1 Department of Corporate Secretaryship (Shift-II), Dwaraka Doss Goverdhan Doss Vaishnav College (Autonomous), Chennai, Tamil Nadu, India

2 PG and Research Department of Commerce, Guru Nanak College (Autonomous), Chennai, Tamil Nadu, India

3 Department of Interdisciplinary Studies, The Tamil Nadu Dr. Ambedkar Law University, Chennai, Tamil Nadu, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

The objective of this investigation is to analyze the intention behind user behavior toward employing Unified Payment Interface (UPI) apps and pinpointing successful solutions for mitigating frauds linked to them. This will increase safety measures, which would lead to an escalation in usage among consumers, ultimately resulting in higher financial inclusion across India through cashless transactions. The Indian digital payment system has been transformed by these platforms, including Google Pay, PhonePe, and Paytm, which together account for over 90% of all online payments made. Users are attracted primarily due to its convenience as well as ease-of-use factors along with influence from their peers who have turned into avid users themselves. Largely, due to COVID-19 lockdown disruptions many people shifted away from traditional monetary exchanges toward Internet Banking options leading to a surge-related crime involving transactional fraudulent practices costing up to 346%. The popularity itself throughout time due again mainly because it’s easy access capabilities UPI payment app development on fraudulent activities continued. A structured questionnaire was adopted during the collection phase within Chennai City among active UPI payment apps users whose data were analyzed using multivariate statistical techniques. The result proves that predictors such as perceived security, safety, risk consistent advantageous represents key inferences, supplying impetus towards utilizing technology and providing cautionary advice where deficiencies subsist. Info dissemination, emphasizing feature/benefit analysis targeting core customer groups, delivered periodically supplemented defensive protocols, incorporating trial process adaptations can mitigate further risk associated with application utilization. Reader response, demonstrating accommodative response based on familiarity, empowering generational social structure, and enabling transformation gained momentum, demonstrates structural readjustment and solidifies the benefits borne out by increased adaption ratified effective outcomes accruing overall benefits, favourably impacting a variety of demographic profiles, and guaranteeing continued use.

Digital payment, behavior intention to usage, UPI application, frauds, perceived ease of use

Introduction

The digital payments software has changed the way people go about paying for things, causing a revolution. Over time in India, digital transactions have been on an upward trend with Unified Payment Interface (UPI) apps, making it easier to transfer money and, therefore, making payments more accessible as well as convenient (Sujith & Julie, 2017). Google Pay, PhonePe, and Paytm are just some of the popularly used applications that have seen increased customer usage; 90% of all electronic commerce operations occur through these services today (Baghla, 2018; Nathani et al., 2022). In January 2020 alone there were over one billion recorded instances, involving UPI apps: this is huge progress from before and depicts how much impact such programs can exert upon individuals’ financial stability at large within Indian society. Furthermore, these days users no longer use these types of interfaces simply because they are quick or easy but take advantage also other features like cashback incentives or discounts when shopping online via said platforms, which then drives up their popularity even further among consumers looking for set payment solutions. Nonetheless, change is not only happening due to convenience factors regarding user experience, etc., businesses must be aware too: Customer perception is subject to change based on a number of factors, such as ratings for ease of use and consideration of safety and security issues by business leaders and customers who may be reluctant to use them due to potential vulnerabilities in cyberspace, community feedback regarding previous experiences, and interactions with employees of other companies across a range of industries that could have serious downstream effects if not handled appropriately.

With the outbreak of COVID-19, many people are now turning to online and mobile payment options to avoid crowded areas and contact with others (Bohman et al., 2021; Czarnecki et al., 2023). UPI apps were supposed to make online payments easier, but it seems that this is not the case during COVID-19 (Das et al., 2020; Jain et al., 2020). UPI payment transaction fraud has been increasing at an alarming rate lately (Mitra Mustauphy, 2023). According to a study by Assocham, conducted in collaboration with EY (Ernst & Young), fraud has increased by a whopping 346% in the last two years. This is a major cause for concern for both consumers and businesses alike. Many customers are reporting problems with using UPI apps for payment. There are several reasons for UPI payment transaction fraud, some of which are listed as follows: Phishing: This is one of the most common types of frauds and it involves criminals sending fake emails or text messages purporting to be from your bank or other financial institution. There have been a few cases where people have fallen prey to UPI payment frauds.

