1 Xavier School of Management, XLRI, Jamshedpur, Jharkhand, India

2 Climate and Sustainability Initiative, New Delhi, Delhi, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

The Government of India (GoI) had a target to add a cumulative rooftop solar capacity of 40 GW by 2022 as part of the country’s Intended Nationally Determined Contributions (INDC). However, installations only made up about 30% of the target, even after the intended timeline. Within the rooftop solar sector, the household segment holds promise. However, it cannot realize its potential due to economic, regulatory, and structural reasons, including a lack of access to debt financing for households, which hinders progress. Existing solar debt financing products face challenges such as having limited financial performance records and requiring excessive collateral. Addressing these barriers is crucial for the residential rooftop sector’s growth. The proposed resolution involves a retail loan product that employs the subsidy allocated to the residential sector to guarantee the solar system loan. This loan product will address access to finance issues in the residential rooftop solar sector using the capital expenditure (CAPEX) model. Banks and Financial Institutions (FIs) will be more comfortable lending to household consumers as there is a guarantee (30% of asset value). Since the subsidy is given back to the customer after the full loan payment, the customers have a greater incentive to repay the loan. Besides, this solution will also help address the lengthy subsidy disbursal issue. The loan product presents a pioneering approach to tackling the financing obstacles in the residential rooftop solar market. It not only aims to offer crucial debt financing but also showcases the commercial feasibility of the residential rooftop sector. By aligning the financial solution with the customers’ requirements through favorable credit terms, this financing option encourages residential customers to transition to rooftop solar systems.

Retail loans, residential rooftop solar, subsidy guarantee

Introduction

The sheer size of India’s population and economy and the potential for strong economic growth for the next two decades can make India the world’s second-largest emitter after China by 2030. India is leading from the front to fight climate change; under Nationally Determined Contribution (NDC), the Government of India (GoI) has pledged to lower the emissions intensity of GDP by 45% below 2005 levels by 2030 and reach net zero by 2070 (UNFCCC, 2022). India must invest in several low-carbon technologies to achieve this ambition: renewable energy (RE), green hydrogen, electric vehicles, green building, etc. RE will be the most important technological option to decarbonize the economy. The cost of adopting RE as a source of electricity has been declining rapidly between 2010 and 2022, which enables it to be a mainstream source of electricity due to a decrease in the cost of technology, an increase in the efficiency of technology, and a lower cost of capital (IRENA, 2023). The cost of electricity from solar photovoltaic (PV) and wind decreased by 89% and 69% between 2010 and 2022, respectively (IRENA, 2023). In India, it is no different—the cost of solar PV decreased by 80% between 2014 and 2020 (CEEW, 2021). In the RE segment, solar technology has become the dominant technology. Solar PV’s technological performance record is already proven. Solar PV’s energy source is the sun, so the energy input cost is zero and abundant, making solar a reliable and low-cost energy source. The key components of a solar PV system are solar panels, inverters, and solar batteries. The raw materials for these key components of solar PV are accessible, although there are challenges in certain countries. However, all large economies are investing in identifying new sources of raw materials and alternative raw materials for solar PV technology. Although solar panel production is heavily concentrated in China, other countries, including India, have started manufacturing solar panels, which can reduce supply chain challenges.

In India, solar power contributed to 57% of total RE capacity by the end of April 2024, compared to wind energy, the second-largest RE source, contributing 32% (MNRE, 2024). The rapidly declining cost of solar panels and batteries and the financing cost of solar energy have aided the cost of solar energy adoption, resulting in increased capacity addition (CEEW, 2021). There are two business models in solar technology: OPEX and capital expenditure (CAPEX) (Sarangi & Taghizadeh-Hesary, 2021). In the OPEX model, the project developer owns the solar assets and enters into a power purchase agreement (PPA) with the off-taker. The off-taker pays a monthly bill for all the generated units at the tariff agreed upon in the PPA. In the CAPEX model, the off-taker owns the system by paying the entire cost upfront. In the utility segment, OPEX is the primary business model where a large solar developer agrees with a distribution company (DISCOM) to supply electricity for a certain number of years at the agreed price. In the distributed solar segment, there is a combination of CAPEX and OPEX; however, CAPEX is the dominant business model (GIZ, 2024). Both these models are commercially viable as the cost of solar energy is competitive with fossil fuel-based energy.

