1 Department of Economics, Aligarh Muslim University, Aligarh, Uttar Pradesh, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

The study’s primary goal is to determine how the increase in digital transactions has affected narrow money, also known as M1, which serves as a proxy for nominal GDP and national income. The National Electronic Funds Transfer (NEFT), the Immediate Payment System (IMPS), the Unified Payment Interface (UPI) and Mobile Banking (MB) are all used in the study as proxies for digital payment systems. In contrast, M1, or narrow money, is used as a proxy for the money supply in India from July 2016 to August 2022. Every month, the Reserve Bank of India database has served as the source of the statistics. The effect of digital transactions on M1 has been studied using the sophisticated econometric approach known as the ARDL (autoregressive distributed lag model). The presence of cointegration between the variables is further demonstrated by the long-run cointegration bound test. The findings of the diagnostic tests show that serial correlation and heteroskedasticity are absent. According to the results of the CUSUMSQ (CUSUM-square) and Jarque–Bera tests, the model is stable and normally distributed. Digital payments are statistically significant and positively correlated with the money supply, according to the error correction model test. The long-run equation results also demonstrate that the digital payments system might have a long-term positive or negative correlation with M1. Since every other independent variable, excluding IMPS, is positively connected to the money supply and IMPS is negatively related, the two are inversely related. The money supply will shrink as IMPS transaction volume rises, but this will have minimal substitution impact on the M1 monetary aggregate. Thus, the study’s findings imply that there might be several changes to the money supply or monetary aggregates, which are crucial tools of monetary policy, due to the impudent rise of financial innovations or additional fintech opportunities. Because of this, the demand for money function may become unstable, making it difficult for policymakers to put their plans into action.

Fintech, narrow money, ARDL model, error correction model and cointegration, monetary policy, IMPS, UPI, NEFT

Introduction

The terms ‘finance’ and ‘technology’ are combined to form the phrase ‘financial technology’ (fintech). The application of technology in financial services is hence referred to as fintech. In other words, fintech is the use of technological advancements to deliver financial services. These services, created using cutting-edge innovations, provided a fresh approach to transaction facilitation and assisted in advancing customers’ access to financial services. (Kim Lien et al., 2020). It is not a unique idea that a cashless society would be more straightforward and economically effective and that actual money is troublesome. A cashless economy is one in which payments for products and services are made by cheque or electronic transfer rather than cash (Tee & Ong, 2016). Further, we can see that India is now one of the world’s fintech marketplaces with the quickest growth, as shown. The Indian fintech sector was valued at $50 billion in 2021, and by 2025, it is anticipated to expand to $150 billion. The report also includes the Reserve Bank of India (RBI) Payments Vision 2025, which states that by the year 2025, the RBI hopes to triple the volume of digital payment transactions, double the number of registered customers for mobile-based transactions, improve prepaid payment instruments transactions by 150% and double the amount of card acceptance infrastructure to 25 million. The Indian payment system has altered as a result of technological advancements. The once-cash-driven Indian economy is increasingly moving towards mobile payments.