The objective of this study is to assess the intentions of users concerning UPI payment apps and establish effective solutions for decreasing fraud occurrences connected with them. The insights obtained from this research could potentially influence policymakers, as well as businesses, enabling them on promoting safe practices when using these applications while reducing fraudulent behaviors. This investigation can also contribute toward enhancing safety and security measures related to UPI payments, resulting in higher usage rates and leading toward greater financial inclusion within India’s economy growth framework. Therefore, it is imperative that additional investigations be conducted so that such findings may undergo validation, which will consequently develop a more comprehensive understanding regarding user patterns associated with utilizing UPI payment apps alongside remedial actions established by means of our review aiming at ensuring secure usage while minimizing instances involving fraudulent activities linked to those services being rendered available for use among various members of the public pool alike. In conclusion, our ultimate goal is to increase consumer confidence about the availability of UPI apps among potential customers looking for online platform alternatives across India by conducting insightful research on consumer behaviour with the intention of putting suggestive strategies, such as workable anti-fraud initiatives, into practice.

Review of Literature

UPI is a real-time payment system that enables instant money transfer between bank accounts through a mobile device. UPI has gained widespread popularity in India and has become a dominant mode of digital transactions in the country. With the increase in UPI usage, there has also been a rise in payment transaction frauds. This literature review aims to examine the existing studies on the role of UPI application usage in mitigating payment transaction frauds.

A study found that the adoption of UPI has been driven by factors, such as convenience, ease of use, and availability of incentives. The study also highlighted the importance of UPI in promoting financial inclusion and reducing cash transactions. Another study found that UPI has become the preferred mode of payment for small- and medium-sized businesses due to its low transaction fees and quick settlement time. The study also highlighted the need for improved security measures to prevent payment transaction frauds. Kumar et al. (2022) delve into the amplification and importance of UPI with regard to India’s evolution in mobile payment operations. Its aim is to scrutinize the international impact and escalation of UPI, which has fast become one of India’s most favored modes for digital payments. The analysis highlights a call for better security protocols that would help safeguard transactions from collapse as well as cyber deceitfulness while positing that NFC (Near Field Communications)-based UPI remittances will transform merchant-to-customer compensation schemes. Shahid (2022) discussed the UPI platform as the most advanced mobile-based payment system in the recent past. This study examines the factors influencing the UPI adoption, usage, and intention to recommend by the existing customers. The researcher focused on determinants of adoption of UPI by Indian customers based on the diffusion of innovation theory to achieve a specific result on usage and recommendation intentions. The result of the study revealed that relative advantage, complexity, and observability, which are the main determinants of the adoption of UPI, have a significant positive association with the intention to use of users. Furthermore, the results conclude that the higher intention to use and satisfaction positively correlate with the different aspects of UPI that influence the usage and recommendation intentions.

Kumar and Amalanathan (2022) focused on understanding the UPI’s growth and progression in retail digital payments over the years. The main intent of this paper is to figure out how the digital payment service by UPI fits into the digital ecosystem and where it stands in comparison to other digital payment options. The paper also examined the UPI’s strengths and weaknesses, as well as opportunities and challenges. The emphasis then shifts to a SWOT analysis of UPI to identify its core strengths and growth prospects, as well as areas for future research to explore the entire e-payment ecosystem in India. Furthermore, the authors found that the expected performance, social impact, pricing rate, safety, and data privacy are considered to be important factors influencing the adoption of the mobile payment system. The implications of the study bring a note in the future, if regulators want to levy a service tax on UPI, they are to be careful and focus on upgrading the existing banking network to make it easier for FinTech businesses to provide payment services. To resolve consumer grievances, PSPs must build effective grievance redressal systems.

The purpose of this paper is to explore how our smartphone simulator can be used to understand UPI user decision-making processes, which will help us devise human-centered phishing prevention strategies (Sharma et al., 2022). It is important to observe users interacting with an actual UPI interface whose design can greatly shape their decision-making and reactions. This study sought to find a more immersive way to present realistic scenarios involving UPI transactions than through scenario-based surveys or interviews. They observed how users responded to the scenarios through a variety of user interface designs and attack models. The study concludes that the application motivated users to make deeper insights into their decision-making processes.