In 2015, the GoI announced a bold target of installing 100GW of solar power by 2022, comprising 60GW from ground-based solar systems and 40GW from solar rooftop systems. The government has had some successes with ground-based solar systems; 60GW of solar was installed by the end of 2022 and touched 82GW by the end of April 2024. The rooftop solar segment holds significant potential. A report by TERI suggests that the potential installed capacity of rooftop solar in urban settlements is about 124GW compared to 280GW of total existing power generation capacity in India (TERI, 2014). Thanks to the declining cost of solar PV systems, electricity generation from rooftop solar installation is already economically viable and, in some markets, cheaper than conventional energy sources. The rooftop solar sector has already achieved grid parity in most states. Despite its potential, few rooftop systems have been built in India, with installations totaling only 10.4 GW as of November 2023 (PIB, 2023), despite its commercial viability. The lack of an effective net metering policy, non-availability, high cost of debt financing, and concerns over enforcement of long-term contractual agreements are slowing down the sector’s potential growth.

Within the rooftop solar segment, the residential rooftop solar segment holds significant potential in reaching this target, as it accounts for more than half of the identified rooftop solar potential in India, which stands at 124GW (RETA, 2016), with 72GW coming from the residential sector (Bridge to India, 2016). However, installed capacity in the residential rooftop sector was only 2.7GW by the end of June 2023, out of a total installed capacity of approximately 12GW of rooftop solar plants (Statista, 2023). The residential category makes up a mere 17%, which is disproportionately small considering the over 300 million households (IEEFA & JMK Research, 2023). Despite the declining cost of solar PV systems, which position rooftop solar PV as a cost-effective power source, the current installations fail to capitalize on their potential. Certain consumer segments have already achieved grid parity in the rooftop solar sector.

Although factors have been driving the adoption of solar rooftop systems in the residential sector, resulting in approximately 2GW of cumulative installations in FY 2022 (Gulia et al., 2022), the progress has been slow. This sluggish growth raises concerns about the government’s ability to achieve its intended objective. The obstacles hindering the sector’s expansion are numerous and varied.

Significance of the Study

The government’s ambition to decarbonize the economy needs the success of all kinds of low-carbon technologies, including residential rooftop solar. Since residential rooftop solar capacity and electricity generation are far less than desired to enable India to achieve its desired goal, it is important to address the challenges of adopting residential solar. One of the crucial barriers to low-carbon technologies is access to finance at an affordable rate. We are proposing a financial product that the government can deploy to enable households to raise debt financing, which is essential to buy rooftop solar systems.

Data Collection and Research Methodology

We have employed both primary and secondary research to conduct this study. We have identified key barriers to the residential rooftop solar sector through a literature review but validated and ranked these barriers based on primary research. We interviewed banks, government agencies, banks and financial institutions (FIs), and rooftop solar project developers. We have collected data on electricity consumption and the cost of electricity from secondary research; the sample city is a tier 3 city with maximum rooftop potential. We have collected all the data points for the rooftop solar system, including the cost of the solar PV system, operations and maintenance costs, capacity utilization, and annual degradation of the solar system by conducting primary research. We have interviewed solar developers to collect these data points. We have also collected all the financing-related data points, including bank executives’ credit terms, loan cost, and loan tenure, by conducting interviews with bank executives.

Barriers to the Rooftop Solar Sector

The barriers to the growth of the rooftop solar sector are multi-fold, with some of the obstacles common to both OPEX1 and CAPEX models. Some of them are listed below:

a) Lack of awareness: Insufficient understanding of rooftop solar systems and their financial implications, coupled with a lack of knowledge about government incentive programs, impedes the widespread adoption of rooftop solar. Comprehending the trade-offs involved and being aware of the available incentives are paramount for individuals and resident housing societies to make informed decisions (Quraishi et al., 2019).

b) Lack of adequate financing: The limited scale of deals, low energy tariffs in residential segments, and a lack of track record deter banks from offering debt financing to the solar sector. Additionally, the absence of suitable financial mechanisms further exacerbates the challenge of securing funding for solar projects (Garg & Shah, 2020; Thakur & Chakraborty, 2015).