Moreover, the RBI often creates working groups on a recurring basis to analyse and improve the monetary aggregates to review the ongoing and numerous impending changes in the Indian economy and advancements in the monetary sector. Three working groups have been established so far: the first working group on money supply was established in 1961, the second in 1977 and the third in 1998 under the title ‘Working Group on money supply: Analytics and Methodology of Compilation’. India developed four monetary aggregates, known as M0 (monetary base), M1 (narrow money), M2 and M3 (broad money), which are used in the formulation of monetary policy. These aggregates were developed by the recommendations of the first working group (1961) and the Y.V. Reddy Committee (1998) on the money supply. As per the report of (SBI Research & ECOWRAP, 2022), the concept of M1, or narrow money, also includes overnight bank deposits. Thus, to assess the effect of a cashless economy on money supply, the study has gone through the latest reports published on the fintech trends and composition of money supply present that the demand for cash is decreasing as the number of digital transactions rises through various digital payment systems like Unified Payment Interface (UPI), wallet, Immediate Payment System (IMPS), National Electronic Funds Transfer (NEFT) or mobile banking (MB). At the same time, the amount of money in circulation is rising while the trend is reducing (SBI Research & ECOWRAP, 2022). However, over a few decades, cashless payments have become commonplace, and economies have begun implementing policies to make their country completely cashless. This has raised concerns about how to ensure the security of the payments and make them feasible for all parties, particularly in light of the global pandemic that has altered people’s lifestyles and forced changes to government policies. The pandemic has led to a surge in cashless payment methods, highlighting the need for reliable and secure transactions. As demand grows, studies and research are needed to guide policymakers and companies, as the future is cashless, offering advantages over security risks (Jain, 2023). Here’s how to determine the effects of these transformations; as a result, the research began discussing the effects that seamless transactions using various digital payment methods are having on the Indian economy. The government of India actively promotes digital transactions through initiatives like Digital India and the demonetisation drive in 2016. The adoption of digital payment methods such as UPI, mobile wallets and other electronic modes has increased significantly. People increasingly use digital wallets, online banking and mobile payment apps for day-to-day transactions, reducing their reliance on cash. The Indian government has launched various schemes and incentives to promote digital financial inclusion, aiming to bring more people into the formal financial system. While digitalisation offers several benefits, challenges such as cybersecurity risks, digital literacy and the digital divide must be addressed. The RBI and other regulatory bodies have been actively involved in shaping the regulatory framework for digital payments and fintech. Accordingly, the escalating utilisation of pre-paid instruments is exerting a profound influence on the constitution of monetary aggregates, particularly M1, which was the focal point of our inquiry. Such a phenomenon may lead to fluctuations in the demand for money function, constituting a formidable hurdle for policymakers in executing their policy objectives.

Therefore, our primary objectives are to investigate the effects of these technical advancements on the money supply of the economy and to tackle the specific challenges that arise, making it difficult for policymakers to execute appropriate policies. Consequently, a comprehensive examination of the aftermath of digital payment systems and fintech on the narrow money or money supply is of paramount importance in the academic discourse to enable the implementation of precise and effective monetary policies.

Review of Literature

The literature on the financial payment system has evolved in a variety of ways as a result of the development of electronic money into a technological necessity, such as Hye (2009) investigates the association between Pakistan’s financial innovation and money demand. The study employed the robust time series approach from 1995–1996 to 2007–2012 on monthly time series data. International Financial Statistics are used to gather information on factors including money demand (wide money M2), narrow money (M1), price level (GDP), interest rate and exchange rate. For co-integration regression, the study used the FMOLS approach. The study’s empirical results indicate a long-term link between money demand, interest rates, economic activity, inflation, financial innovation and exchange rates. The findings also show that financial innovation has a favourable impact on money demand over the long and short terms. Meanwhile, Columba (2009) examined the effect of transaction technology on M1 using data from Italy. This study seeks to understand how the proliferation of POS (points of sale) and ATMs (Automated Teller Machines) has impacted the demand for M1 and cash. Innovation in transaction technology was shown to have a favourable influence on M1 but a detrimental effect on the demand for money in circulation. In other research, such as Ugwuanyi et al. (n.d.), the effect of digital finance on Nigeria’s money supply between 2009 and 2018 is empirically examined. The study substitutes the POS, online payment system and ATM payment system as independent variables for digital finance.