Several studies have examined the various types of payment transaction frauds and the measures that can be taken to mitigate them. A study identified phishing, SIM swapping, and malware attacks as the most common types of UPI frauds. The study suggested measures such as two-factor authentication, biometric verification, and awareness campaigns to mitigate these frauds. Similarly, a study recommended the use of blockchain technology and machine learning algorithms to prevent payment frauds. In conclusion, UPI has emerged as a popular mode of digital payments in India, driven by factors, such as convenience, ease of use, and financial inclusion. However, the rise in UPI usage has also led to an increase in payment transaction fraud. The existing literature suggests that measures such as two-factor authentication, biometric verification, awareness campaigns, and the use of blockchain technology and machine learning algorithms can help mitigate these frauds. Further research is needed to identify the most effective measures to prevent payment transaction frauds and ensure the security of UPI transactions.

Need and Scope of Study

Over the last few years, UPI payment apps have become increasingly popular due to their ease, convenience, and affordability, as noted by George et al. (2021). With more and more users opting for UPI payments, this technology has revolutionized the way people transfer money. However, there has been a rise in UPI transaction-related frauds, and it is essential to implement measures that can reduce such occurrences and safeguard customers. In addition, the perceived ease of use and usefulness of UPI payments plays a crucial role in determining user behavior toward this technology. If users find it difficult to use or comprehend the workings of a UPI payment app, they may not be inclined to switch from traditional payment methods like cash or cards. Therefore, service providers must design user-friendly interfaces that provide high-quality information and services.

Additionally, in order to encourage the usage of UPI payments and reduce frauds related to it, banks can create awareness campaigns that explain the features and benefits of using a UPI payment app. Customers should also be educated on how to identify suspicious activities or transactions, so they are better equipped to protect themselves against frauds (Knuth & Ahrholdt, 2022; Sudjianto et al., 2010). Risk mitigation strategies such as two-factor authentications can also help reduce the risk of fraud associated with UPI transactions (Basori & Ariffin, 2022). These measures will ensure that users feel safe and secure while using a UPI payment app, thus encouraging more people to switch over from traditional modes of payment (Purwandari et al., 2022; Zhong & Moon, 2022). UPI payments offer many advantages over traditional methods of payment, it is important to take remedial measures to reduce frauds related to these payments (Croxson et al., 2022). The perceived usefulness and ease of use of UPI payment apps should be taken into consideration when designing the user interface, and banks should inform customers about the features and benefits of using UPI payments (Pachabotla & Konka, 2022; Purohit et al., 2022; Sinha & Singh, 2022). Self-efficacy is an important factor in the adoption of UPI payment apps as it allows users to feel more confident in using the app for their transactions (Savitha & Hawaldar, 2022). Self-efficacy has been linked to higher levels of usage and satisfaction with UPI payment applications (Belanche et al., 2022; Liu et al., 2022). However, there are some issues related to UPI payment application usage, such as security concerns, especially when it comes to frauds (Vinoth et al., 2022). To ensure that users remain safe while using UPI payment apps, organizations can implement various measures to reduce the risk of fraudulent activities (Sinha et al., 2022). Additionally, risk mitigation strategies, such as two-factor authentications, should be put in place to ensure customer safety. With these measures in place, UPI payments can become a safe and efficient way of transferring money.

Research Methodology

The objective of this study is to investigate users’ behavioral intentions toward utilizing UPI payment applications in India and explore feasible measures to mitigate fraud risks associated with UPI transactions. The research methodology employed in this empirical study involves descriptive statistical techniques, and the data were gathered from UPI payment app users through a structured questionnaire. The questionnaire comprises queries related to various factors, such as internal attacks, external attacks, perceived relative advantages, perceived safety, perceived security, perceived risk, and behavioral intention to use—fraud prevention. The results of the survey analysis provide valuable insights into user behavior concerning the adoption of UPI payments, which can aid in identifying potential areas where remedial actions could be implemented to minimize fraud risks linked with UPI transactions.

Results and Discussion

In India, the UPI apps usage is very popular among the consumers and it is very important to know the demographic profile of the users and their perception to reduce fraud. The following are the three demographic profiles and two perceptions of reducing fraud behavior intention of UPI apps in India. The majority of the UPI apps users in the study area belongs to a male and graduated educational background. Furthermore, respondents are salaried employees. The majority of the respondents are using UPI apps less than 5 times in a week and maximum of the respondents prefer to use UPI apps in their daily requirements.