c) Unstable policies: Frequent updates and policy changes lead to instability, which creates uncertainty for project developers and investors. Furthermore, the complex and time-consuming process of disbursing subsidies, coupled with the unwillingness of electricity DISCOMs to offer net metering connections, acts as an obstacle to the growth and stability of the solar sector (Rathore et al., 2019).

d) Natural disasters: Incidents such as cyclones, forest fires, etc., have the potential to damage or even destroy solar installations, causing a detrimental impact on their efficacy and increasing the perceived risk and costs associated with their implementation (Galvan et al., 2020).

e) Opportunity cost: The economic benefit of implementing solar energy is not particularly strong in cost savings due to the minimal difference in expenses between solar rooftop systems and grid tariffs (Dalal et al., 2023; Singh & Deshmukh, 2019).

f) Lack of maintenance: Neglecting the essential tasks of cleaning, inspection, and repair can lead to diminished efficiency, reduced energy generation, and even system failure, which can impede the overall performance and durability of the solar installation. Consistent maintenance is necessary to ensure the optimal output of the system (Farhan et al., 2021).

g) Lack of creditworthiness: OPEX models are challenged by the possibility of nonpayment or consumer default on payments, as beneficiaries may be unable to honor the contract agreement-based sales. This is further compounded by lengthy payback periods and limited revenue streams, which raise concerns about creditworthiness and the associated risks. Moreover, the institutions may view rooftop projects that lack experience as a creditworthiness risk (Dutt, 2020).

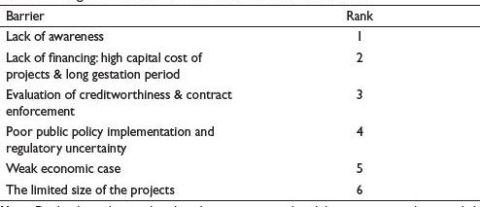

Based on the inputs of stakeholders from our primary research2, we have identified six key barriers impeding the growth of the rooftop solar sector. A snapshot of the prioritization of these barriers is highlighted in Table 1 based on the feedback received from stakeholders.

In this report, our focus is on the need for more financing options available to residential customers. A key reason for the lack of growth in solar rooftop installations in the residential segment is the lack of access to debt finance. This is important since rooftop solar systems are asset-heavy and carry a hefty price; thus, residential customers rely on bank financing to cover a portion of their CAPEX. Despite the availability of loan products for solar rooftop installations, they have not gained traction due to the following reasons:

Table 1. Weighted Scores and the Ranks of the Identified Barriers.

Note: Display the six barriers based on the primary research and the respective weights compiled by the authors.

a) Collateral requirement: While home improvement/home equity loans are offered at reasonable rates, banks typically request the house itself as collateral against the rooftop solar loan. Since the rooftop solar system is considered a depreciating asset and lacks a secondary market, assessing its resale value and recovering losses can be challenging. This loan covenant discourages households from borrowing capital to invest in rooftop solar systems, especially when the value of their homes far exceeds the value of the solar installation (Jasmin & Mahesh, 2020).

b) Limited loan performance history: Banks rely heavily on the historical performance records of a class of loan to evaluate associated risks. For instance, debt financing for the rooftop solar sector in the household segment is constrained due to the lack of historical performance records (CEEW, 2022). The lack of a long-standing history in the residential rooftop solar industry makes it difficult for banks to accurately assess performance and associated risks, making lenders apprehensive about providing loans to the residential rooftop solar sector.

Other loan products:

c) Personal loans: Personal loans typically attract high interest rates, have short durations, and are unsecured. These financial terms and conditions do not align with the specific requirements of the residential rooftop solar sector.

d) Consumer durable goods loans: Loans of this type, usually unsecured and meant for purchasing consumer durable goods like air conditioners, refrigerators, televisions, etc., are currently unavailable for buying solar rooftop equipment.

Considering the above barriers, we propose introducing a retail loan product that caters to the needs of households intending to invest in rooftop solar systems while also addressing the concerns of financiers through the efficient utilization of subsidies allocated to the residential rooftop solar sector.