To conclude, M2 was assessed simultaneously as a measure of the money supply (a dependent variable). According to the findings of the autoregressive distributed lag (ARDL) model, Nigeria’s money supply benefited from digital finance over the research period. Using monthly agglomerated data from the period of June 2003 to March 2011 in Uganda, Nakamya (2014) analyses the impact of the number of electronic fund transfers (EFTs) and the number of ATMs on demand for M1. The Johansen–Juselius cointegration model was applied. The study’s outcomes demonstrate that, in the long-term model, income positively impacted the demand for M1. Furthermore, ATMs and EFTs—proxy variables for advancements in payment technology—have favourable and substantial effects on the demand for M1. By employing secondary data sources from Indonesia, Bank (Ulina & Maryatmo, 2021) evaluated the effect of ATMs and credit cards as proxies for the volume of non-cash transactions and electronic money on the money supply in Indonesia from 2009 to 2019. The results show a statistically significant positive correlation between the use of credit cards and electronic money with the money supply. Similarly, Song et al. (2022) employed a spatial econometric model to explore the impact of digital finance on the effectiveness of monetary policy and its heterogeneity in the case of China’s economic market conditions. The empirical findings show that the digital finance index has a negative effect on economic growth, but the relationship between digital finance and monetary policy is significantly positive. Aminy (2022) uses multiple linear regression tests intending to test the effects of the credit-card-based payments system and electronic money on the money supply. The data have been taken from the period January 2016 to April 2020. The investigations show that debit cards and electronic money have a significant and positive effect on the money supply, whereas credit cards and money supply are negatively related to each other. However, Hasanah and Hasmarini (2023), in their study, want to assess how Indonesia’s money supply is affected by non-cash transactions in the present digitalisation era. The study uses a quantitative technique and gathers time series data from secondary sources between January 2016 and July 2022 from the Central Statistics Agency and Bank of Indonesia. Inflation, interest rates, economic growth, debit card transaction volume and ATM/debit card volume, as independent variables including e-money transaction volumes, were all measured for the study. For the analysis, the Engle-Granger error correction model (ECM) has been used. According to the short-run results, inflation, the number of ATM and debit card transactions, and the gross domestic product all significantly and positively affect the amount of money in circulation. In contrast, long-term results indicate that interest rates, credit card transaction volume, ATM/debit card transaction volume and e-money factors significantly affect Indonesia’s money supply. contradictory to this, Jain (2023) in her study, tried to study the impact of cashless transactions on India’s money supply. The study gathered yearly cross-sectional data on several variables, M0 and M1, which served as proxies for the money supply, and on credit card payments, debit card payments, NEFTs, UPI payments, pre-paid instruments and inflation, which served as proxies for electronic money, from 2010 to 2021. Financial websites and the RBI handbook of statistics provided the study’s data. The amount of money supply, represented as M1(M0), considered the dependent variable, reduces by 1.44 units with every unit increase in cash converted into e-money, according to the study’s partial regression coefficients of electronic payment. It demonstrates that, while to a small level, electronic payments do affect the amount of money in circulation.

Research Gap

It is clear from the above survey of literature that a limited number of studies have been conducted in India, and most of these pertain to the pre-COVID period. We need more such studies using recent data to confirm the results. Therefore, further research is required to fully understand how the fintech sector or an increase in digital transactions affects the demand for M1 and thus impacts the monetary sector in particular and the economy in general.

Methodology

This section explicitly shows the research design and model to define the relationship among the variables and various tests conducted to know the causal relationship among the variables and further to check the stability of the model.

Research Design

This study is an example of a case study on the Indian economy. It uses experimental research to know the causal link between the dependent and independent variables. The study collected data on M1 as a dependent variable and on IMPS, MB, NEFT and UPI as independent variables. The time series data were obtained monthly from July 2016 to August 2018 from the publications of monetary statistics and payment systems of the RBI databases for the study. As far as the methodology is concerned, the ARDL model and the long-run bound test for co-integration, as well as the ECM model for the short-run causal link, were used in the study’s data analysis. In addition, certain diagnostic tests were performed to determine the model’s stability.

Model Specification

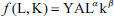

The basic model specified following the Cobb–Douglas production function is presented as follows:

where M1 = narrow money; MB = mobile banking; NEFT = national electronic funds transfer; IMPS = immediate payment system; UPI = unified payment interface.

Moreover, transforming the variables into a natural logarithmic algorithm form can be shown as follows:

Unit Root Tests

It is necessary to perform stationarity tests to determine whether the data are stationary before beginning the study. There are a variety of test statistics to check this; however, this study utilised the augmented Dickey–Fuller (ADF) and Phillips Perron test (PP) to assess the stationarity of the data.

Cointegration Test

To evaluate the long-run relationship in this study, we adopted the ARDL model and the bound testing method suggested by Pesaran et al. (2001). The ECM has also been used to examine the short-term correlation and rate of adjustment among the variables.

Diagnostic Tests

Numerous diagnostic tests have been used to evaluate the resilience of the estimated ARDL model, including the Jarque–Bera normality test, the serial correlation test, the heteroskedasticity test and the CUSUM of squares stability test.

Results and Interpretations

The analysis of the data used in the study is presented below, together with the empirical findings of the econometric methodologies utilised.

Data Statistics Description

It is crucial to look at the descriptive data and statistics that provide an understanding of the maximum, minimum, mean, median, skewness and standard deviation of the study’s variables before the regression analysis. The statistics are displayed in Table 1 as follows.

Table 1 shows that all variables are negatively skewed, except MB, which is positively skewed. Each variable’s standard deviation is lower than its mean value, indicating consistent changes. Moreover, the Jarque–Bera value is larger than 0.05, demonstrating the stability of the variables.