The result depicts the use of UPI apps and how to reduce fraud awareness attributes. UPI apps have increased in popularity in recent years, as they offer a convenient and safe way to transfer money. However, there have been some reports of frauds associated with UPI apps. To reduce the risk of fraud, it is important to be aware of the potential risks and to take steps to protect consumers themselves (Fan & Yu, 2022). There are many advantages to using UPI apps, but there are also some risks that need to be considered. According to the findings, the digital certificate attribute has higher awareness among UPI app users and reduces UPI app payment frauds when compared to other attributes such as receiving a one-time password login, using third-party app protection, UPI PIN & virtual keyboard, one device registration, login & transaction monitoring SMS, secure socket layer/server firewalls, others (technology features, etc.). These attributes enhance the consumers to make use effectively and help to understand and reduce the UPI app payment frauds in their daily needs (Chavan et al., 2022) (Tables 1-3).

Table 1. Demographic Characteristics for the Respondents.

Source: Primary Data

Table 2. UPI Fraud Awareness Attributes.

Source: Primary Data

Table 3. UPI Apps Preference to Usage.

Source: Primary Data

Figure 1. UPI Apps Prefer to Use.

Source: Primary Data

According to the results, Google Pay is the most preferred UPI app in the study area, with the respondents saying that they use it the most (Figure 1). The consumer prefers Gpay because of its simple and straightforward interface, according to the results. PhonePe ranks second in terms of consumer usage preferences. In the recent past, the PhonePe app was a UPI app that was extremely popular in India. It is known for its user-friendly interface and wide range of features. Customers prefer to use this app. Other apps such as Amazon Pay and Paytm are tied for third place among the respondents, each saying that they use them the most. Similar apps include BHIM, MobiKwik, Airtel UPI, iMobile Pay, Payzapp, Freecharge, and others.

Table 4. Descriptive Statistics and Test of Normality for Perception Variables

Note: aLilliefors Significance Correction; **Denotes 1% sig. level

Note: aLilliefors Significance Correction; **Denotes 1% sig. level

Source: Primary Data.

Table 5. Correlation Matrix.

Note: **Correlation is significant at the 0.01 level (2-tailed). *Correlation is significant at the 0.01 level (2-tailed).

Source: Primary Data

The bold characters show the statistical significance for the relationship testing between the variables.

Testing for normality and using descriptive statistics to find the determinants of behavior intention to use UPI fraud prevention (Table 4 and Table 5). When the data are not normally distributed, then the results of any statistical tests could be inaccurate. By understanding the distribution of the data, analysts can make more informed decisions about which statistical tests to use. Testing for normality we can ensure that the data is not skewed and that the results of any statistical tests are not biased. Finally, descriptive statistics can provide valuable insights into the relationships between internal attacks, external attacks, perceived relative advantages perceived safety, perceived security, perceived risk, behavior of intention to use—fraud prevention variables, which can help to identify potential causes of UPI fraud and provide remedial measures to reduce the same. This is important when investigating the determinants of behavior intention to use UPI fraud prevention as it can help us to identify which factors are most important in influencing behavior. Finally, by using both normality tests and descriptive statistics we can be more confident that the results of our analysis are robust and reliable. The result indicates that the perceived relative advantage, perceived security, perceived risk, and perceived safety placed higher relative to the study compare to other variables, such as internal attacks and external attacks awareness toward behavior intention to use UPI and reduce frauds.

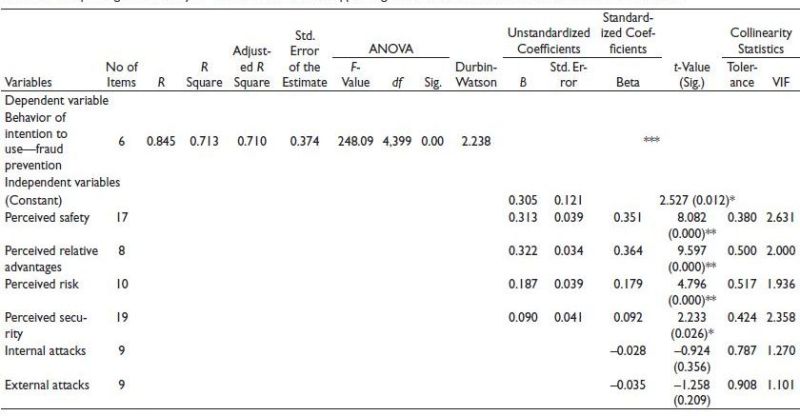

Table 6. Multiple Regression Analysis—Determinants of UPI Apps Usage and Behaviors Intention to Use of Prevent UPI Frauds.

