more tech-literate demographic. This group may be more open to investing in technology-based financial products, such as stocks and cryptocurrencies. Additionally, Chennai is a major educational hub, with a range of institutions providing students and professionals with access to education, as well as a vibrant film industry, Kollywood, which is a powerful economic and cultural force. Despite the city’s economic strengths, it is important to note the socioeconomic disparities that exist.

These cultural and socioeconomic factors play an important role in analyzing the usage of innovations like cryptocurrencies in Chennai. Chennai’s conservative outlook on investing may lead to a preference for stability and security over riskier, higher-return options. Fixed deposits and government savings plans may be more favored.

History of Currency

Cash has been a fundamental part of human life since the caveman era, when it was used in barter systems to exchange commodities and services. However, its influence diminished as it was exposed to a variety of drawbacks, including the inability to match with people’s needs, the absence of a unit of measure, the inability for all goods to be divided or separated, the inability for items to be easily transported, and more. After recognizing its inadequacies, the currency underwent several iterations, including the minting of an official currency in 110 BC, the introduction of gold-plated Florence in 1250 AD, and the widespread use of paper currency from 1600AD to 1900AD. This is the origin of modern currency, which includes paper money, coins, credit, digital wallets, Apple Pay, and PayPal, all under the control of banks and the government. However, there are some drawbacks to this approach, like technical issues at banks, the ability to take control of users’ accounts, and each account having a limit on how much can be transferred.

Cryptocurrency

Ten years have passed since the world’s first cryptocurrency1, Bitcoin, was created by Satoshi Nakamoto in 2008. Over the past few years, Bitcoin and other digital currencies have become increasingly popular in various industries due to their potential benefits (Singh & Raj, 2022). Cryptocurrencies work in a way that is easy to understand2. Think of it as a digital, decentralized ledger that records all transactions. Digital coins or tokens are used to represent value, and each type of cryptocurrency has its own set of features and uses. Bitcoin, Ethereum, and other cryptocurrencies are decentralized, meaning they are not controlled by a single person or government. Blockchain technology records transactions on a digital chain, which is a list of each transaction, and then adds a new block to the chain (Shukla, 2019). This creates a secure chain, making it hard to change past transactions without affecting all the subsequent blocks—something that takes a lot of computing power to do. To make sure transactions on the blockchain are legit and not fraudulent, “miners” need to be used to verify them. These miners have powerful computers that solve complex math puzzles, and the first one to solve them gets to add a new block of transactions. They are rewarded with new coins.

When you own crypto, you have two keys: one is a public key, like an address, and the other is a private key, like a password. The public key is public and can be seen by others and used to get your cryptocurrency, while the private key is private and needed to access it and spend it.

On the other hand, P2P transactions3 take place directly between people without any middlemen like banks, which can make transactions go faster and cheaper, especially when it comes to international transfers. You create a transaction, sign it, and then broadcast it to the network. Once it is added, it is irreversible. Cryptocurrencies have a finite supply, such as 21 million Bitcoin, which can have an impact on their value. Additionally, cryptocurrencies can be used for a variety of purposes, such as digital money, cross-border value transfers, smart contracts, and more.

There are infinite number of studies exploring awareness about cryptocurrency, but studies concentrated in Chennai city are really few. This study seeks to address this gap in research, which may be due to the city’s unique socioeconomic and cultural characteristics. Previous studies on cryptocurrency typically focus on global or financial centers, and thus there is a lack of localized studies. This study seeks to fill this gap by examining the factors that affect cryptocurrency adoption in Chennai and its potential as a form of payment. Additionally, the findings of the study will be used to make recommendations for the success of the cryptocurrency industry in Chennai, which can be used as a basis for policy decisions and can provide a framework for the adoption of cryptocurrencies in other cities, as well as for venture capitalists and stakeholders to make informed decisions when investing in cryptocurrency.

Objectives

To compare the perception, awareness, and usage of cryptocurrency across different demographic factors such as age, gender, education, and income levels.

Review of Literature

Jenita et al. (2022): This study found that both men and women invested in cryptocurrency with the goal of making money in the short and long term. The idea is to use the extra money saved by salaried employees to invest in better options with less risky strategies, so that the money can be rolled back and still make a good return.

Scott et al. (2022): This study wanted to get an idea of how people feel about these new digital currencies. People are really interested in them, and the results show that the majority of people know about them and want to invest in them. However, they are scared of the risk and do not trust the government or regulators to keep an eye on them.

Khakhar (2018): The use of Bitcoin is not popular among individuals. Although there is a general understanding of virtual currency, its use is limited due to the fact that it is not legally accepted in India.