Testing Stationarity

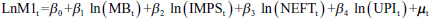

To ensure all the variables were stable, the study carried out unit root tests, including the ADF and PP tests. This is followed by Table 2, which displays the results.

The results of the ADF and PP-test are shown in Table 2, indicating that both M1 and UPI are stationary at a level integrated of order 0 or I (0), while I (1) integrate MB, NEFT and IMPS. In light of these facts, it is shown that some variables are integrated of order I (0), and some are of I (1). Thus, we used the ARDL model, the most suitable regression technique when it is the combination of both.

Regression Analysis

We used an ARDL model of regression, along with the long-run bound test for cointegration, for a long-run estimate and the ECM to determine the short-run outcomes. Tables 4–6 display the regression analysis findings.

Table 1. Descriptive Statistics.

Table 2. Unit Root Tests.

Table 3. ARDL Estimations.

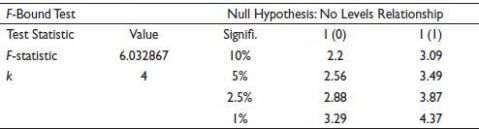

Table 4. Long-Run Co-Integration Bound Test.

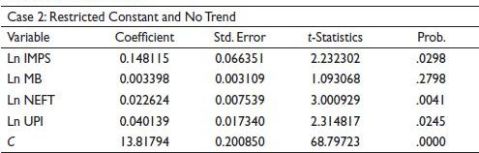

Table 5. Level Equations.

Table 6. Case 2: Restricted Constant and No Trend.

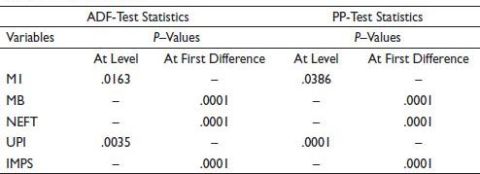

The results of the ARDL estimation show that the money supply (M1), the dependent variable and the two independent variables, IMPS and UPI, are statistically significant at less than 5%. However, MB and NEFT have P-values greater than 0.05, indicating that they are insignificant. Additionally, the R-squared value of 98% shows that the dependent variable accounts for around 98% of the variance in the independent variables. However, the remaining 2% may be ascribed to additional factors that were not considered in the model. Additionally, the P-value for the F-statistics indicates that the entire model fits the data well.

The long-run cointegration bound test has been used to examine the long-term relationship, and the results show that there is a cointegrating relationship between the variables, as shown in Table 4. The resultant value of F-stat, or 6.032867, is higher than the upper bound I (1) critical value of 3.49 at a 5% significance level with a 95% confidence level. This validates the long-term relationship between the M1 (narrow money supply) and other explanatory factors.

The above-presented Table 5 shows the results of long-run level equations. The results show that all the independent variables are significant except mobile banking, represented by MB as the probability value depicted as (prob.) in the table of all variables is less than 0.05, but the probability value of MB is greater than 0.05 that is 5% level of significance. This given table represents the long-run equation depicted below as follows.

Long-Run Equation

Ln M1 = 13.8179 -0.1481ln IMPS + 0.0034ln MB + 0.0226ln NEFT + 0.0401ln UPI + ECT

The long-run equation shows that, except IMPS, all explanatory variables are positively connected to the money supply, demonstrating an inverse relationship between the two. The money supply will decrease by 0.14% for every cent rise in the IMPS. The money supply is only little increased by NEFT and UPI payments, notwithstanding the favourable growth of MB.

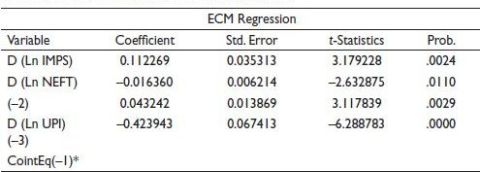

Following the establishment of the long-run cointegration, the short-run relationship has also been examined using the ECM, which offers the short-run findings between the variables and the speed of adjustment. As all factors are significant and positively correlated with the M1, these findings are consistent with those of Ulina and Maryatmo (2021). Table 6 shows the results during the short term. Additionally, the cointEq (–1) term is highly significant and negative. The adjustment for equilibrium is –0.423. This suggests that the rate of adjustment is 42%.