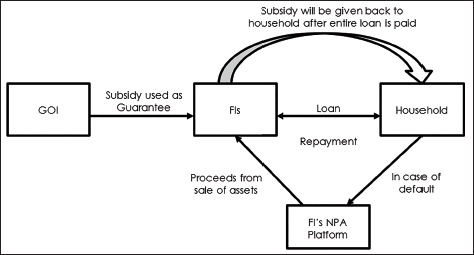

Proposed Product Mechanics

The loan product (specified in Figure 1) possesses a range of features, including the ability to cover approximately 75% of the total installation cost (post-subsidy), with credit terms that are reasonable enough to generate power cost savings greater than monthly cash outflows on the loan. Additionally, only the underlying rooftop solar system will be utilized as collateral. Furthermore, the subsidy, which amounts to 30% of the asset’s value, can be materialized by banks and FI and locked in as a guarantee. This guarantee may be returned to the consumer upon fulfilling all debt obligations. In the event of a default, the FI can resort to the sale of the asset in the secondary market, and the resulting proceeds will be utilized to offset banks’ and FIs’ loan losses.

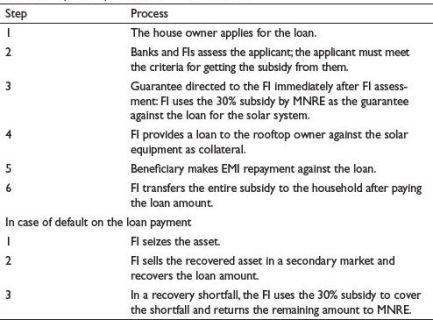

The process to implement the financial product is outlined in Table 2.

Figure 1. Diagrammatic Representation of the Process.

Note: A diagrammatic illustration of the envisioned procedure formulated by the writers.

Table 2. Steps to Implement the Financial Product.

Considering the barriers (as discussed in the previous section), we suggest the development of a new loan product, whose features are described below:

a) Loan amount: We propose a loan that covers approximately 75% of the total cost of the installation (post-subsidy). The remaining 25% cost is to be borne by the owner upfront.

b) Use of subsidy: The current subsidy given to residential households to install a rooftop solar system would be a guarantee to the bank and FI.

c) Collateral: The bank/FI may seize the underlying rooftop solar system in case of default. We assume the balance of systems (cables, etc.) and installation costs cannot be recovered. Our primary research suggests that 50% of the value of the original installation (without considering depreciation) can be recovered (solar panels + inverter).

d) Tenor: The loan tenor should be such that the monthly power cost savings exceed the monthly interest outflows.

e) Interest rate: Given that the degree of risk associated with the loan product falls between that of personal loans and home loans, we postulate that the loan cost should be reasonable enough to generate savings from the very first year. This feature will encourage customers as they see the immediate realization of savings.

f) Suitable financers: Most retail banks and FIs may offer loans catering to the personal and home loan market.

The loan product aims to expand the market for residential rooftop solar systems by fulfilling the needs of households. Furthermore, the loan product effectively reduces the potential risks debt financiers face by utilizing the current subsidy as a loan guarantee mechanism.

Innovation

The loan product presents a pioneering approach to tackling the financing obstacles in the residential rooftop solar market. It not only aims to offer crucial debt financing but also showcases the commercial feasibility of the residential rooftop sector. By aligning the financial solution with customers’ requirements through favorable credit terms, this financing option encourages residential customers to transition to rooftop solar systems. Furthermore, including a 30% asset value guarantee provides reassurance to FIs, enhancing their willingness to extend loans. In the event of default, this guarantee can be monetized, bolstering the FI’s confidence in providing the necessary funds.

Furthermore, the following impediments have been taken into consideration.

a) Addressing the financing needs of households: The retail loan product aims to tackle the prevailing finance accessibility issues in the residential rooftop solar sector, utilizing the CAPEX model through the provision of credit at more favorable terms.

b) Making banks and FIs comfortable to lend to the sector: Banks and FIs will be more inclined to extend credit to customers with the assurance of a 30% asset value guarantee that may be utilized in the event of nonpayment.

c) Better recovery of loan: Since the provision of subsidy is contingent on the complete payment of the loan, customers are incentivized to repay their loans with greater enthusiasm.

d) Addressing lengthy and cumbersome subsidy availability procedure: This measure will additionally tackle the matter of subsidy allocation, as banks and FIs will receive the subsidy directly from the government, sparing the consumer from having to undergo the lengthy and cumbersome process.

e) Mitigating moral hazard issues: The consumer will be motivated to repay the loan since the complete subsidy shall be availed only upon the full repayment.