Note: Dependent variable: Behavior of intention to use—fraud prevention.

Predictors in the model: (Constant), perceived safety, perceived relative advantages, perceived risk, and perceived security

Source: Primary Data.

Predictors in the model: (Constant), perceived safety, perceived relative advantages, perceived risk, and perceived security (Table 6). The regression analysis utilizing OLS method was applied to detect the noteworthy effects of factors that impact UPI apps usage and prevent fraudulent activities. The variables considered were perceived safety, perceived relative advantages, perceived risk, perceived security as well as internal and external attacks in order to explore how each variable influences consumer behavior when it comes to using UPI apps and preventing frauds. Results show that all aforementioned variables have a positive influence on intentional behavior toward consumers’ use of both UPI apps and fraud prevention measures; this being significant for influencing decisions made by these individuals. The perceived safety with respect to influencing user behaviours regarding uptake or rejection of any given app or feature offered within them.

The regression analysis with OLS method has been applied to find the significant influences of determinants of UPI apps usage and fraud preventions with respect to perceived safety, perceived relative advantages, perceived risk, perceived security, internal attacks, and external attacks. The result explores that the perceived safety, perceived relative advantages, perceived risk, and perceived security were positive and significant, influencing the behaviour of intention to use UPI apps & fraud prevention consumers. Perceived safety is likely to be a major factor influencing consumer behaviour as it pertains to UPI apps and fraud prevention. Perceived safety is likely to be a major factor influencing consumer behavior as it pertains to UPI apps and fraud prevention. If consumers believe that using a particular UPI app is safe and that their personal information will not be compromised, they are more likely to use it. On the other hand, if consumers perceive that there is a risk of fraud or that their personal information may be at risk, they are less likely to use the app. Perceived relative advantages are another factor that may influence consumer behavior. If consumers perceive that a particular UPI app offers them more advantages than other similar apps, they are more likely to use it. For example, if a consumer believes that a particular UPI app is more user-friendly or offers more features than other apps, they are more likely to use it. Perceived risk is also likely to influence consumer behavior. If consumers perceive that there is a risk of fraud or that their personal information may be at risk, they are less likely to use the app. Perceived security is also likely to influence consumer behavior. If consumers perceive that a particular UPI app is more secure than other similar apps, they are more likely to use it. For example, if a consumer believes that a particular UPI app uses encryption to protect their personal information, they are more likely to use it.

One of the main reasons why perceived safety, perceived relative advantages, perceived risk, and perceived security influencing the behavior of intention to use UPI apps & fraud prevention consumers is because they are all important factors that can affect a person’s decision to use UPI apps. If a person perceives that a UPI technology is safe to use, they are more likely to use it. Similarly, if a person perceives that a UPI app has advantages over other services, they are more likely to use it. On the other hand, if a person perceives that a service is risky or insecure, they are less likely to use it.

There are many reasons why consumers may be reluctant to use UPI apps, or may not be aware of the potential advantages of doing so. One reason is perceived safety. Consumers may be concerned about the security of their personal information and the safety of their money if they use UPI apps. Another reason is perceived relative advantages. Consumers may not be aware of the potential advantages of using UPI apps, such as the ability to make payments without sharing their bank account details. They may also be concerned about the potential risks associated with using UPI apps, such as the possibility of fraud or the loss of their money. Finally, consumers may be concerned about the perceived security of UPI apps. They may not be confident that the apps are secure and may not trust the companies that offer them.

The result also explores that the internal attacks and external attacks awareness not influencing behavior of intention to use UPI apps & fraud prevention consumers. It indicates that there are several reasons why internal attacks awareness and external attacks awareness may not be influencing the behavior of intention to use UPI apps & fraud prevention consumers. First, it is possible that consumers are already aware of the risks of internal and external attacks and are taking steps to protect themselves. Second, it is also possible that consumers believe that the benefits of using UPI apps outweigh the risks. Finally, it is also possible that consumers feel that the risks of internal and external attacks are low and are not concerned about them.