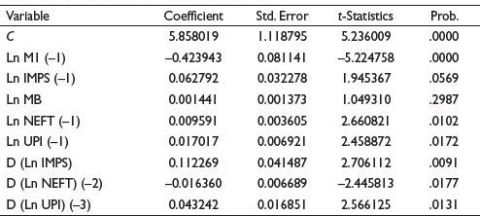

Furthermore, Table 7 shows the results of conditional error correction regression, demonstrating that the value of all variables is significant, that is, has a probability value of less than 0.05 in both the long run and short run, with the exception of mobile banking, denoted as MB. The results demonstrate conditional regression of long-run and short-run associations. The long-run conditional error correction regression is represented by the variables Ln M1, Ln IMPS, Ln MB, Ln NEFT and Ln UPI with varying lags. The variables displayed as D (Ln IMPS), D (Ln NEFT) and D (Ln UPI) with varied lags demonstrate the variables’ short-run conditional error corrections.

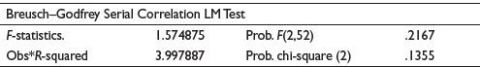

The results of the serial correlation test are shown in Table 8 since the p-value is higher than 0.05, and the null hypothesis rejecting the existence of serial correlation is valid. Therefore, the model has not revealed any association.

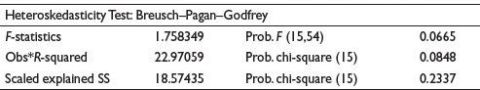

The outcomes of the heteroskedasticity test, which are shown in Table 9 and displayed below, reveal that there is no heteroskedasticity in the model. The Breusch–Pagan–Godfrey test indicates that the residuals are homoskedastic.

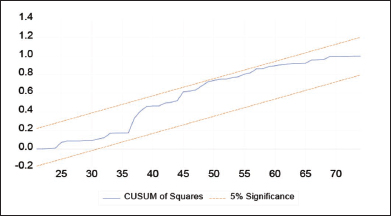

Regarding Figure 1 and Figure 2, Figure 1’s plot of CUSUMSQ shows that the findings are less than the threshold of a 5% significance level, showing that the model is stable. These results, in contrast to those of Chaudhari et al. (2019), show that the model failed the CUSUM-square test but achieved the stability test based on the CUSUM test.

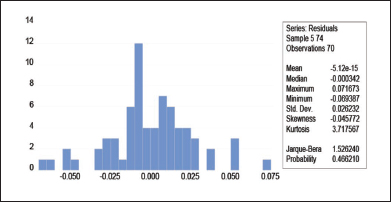

Figure 2 shows the results of the Jarque–Bera normalcy test in contrast. The results demonstrate that the data follows a normal distribution since the probability value is higher than 5%.

Hence, from the above data analysis, it has been interpreted that all variables, that is, dependent and independent variables, are significantly related to each other, showing that economic digital payment systems impact the money supply of the economy. The long-run bound test and the short-term ECM confirm the two’s long-run and short-run relationship. Also, the findings reveal a positive relationship between the money supply and the variables used as a proxy of digital payment systems, except IMPS, which is found to be negatively related to the money supply. Further, applying some diagnostic tests exhibits the stability of the model by rejecting the null hypothesis of homoskedasticity and autocorrelation, achieving stability through the CUSUM of square test and the Jarque–Bera normality test.

Table 7. Conditional Error Correction Regression.

Table 8. Serial Correlation Test.

Table 9. Heteroskedasticity Test. Null Hypothesis: Homoskedasticity.

Figure 1. The Plot of CUSUM of Square.

Figure 2. Normality Curve.

Discussion and Implications of the Study

According to the research study on the impact of fintech on the money supply in the Indian economy, it has been found that most studies conducted on this topic in diverse countries other than India constitute the existing research. Various studies have used different variables based on their economic efficiency and diverse methodologies, such as the study by Columba (2009), which examined the influence of ATMs and POS on demand for cash in the Italian economy and found that the proxies of fintech, that is, ATMs and POS, have a positive impact on M1 align with this study which also revealed that all the variables, except IMPS, positively correlate with money supply, that is, M1, in the long-run cointegration. This finding is also consistent with the previous studies conducted by Mulyani and Davronov (2023) and Jain (2023). The latter study used partial regression coefficients of electronic payment to demonstrate that with a unit increase in cash converted into e-money, the volume of money supply, represented as M1(M0), taken as the dependent variable, decreases by 1.44 units, similar to one of the results of this study, as IMPS is negatively related to the money supply.