Shukla (2019): It is evident that the general public is cognizant of the potential of cryptocurrencies to generate high returns; however, they are hesitant to invest in them due to the lack of regulatory oversight from the government and its regulatory bodies. If the government of India is willing to regulate the use and transactions of cryptocurrencies in the financial sector, it can have a significant impact on the overall investment portfolio.

Rejeb et al. (2021): Cryptocurrencies offer tangible benefits by facilitating more efficient online transactions, reducing costs, and simplifying payment processes. An ecosystem based on cryptocurrencies has the potential to offer opportunities for new market entrants and aid startups by streamlining the fundraising process.

Kyriazis (2020): Bitcoin continues to be a major influence on the cryptocurrency markets, although the extent of this influence and the periods in which it produces herding effects are not universally agreed upon. Generally, bearish conditions are more conducive to the occurrence of herding effects in digital currency markets.

Significance of the Study

Investments in unregulated cryptocurrencies have shown an upward trend since 2020, despite uncertainty surrounding their future in India (Umair, 2023). This study seeks to gain a comprehensive knowledge of the perception, understanding, and utilization of cryptocurrencies in Chennai, taking into account the technological, economic, social, and other factors that influence people’s decisions. The findings can be used to inform educational initiatives and regulate the local regulatory climate. The objectives of the study are to gain a better understanding of how people perceive and adopt cryptocurrencies in Chennai and to provide practical applications for policymakers, businesses, and educational institutions in the region.

Methodology

It is an exploratory and descriptive study based on primary and secondary data. The general public constitutes the universe of the study. The number of respondents in the study is 95. A convenient sampling method was used for data collection.

A five-point Likert scale questionnaire is employed to collect data from the general population; Google Forms is used to create it.

The secondary data was collected from articles, research papers, online sources, and so on.

Data Analysis

The primary data collected were coded, calculated, and statistically processed, classified, and tabulated using appropriate methods. Tables and statistical results were derived using Statistical Packages for Social Sciences (SPSS).

Research Hypothesis

Data Analysis

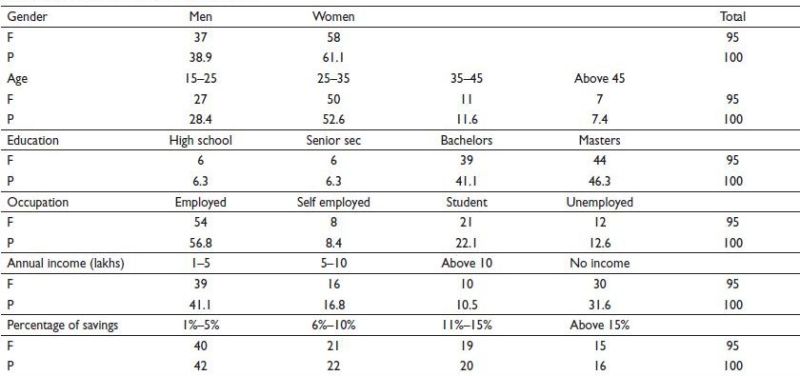

From Table 1, we can infer that most of the respondents are female, and many of them fall under the age group of 25–35 years. The education background of the respondents shows that most of them pursued master’s degree, and most of them are employed in different sectors (57%). Most of the respondents fall under the income group of 1–5 lakhs per annum, and 42% of them are saving their income by investing in various investment avenues.