Implementation Pathways

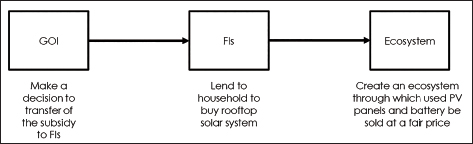

The loan program may be rolled out in states that are favorable to the growth of the residential rooftop solar sector. The implementation pathway is depicted in Figure 2. The specific key criteria, such as high electricity tariffs, state net metering policies, and a favorable stance toward the residential rooftop solar sector, can be used to identify states and cities suitable for the pilot implementation. Potential customers will be evaluated within the target states and towns based on various parameters such as income levels, electricity tariffs, customer and home loan records, electricity usage, and home ownership. Considering factors like shorter application processing time and high electricity tariffs—two critical drivers for adopting and installing rooftop solar systems—Maharashtra and Karnataka emerge as two ideal states to initiate this financial solution. Since public sector banks have a better footprint in tier-three cities, they will be suitable for rolling out the product. Additionally, as it is a government scheme, public sector banks are better positioned to launch the loan product.

Figure 2. Diagrammatic Representation of the Implementation Pathway.

Note: A diagrammatic illustration of the envisioned pathway formulated by authors.

a) Government: The government must decide to transfer the subsidy allocated for the residential rooftop solar sector to banks and FIs and transform it into a guarantee against loan default.

b) Banks and FIs: FIs need to develop a comprehensive framework that evaluates both financial and behavioral aspects, such as the customer’s financial robustness, the feasibility of adopting residential rooftop solutions to economize on electricity consumption, and their standing in the community upon embracing the residential rooftop solution. The specifics of this framework are elaborated in the annexure.

c) Ecosystem: There is a need to establish an ecosystem that enables the sale of used PV panels and batteries at a fair price. We suggest the following steps to facilitate the creation of an effective secondary market for the rooftop solar system.

Create a platform: MNRE can develop a platform with rooftop solar developers and manufacturers. The platform will act as a marketplace to buy/sell through which secondary rooftop plants and inverters are aggregated and sold over a platform.

Securitize and identification of the assets: The financiers can create a security interest (through registration at CERSAI3) in the form of solar rooftop assets of standard quality with a proper O&M in place for the loan period. The key assets of solar PV systems are solar panels and inverters. These assets must have a unique identification number (RFID number, e.g.), making it easier to trade used solar panels and inverters in a secondary market.

Quantitative Modeling

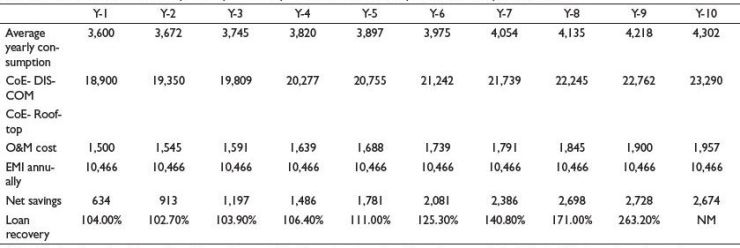

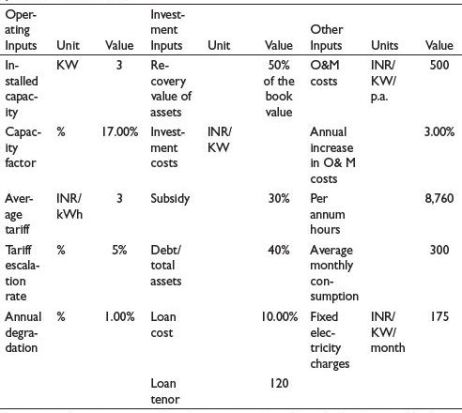

In this section, we have analyzed to quantify the potential savings for prospective customers and evaluate loan performance from the perspective of debt financiers. Various factors, which we refer to as variables, can influence the saving potential and the loan performance. These factors include the lifespan of the solar PV systems, efficiency measured by the capacity utilization factor, system degradation over time, operation and maintenance (O&M) expenses, existing tariff rates, and the cost of interest. To assess the financial aspects, we have developed a cash flow model (Table 3) that aligns with the suggested capital structure outlined in the loan product features.