Hence, the above findings of this study show that the increment in digital transactions having a positive impact on money supply through UPI, MB and other payment systems implies that the demand for cash is declining, and this may result in a decrease in the money multiplier and consequently can affect the overall composition of the money supply and further impact the central bank’s control of money supply. It can also enhance the effectiveness of monetary policy transmission. The central bank can have better control over the money supply and interest rates, leading to improved economic stability. This suggests that the proliferation and use of fintech services increase the quantity of money in circulation. To improve the efficiency of financial transactions and increase the amount of money in circulation, Indian authorities could find it advantageous to support and encourage the further development of fintech infrastructure.

Moreover, the F-statistic value of 339 and the p-value of the f-statistics shown in Table 3 indicate that the overall model is significant. In light of the short-run results, all variables are found to exhibit a positive correlation with M1. This finding is consistent with previous studies conducted by Ulina and Maryatmo (2021), who examined the influence of ATMs and credit cards on the money supply in Indonesia. Additionally, Nakamya (2014) also reached similar conclusions in her study of Uganda, utilising the Johansen-Juselius model for cointegration. Specifically, she established that ATMs and the volume of EFTs, as proxies for payment technology developments, exert a significant and positive impact on demand for M1. However, the study emphasises how crucial it is to consider a range of variables and research methodologies when examining how fintech affects money availability. It might be important to comprehend the subtle differences between different fintech components to formulate appropriate regulations. Notable among the study’s conclusions is the differentiation between long-run and short-run dynamics. Policymakers must acknowledge that how fintech affects the money supply might change in the future.

Further, several diagnostic tests were carried out to ensure the model’s stability, including serial correlation, normality, Jarque–Bera, heteroskedasticity and CUSUM-square test. The results of these tests also demonstrate the stability of the study’s model. Table 8 presents the results of the serial correlation test using the Breusch–Godfrey model. Table 9 represents the heteroskedasticity test, and both are consistent with the findings of Hasanah and Hasmarini (2023, p. 1105). This is because the prob chi-square is greater than the 5% significance level, indicating the absence of serial correlation and heteroskedasticity.

Analogously, the normal distribution of the data used in the analysis is demonstrated by the Jarque–Bera test results in Figure 2, which are also compatible with the findings of Hasanah and Hasmarini (2023). The model is found to be stable by CUSUM-square, yet the CUSUM test was not passed. Contrary to the findings of Chaudhari et al. (2019), the model passed the stability test based on the CUSUM test but failed the CUSUM-square test. Though the study finds that the model is stable, but it also observes differences in its capacity to pass particular tests compared to previous studies. As far as the limitation regarding methodology is concerned, the restricted time span for data availability creates opportunities for more studies to investigate the causes of these variations and improve the model for a more realistic depiction of methodology and the money supply–fintech relationship.

Further, this study also infers that the positive upsurge in digital payment systems can also improve the country’s financial inclusion, that is, it can promote inclusive economic growth and reach underserved and unbanked communities. Further, it suggests that widespread customer education is necessary as fintech services continue to develop. Fintech may help bridge the economic gap by granting access to digital financial services, especially in underserved and rural regions. The use of fintech may bring about cultural changes in the way people view and interact with financial services. This change might result in a greater percentage of financial transactions being done via the Internet, a shift in public perception of traditional banking, and the development of a more technologically aware financial culture.

Scope and Limitations

Regarding the research’s limitations, we know that every study has advantages and disadvantages. As a result, several gaps in this study offer other researchers with a larger gap to perform further research on this broad topic. One of the major drawbacks of the study is the limited time span for data collection. More observations are possible. Furthermore, the variables might be chosen differently depending on the gap or need for future research.

Hence, the future of analysing fintech’s influence on money supply is multidimensional, emphasising adjusting to technical improvements, legislative changes and larger economic implications. To stay up with this fast-changing sector, researchers must be adaptable and collaborative. As fintech payment systems improve, there will be a greater need to research how these systems affect the velocity of money and total money supply. CBDCs acceptance and development will be crucial. Researchers can investigate how CBDCs interact with fintech and their future influence on conventional money supply.

Furthermore, the advent of cryptocurrencies, continued expansion in fintech businesses, and legislative changes in fintech can all have a substantial influence on its position in the money supply. As a result, the researchers will need to stay up-to-date on changing legislation and their consequences.