Implication and Conclusion

The digital payment system known as UPI payment has gained immense popularity in India primarily due to its convenient nature, high level of security, and versatility across various platforms. The decision-making process of customers regarding the use of Google Pay, PhonePe, Paytm, and other payment apps for UPI transactions highly depends on factors such as their perceived safety and risk associated with using these services along with any relative advantages they may offer compared to other means. Moreover, customer ease-of-use is linked directly to how much effort would be required from them while performing a transaction whereas customer-perceived advantage pertains solely toward effectiveness. As an effective countermeasure against fraudulent activities surrounding UPI payments, both banks and service providers have adopted strict authentication processes that include real-time monitoring systems that ensure swift identification and rectification whenever suspicious activity takes place—this not only boosts consumer confidence but also builds trust among users. With so many features already offered by these secure methods like convenience during the payment procedure itself and availability over multiple devices; it is no wonder people find them appealing enough thus altering user behavior tendencies even further. Customer perceived ease-of-use (CPEOU) defines just how easy digital payments applications are when used by consumers alongside allied aspects relating back into navigation simplicity providing quick responses too making all involved steps stress-free overall—A worthwhile consideration indeed! Businesses who invest time gathering feedback related specifically around CPEOU can fine-tune pertinent areas within their own setups, improving satisfaction levels between clients/customers alike and leading us right up until present day where companies must now provide more advanced experiences rooted deeply inside each aspect catered direct preferences themselves remaining competitive forevermore despite ever-changing markets requiring constant evolution driven purely via innovations generated internally and borne out through trial/error cycles occurring frequently nowadays, fostering creativity manifold and pushing boundaries beyond previous limits that were set years ago.

To summarize, a user’s inclination toward using UPI payment and fraud prevention choices like Google Pay, PhonePe, Paytm, and other payment apps is significantly influenced by perceived relative advantages, perceived safety, perceived security, and perceived risk. The popularity of digital payment applications within one’s social group can increase the likelihood of their adoption as it establishes trustworthiness. To prevent fraudulent activity in the system, banks have instituted various solutions, such as reliable authentication methods and assessing systems for an added layer of security, which bolsters users’ confidence in this method. Furthermore, the ease with which people can employ UPI payments coupled with their relative advantages makes them more appealing to potential consumers, thus increasing uptake rates. Therefore, it is anticipated that increased intentionality will be observed from patrons to use these services, given these preventative actions are taken.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

B. Franklin Edburg  https://orcid.org/0000-0003-0601-3358

https://orcid.org/0000-0003-0601-3358

Baghla, A. (2018). A study on the future of digital payments in India. International Journal of Research and Analytical Reviews, 5(4), 85–89.

Basori, A. A., & Ariffin, N. H. M. (2022). The adoption factors of two-factors authentication in blockchain technology for banking and financial institutions. Indonesian Journal of Electrical Engineering and Computer Science, 26(3), 1758–1764.

Belanche, D., Guinalíu, M., & Albás, P. (2022). Customer adoption of P2P mobile payment systems: The role of perceived risk. Telematics and Informatics, 72, 101851. https://doi.org/10.1016/j.tele.2022.101851

Bohman, H., Ryan, J., Stjernborg, V., & Nilsson, D. (2021). A study of changes in everyday mobility during the Covid-19 pandemic: As perceived by people living in Malmö, Sweden. Transport Policy, 106, 109–119. https://doi.org/10.1016/j.tranpol.2021.03.013

Chavan, S., Gore, P., & Bhutkar, G. (2022). User survey of UPI-enabled payment apps. In Ergonomics for design and innovation: Humanizing work and work environment: Proceedings of HWWE 2021 (pp. 1457–1469). Springer International Publishing.

Croxson, K., Frost, J., Gambacorta, L., & Valletti, T. M. (2022). Platform-based business models and financial inclusion. Bank for International Settlements, Monetary and Economic Department. https://www.sipotra.it/wp-content/uploads/2022/03/Platform-based-business-models-and-financial-inclusion.pdf

Czarnecki, A., Dacko, A., & Dacko, M. (2023). Changes in mobility patterns and the switching roles of second homes as a result of the first wave of COVID-19. Journal of Sustainable Tourism, 31(1), 149–167.

Das, A., Das, S., Jaiswal, A., & Sonthalia, T. (2020). Impact of COVID-19 on payment transactions. Statistics and Applications, 18(1), 239–251.

Fan, J. X., & Yu, Z. (2022). Prevalence and risk factors of consumer financial fraud in China. Journal of Family and Economic Issues, 43(2), 384–396.

George, A., Sonawane, C., & Mishra, D. (2021). A study on the usage and relevance of mobile wallets in India in COVID-19 pandemic. Indian Journal of Commerce and Management Studies, 12(3), 1–12.