Our analysis indicates that household savings will begin from the first year onwards if the loan’s cost is 10% and the loan tenor spans over 10 years. In addition, the FI’s loan recovery is anticipated to exceed 100% from the very first year. The assumptions underlying our financial model, derived from primary research, are discussed in Table 4.

Table 3. Cashflow Model of Rooftop Solar System Compared to Access Electricity from the Grid by a Household.

Notes: Displays the result of the analysis of the cash flow model performed by the authors. The region assumed: Tier 3 city in India where the rooftop solar segment has maximum potential.

Abbreviations: CoE = cost of electricity; O&M = operations and maintenance; EMI = equated monthly installment.

Table 4. Assumptions of the Model: Capital, Operating, and Financing Cost of Solar PV System for a Household.

Source: Based on primary research, we have interviewed rooftop solar developers and bank executives to gather insights on the solar PV system, including modules, inverters, meters, cables, etc., as well as the type of financial institution, such as public sector banks.

Conclusion

As previously mentioned, the lack of consumer financing options and the requirement for collateral in the form of the house have acted as barriers, impeding the widespread adoption of rooftop solar systems in the residential segment. However, this instrument presents an enhanced alternative to existing CAPEX models for rooftop solar, aiming to overcome some obstacles.

Introducing the suggested loan product for residential customers has the potential to facilitate the broader adoption of rooftop solar solutions. This product offers a solution to counter the barriers faced by residential customers, such as the lack of availability and high cost of finance when considering rooftop solar installations. By utilizing the underlying guarantee, banks and FIs can safely diversify their portfolio by lending to a new group of customers. This helps establish a track record for lending in the residential rooftop solar sector and enables the creation of benchmarks for future reference. It can contribute to developing a loan loss curve specifically tailored to funding residential rooftop solar customers and create a historical record of loan performance, serving as a valuable track record for future lending.

The next crucial phase in adopting the product involves obtaining the government’s approval to convert subsidies into guaranteed products for rooftop solar loans. Additionally, it necessitates the creation of a marketplace where secondary solar panels and inverters can be traded at fair prices. Simultaneously, efforts should be made to identify banks and FIs willing to adopt and incorporate the product into their customer offerings. This strategic collaboration with interested FIs will play a pivotal role in driving the widespread implementation and success of the proposed solution in the residential rooftop solar sector.

Annexure

A profile of a typical loan applicant can be:

a) CIBIL score—that depicts the past credit behavior of the loan applicant (A CIBIL score of 650 and above).

b) A case for saving on electricity bill using residential solar solution (an average electricity consumption of 600 units per month and above).

c) Past payment track record (Timely utility payment records, e.g., electricity and phone bills, etc.).

d) Ownership of assets like the car, refrigerator, air conditioners, etc.

e) Positive reference check.

f) Access to the roof of ample size, architecture and minimal shadowing risk.

The above profile provides a strong case for a customer with good financial strength, an economic case for saving on electricity using the residential rooftop solution and good standing in the society adopting the residential rooftop solution.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

Notes

ORCID iD

Labanya Prakash Jena  https://orcid.org/0000-0002-4490-869X

https://orcid.org/0000-0002-4490-869X

Bridge to India. (2016). Poor implementation of net-metering policies poses a major challenge for rooftop solar. https://bridgetoindia.com/poor-implementation-of-net-metering-policies-poses-a-major-challenge-for-rooftop-solar/

CEEW. (2021). How have India’s RE Policies Impacted its Wind and Solar Projects? https://www.ceew.in/cef/solutions-factory/publications/CEEW-CEF-How-have-India%E2%80%99s-RE-Policies-Impacted-its-Wind-and-Solar-Projects-03Dec21.pdf

CEEW. (2022). Roadblocks and Solutions to Financing EVs in India. CEF. https://www.ceew.in/cef/masterclass/explains/roadblocks-and-solutions-to-financing-evs-in-india

Dalal, R., Bansal, K. & Thapar, S. (2023). Grid parity of residential building rooftop solar PV in India. Strategic Planning for Energy and the Environment, 39(1–2), 19–40. https://doi.org/10.13052/spee1048-4236.39142

Dutt, D. (2020). Understanding the barriers to the diffusion of rooftop solar: A case study of Delhi (India). Energy Policy, 144, 111674. https://doi.org/10.1016/j.enpol.2020.111674