Conclusion

From the study’s analysis discussed above, it has been determined that the long-run findings do not allow us to reject the null hypothesis that there is no long-run association between the digital payments system and the money supply, or M1. However, the findings indicate that there is both a long-run and short-run relationship between the two. According to the ECM test, digital payments are statistically significant and positively correlated with the money supply. Additionally, the outcomes demonstrate that it may have positive and negative relationships as well over the time. All factors, including NEFT, UPI and MB, positively correlate with the M1. Even though there is a negative or inverse relationship between the money supply and the IMPS, this relationship shows that as IMPS usage grows, the money supply will decrease. Moreover, the CUSUM-square test’s graphical representation, the absence of heteroskedasticity and the Jarque–Bera normality test value also indicate that the data distribution is normal and our model is stable.

The current study’s findings thus represent those numerous changes in the money supply or monetary aggregates, which are vital instruments of monetary policy, could take place with the impudent rise of financial innovations or additional fintech opportunities, leading to an unstable demand for money function and making it challenging for policymakers to implement their plans. As a result, this significant advancement in fintech gives room for future research to use alternative approaches and determine how the digitalisation of the economy will affect the money supply, other monetary aggregates and various economic sectors.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

Aminy, A. R. (2022). Analysis of influence of card-based payment and electronic money on money supply. Journal of Contemporary Information Technology, Management, and Accounting, 3(1), 48–56.

Chaudhari, D. R., Dhal, S., & Adki, S. M. (2019). Payment systems innovation and currency demand in India: Some applied perspectives. India Occasional Papers, 40(2), 33–63.

Columba, F. (2009). Narrow money and transaction technology: New disaggregated evidence. Journal of Economics and Business, 61(4), 312–325. https://doi.org/10.1016/j.jeconbus.2009.01.001

Hasanah, R., & Hasmarini, M. I. (2023). Analysis effect of cashless payments in the digitalization era on money supply in Indonesian (Vol. 1). Proceeding Medan International Conference Economics and Business. https://proceeding.umsu.ac.id/index.php/Miceb/article/view/216

Hye, Q. M. A. (2009). Financial innovation and demand for money in Pakistan. The Asian Economic Review, 51(2), 219–228.

Jain, R. (2023). Impact of cashless transactions on money supply—Case of India. https://doi.org/10.13140/RG.2.2.22551.55209

Kim Lien, N.T., Doan, T. R.T., & Bui, T.N. (2020). Fintech and banking: Evidence from Vietnam. Journal of Asian Finance, Economics and Business, 7(9), 419–426. https://doi.org/10.13106/JAFEB.2020.VOL7.NO9.419

Mulyani, Y., & Davronov, I. O. (2023). The effect of e-money on the money supply and inflation di Indonesia year 2019-2021. Sinergi International Journal of Management and Business, 1(1), 83–101.

Nakamya, M. (2014). The effect of financial innovation on money demand in Uganda: An examination of new payment technologies on demand for narrow money (HD06/1387U). https://publication.aercafricalibrary.org/server/api/core/bitstreams/6805c7a4-b845-4bdb-894d-6a3eb04f57c6/content

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326. https://doi.org/10.1002/jae.616

Research SBI & ECOWRAP. (2022). The power of digital transactions: Currency In circulation declines in a busy Diwali week for the first time in 20 years (in 2009, a marginal decline of Rs 9.5 bn but reflecting the crisis!) (Issue No. 42). 1–7.

Song, J., Shuang, Q., & Hong, Z. (2022). Will digital financial development affect the effectiveness of monetary policy in emerging market countries? Economic Research Ekonomska Istraživanja, 35(1), 3437–3472. doi: 10.1080/1331677X.2021.1997619

Tee, H.-H., & Ong, H.-B. (2016). Cashless payment and economic growth. Financial Innovation, 2(1), Article 4. https://doi.org/10.1186/s40854-016-0023-z

Ugwuanyi, G. O., Okon, U. E., & Anene, E. C. (n.d.). Investigating the impact of digital finance on money supply in Nigeria. Nigerian Journal of Banking and Finance, 12(1), 47–55.

Ulina, E., & Maryatmo, R. (2021). The effect of non-cash transactions on the money supply Indonesia (2009:Q1–2019:Q2). Conference Series, 3(1), 541–550. http://e-journal.uajy.ac.id/28900/1/Ulina-Maryatmo.pdf