Jain, A., Sarupria, A., & Kothari, A. (2020). The impact of COVID-19 on e-wallet’s payments in Indian economy. International Journal of Creative Research Thoughts, 8(6), 2447–2454.

Knuth, T., & Ahrholdt, D. C. (2022). Consumer fraud in online shopping: Detecting risk indicators through data mining. International Journal of Electronic Commerce, 26(3), 388–411.

Kumar, A., Choudhary, R. K., Mishra, S. K., Kar, S. K., & Bansal, R. (2022). The growth trajectory of UPI-based mobile payments in India: Enablers and inhibitors. Indian Journal of Finance and Banking, 11(1), 45–59.

Kumar, Y., & Amalanathan, P. (2022). Growth of digital payments apps in India-A study. EPRA International Journal of Multidisciplinary Research (IJMR), 8(12), 108–115. https://doi.org/10.36713/epra2013

Liu, Y., Lu, X., Zhao, G., Li, C., & Shi, J. (2022). Adoption of mobile health services using the unified theory of acceptance and use of technology model: Self-efficacy and privacy concerns. Frontiers in Psychology, 13. https://doi.org/10.3389/fpsyg.2022.944976

Mitra, Mustauphy S. (2023, January 9). India innovates for the future. SSRN. https://ssrn.com/abstract=4320529

Nathani, S., Chakhiyar, N., & Pandey, S. K. (2022). A study on consumers perception towards digital payment system in India and various affecting its growth. International Journal of Law Management and Humanities, 5(3), 1162–1181.

Pachabotla, L. S., & Konka, C. (2022). Comparative study of mobile payment apps: Google Pay and PayPal using Nielsen’s Usability Heuristics [Student thesis]. https://www.diva-portal.org/smash/record.jsf?pid=diva2%3A1710789&dswid=4620

Purohit, S., Arora, R., & Paul, J. (2022). The bright side of online consumer behavior: Continuance intention for mobile payments. Journal of Consumer Behaviour, 21(3), 523–542.

Purwandari, B., Suriazdin, S. A., Hidayanto, A. N., Setiawan, S., Phusavat, K., & Maulida, M. (2022). Factors affecting switching intention from cash on delivery to e-payment services in c2c e-commerce transactions: COVID-19, transaction, and technology perspectives. Emerging Science Journal, 6(Special Issue), 136–150.

Savitha, B., & Hawaldar, I. T. (2022). What motivates individuals to use FinTech budgeting applications? Evidence from India during the COVID-19 pandemic. Cogent Economics & Finance, 10(1), Article 2127482.

Shahid, M. (2022). Exploring the determinants of adoption of Unified Payment Interface (UPI) in India: A study based on diffusion of innovation theory. Digital Business, 2(2), 100040.

Sharma, K., Sarathamani, T., Bhougal, S. K., & Singh, H. K. (2022). Smartphone-induced behaviour: Utilisation, benefits, nomophobic behaviour and perceived risks. Journal of Creative Communications, 17(3), 336–356.

Sinha, M., Chacko, E., & Makhija, P. (2022). AI based technologies for digital and banking fraud during covid-19. In Integrating meta-heuristics and machine learning for real-world optimization problems (pp. 443–459). Springer International Publishing.

Sinha, N., & Singh, N. (2022). Moderating and mediating effect of perceived experience on merchant’s behavioral intention to use mobile payments services. Journal of Financial Services Marketing, 28, 448–465. https://link.springer.com/article/10.1057/s41264-022-00163-y

Sudjianto, A., Nair, S., Yuan, M., Zhang, A., Kern, D., & Cela-Díaz, F. (2010). Statistical methods for fighting financial crimes. Technometrics, 52(1), 5–19.

Sujith, T. S., & Julie, C. D. (2017). Opportunities and challenges of e-payment system in India. International Journal of Scientific Research and Management (IJSRM), 5(9), 6935–6943.

Vinoth, S., Vemula, H. L., Haralayya, B., Mamgain, P., Hasan, M. F., & Naved, M. (2022). Application of cloud computing in banking and e-commerce and related security threats. Materials Today: Proceedings, 51, 2172–2175.

Zhong, Y., & Moon, H. C. (2022). Investigating customer behavior of using contactless payment in China: A comparative study of facial recognition payment and mobile QR-code payment. Sustainability, 14(12), 7150.