Farhan, S. A., Ismail, F. I., Kiwan, O., Shafiq, N., Zain-Ahmed, A., Husna, N. & Hamid, A. I. A. (2021). Effect of roof tile colour on heat conduction transfer, rooftop surface temperature and cooling load in modern residential buildings under the tropical climate of Malaysia. Sustainability, 13(9), 4665. https://doi.org/10.3390/su13094665

Galvan, E., Mandal, P. & Sang, Y. (2020). Networked microgrids with rooftop solar PV and battery energy storage to improve distribution grid resilience to natural disasters. International Journal of Electrical Power & Energy Systems, 123, 106239. https://doi.org/10.1016/j.ijepes.2020.106239

Garg, V. & Shah, K. (2020). The curious case of India's discoms: How renewable energy could reduce their financial distress. IEEFA. https://ieefa.org/wp-content/uploads/2020/08/The-Curious-Case-of-Indias-Discoms_August-2020.pdf

GIZ. (2024). Capex report. Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH and Indo German Solar Energy Partnership. https://www.giz.de/en/downloads/giz2024-en-Capex-Report.pdf

Gulia, J., Thayillam, A., Sharma, P. & Garg, V. (2022). Indian residential rooftops: A vast trove of solar energy potential. IEEFAhttps://ieefa.org/resources/indian-residential-rooftops-vast-trove-solar-energy-potential

IEEFA & Research JMK. (2023). Indian residential rooftops: A vast trove of solar energy potential. JMK Research & Analytics. https://jmkresearch.com/indian-residential-rooftops-a-vast-trove-of-solar-energy-potential/

IRENA. (2023). Renewable power generation costs in 2022. International Renewable Energy Agency, Abu Dhabi. https://www.irena.org/Publications/2023/Aug/Renewable-Power-Generation-Costs-in-2022

Jasmin, S. & Mahesh, A. (2020). Market for household solar energy systems in India. Indian Journal of Environmental Protection, 40(4), 430–433. https://www.scopus.com/record/display.uri?eid=2-s2.0-85092943645&origin=inward&txGid=e3285ef06078403ed73aea995c0fb4c9

PIB. (2023). Roof top solar capacity installations growing at compound annual growth rate of around 46%: Union power and new & renewable energy minister. Ministry of New and Renewable Energy. https://pib.gov.in/PressReleasePage.aspx?PRID=1989806

Quraishi, K. S., Salmaahmed, D. & Maran, D. K. (2019). China’s growth in residential solar roof tops—A booster for India. Global Journal of Management and Business Research, 19(A13), 19–29. https://doi.org/10.34257/gjmbravol19is13pg19

Rathore, P. K. S., Chauhan, D. S. & Singh, R. P. (2019). Decentralized solar rooftop photovoltaic in India: On the path of sustainable energy security. Renewable Energy, 131, 297–307. https://doi.org/10.1016/j.renene.2018.07.049

RETA. (2016). Grid parity of solar PV rooftop systems for the commercial and industrial sectors. The Energy and Resources Institute. Retrieved June 25, 2023. https://solarrooftop.gov.in/notification/Notification-08112016903.pdf

Sarangi, G. K. & Taghizadeh-Hesary, F. (2021). Rooftop solar development in India: Measuring policies and mapping business models (ADBI Working Paper Series No. 1256). Asian Development Bank Institute (ADBI), Tokyo.

Singh, A. B. & Deshmukh, M. (2019). Enhancement of performance of roof-mounted SPV system. Energy Procedia, 156, 105–109. https://doi.org/10.1016/j.egypro.2018.11.107

Statista. (2023). Total installed solar rooftop capacity in India as of June 2023, by sector. https://www.statista.com/statistics/500654/solar-rooftop-capacity-installed-in-india-by-sector/`

Thakur, J. & Chakraborty, B. (2015). A study of feasible smart tariff alternatives for smart grid integrated solar panels in India. Energy, 93, 963–975. https://doi.org/10.1016/j.energy.2015.09.100

UNFCCC. (2022). India’s updated first nationally determined contribution under Paris agreement (2021-2030). August 2022 submission to UNFCCC. https://unfccc.int/sites/default/files/NDC/2022-08/India%20Updated%20First%20Nationally%20Determined%20Contrib.pdf