Interpretation

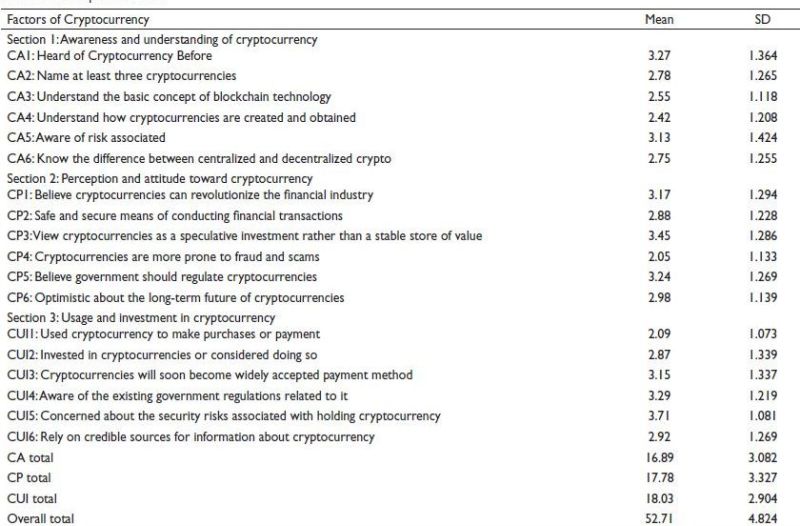

Table 2 shows the descriptive statistics of different factors of cryptocurrency. The mean score is high, which is 3.27 for the statement “heard of cryptocurrency before (CA1)” in the section “Awareness and Understanding of Cryptocurrency”. In the perception and attitude toward cryptocurrency section (CP), the mean score is high (3.45) for the statement “cryptocurrencies as a speculative investment rather than a stable store of value (CP3)”. In the third section, the statement “concerned about the security risks associated with using and holding cryptocurrency (CUI5)” has a high mean score of 3.71. The overall total usage and investment in cryptocurrency (CUI) factor has a high mean score of 18.03, followed by the perception and attitude factor, with a mean score of 17.78.

Table 1. Demographic Profile of Respondents.

Table 2. Descriptive Statistics.

Hypothesis Testing

1. Null hypothesis (H0): Opinions regarding statements that measure awareness and understanding of cryptocurrency are equivalent to the average level.

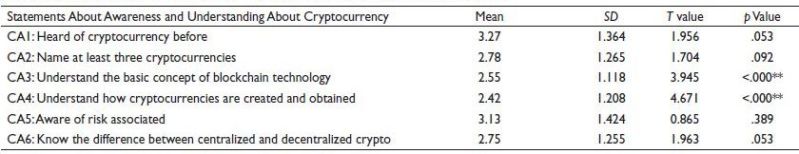

From Table 3, we can understand that the null hypothesis is rejected at a significance level of 1% for statements of respondents’ awareness about the basics of blockchain technology (CA3) as well as how cryptocurrencies are generated and acquired (CA4). Therefore, the opinion on these statements does not equal the average level (3).

The null hypothesis is accepted at a magnitude of 5% for the statements of the respondent’s knowledge about cryptocurrency—"I’ve heard of cryptocurrency before” (CA1), “I can name at least 3 cryptocurrencies” (CA2), “I’m not sure what the risk of the currency is” (CA5), and “The difference between centralized vs. decentralized cryptocurrencies” (CA6) (the average level of awareness). Based on the average score, the statement “I’ve heard about cryptocurrencies before” is more significant.

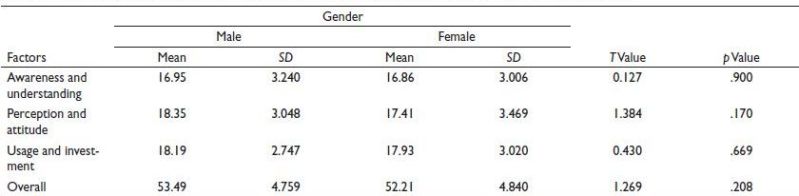

2. Null hypothesis (H0): There is no substantial difference in opinion in terms of gender among respondents when it comes to all aspects of cryptocurrency.

From Table 4, since all the p values are above .05, we accept the null hypothesis at 5% significance. Therefore, there is no difference in opinion regarding all aspects of cryptocurrency in terms of gender. According to the mean score, male respondents are better at understanding, perceiving, and using cryptocurrency than female respondents.

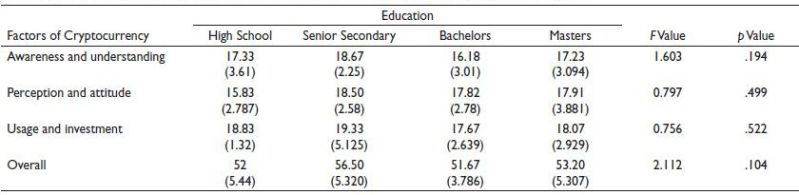

3. Null hypothesis (H0): There is no discernible distinction between levels of education with respect to all aspects of cryptocurrency.

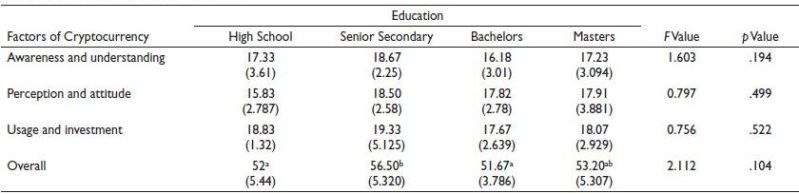

According to Table 6, there is no significant difference in terms of education when it comes to cryptocurrency factors. The p value is higher than .05, so the null hypothesis is acceptable at a 5% level of significance for all factors. Based on the Duncan Multiple Range Test (DMRT), bachelor’s and high school categories in education significantly differ from the senior secondary category at a 5% level of significance. The master’s category in education does not differ from any other category of education.

Findings

Table 3. t-Test for Specified Value (Average = 3) of Statements on Awareness of Respondents.

Note: **denotes significant at 1% level.

Table 4. t-Test Represent Significant Differences in Gender of Respondents with Respect to Cryptocurrency Factors.

Table 5. Education and Cryptocurrency Factors: Significant Differences Revealed through ANOVA Analysis.

Note: Value in brackets refers to SD.

Table 6. Duncan’s Multiple Range Test Table.

Notes: Value in the brackets refers to SD. Different alphabets in education denote significance at a 5% level using the Duncan Multiple Range Test (DMRT).

Conclusion

According to the poll, 61% of the 95 respondents are aware of cryptocurrencies, which may be viewed as a positive sign that the money is gradually reaching everyone. India’s information technology is assisting in this. The improvements and breakthroughs in India’s technological industry are assisting cryptocurrencies, particularly Bitcoin, ripple, and Dogecoin, to acquire appeal among Indians. During COVID, the sector saw a boom in both domestic and foreign investment.

The aim of this study is to gain a comprehensive knowledge of the perception, understanding, and utilization of cryptocurrencies in Chennai. We can conclude from the study that there are concerns about the security risks associated with holding cryptocurrency among respondents as it is not regulated or legalized in India. There will be rapid changes and innovations soon. Human beings know what they need and are good at better defining their wants and quickly transforming this into reality (K S & Kalpana, 2023).

Limitations

Acknowledgement

AI tool Mendeley has been used to insert citations and references for the research study.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.

Funding

The authors received no financial support for the research, authorship, and/or publication of this article.

Notes

ORCID iD

Devayani K S  https://orcid.org/0009-0003-2075-1135

https://orcid.org/0009-0003-2075-1135

Jenita, A. M. A., Fathima, R. K., & Advisor, R. (2022). A study on the perception of crypto currency investment among salaried employees in Chennai city with special reference based on gender. Journal of Positive School Psychology, 6(6), 7733–7741.

Khakhar, C. D. (2018). A study on awareness and perception of cryptocurrencies in Ahmedabad. Journal of Banking Financial Services and Insurance Research, 8(11).

Krishnamurthy, R., & Desouza, K. C. (2015). Chennai, India. Cities, 42, 118–129. https://doi.org/10.1016/j.cities.2014.09.004

K S, D., & Kalpana, G. (2023, February). Artificial intelligence; It’ s time to innovate the future. International Journal of Advanced and Applied Research, 10(3), 28–31. https://doi.org/10.5281/zenodo.7583119

Kyriazis, N. A. (2020). Herding behaviour in digital currency markets: An integrated survey and empirical estimation. Heliyon, 6(8), e04752. https://doi.org/10.1016/j.heliyon.2020.e04752

Rejeb, A., Rejeb, K., & G.Keogh, J. (2021). Cryptocurrencies in modern finance: A literature review. Etikonomi, 20(1), 93–118. https://doi.org/10.15408/etk.v20i1.16911

Sagheer, N., Khan, K. I., Fahd, S., Mahmood, S., Rashid, T., & Jamil, H. (2022). Factors affecting adaptability of cryptocurrency: An application of technology acceptance model. Frontiers in Psychology, 13, 903473. https://doi.org/10.3389/fpsyg.2022.903473

Scott, A., Joseph, R., & Francis, N. (2022). Awareness and perception of cryptocurrency among general public in Ernakulam district: A study. International Journal of Advanced Research in Commerce, 5(1), 183–187.

Shukla, S. (2019). A study on the awareness and perception of cryptocurrency in Bangalore. Indian Journal of Applied Research, 9(4), 15–25.

Singh, A. K., & Raj, M. (2022). A study of analytics and exploration of bitcoin challenges and blockchain. Proceedings of the International Conference on Electronics and Renewable Systems, Tuticorin, India, pp. 929–933. https://doi.org/10.1109/ICEARS53579.2022.9751821

Umair, M. (2023). The emergence of cryptocurrency in India and its implications on investments. In D. Kesavan & N. Mari Anand (Eds.), Emerging insights on the relationship between cryptocurrencies and decentralized economic models (pp. 44–56). IGI Global. https://doi.org/10.4018/978-1-6684-5691-0.ch003