1Department of Commerce, Aligarh Muslim University, Aligarh, Uttar Pradesh, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

The present work examines the association between subjective financial literacy, self-reported by Indian individual investors and the factors that affect their investment decisions concerning fundamental and technical analysis. A structured questionnaire was employed using a purposive sampling procedure to collect the requisite data from individual investors on their demographic profiles, perceived financial literacy and determinants of investment decisions. For developing the measurement model and testing the research hypotheses, Partial Least Squares Structural Equation Modeling (PLS-SEM) was taken into consideration. The result showed that conceptual knowledge, accounting information, technical knowledge and market information are positively associated with the investors’ investment decisions. Furthermore, it highlighted the role of subjective financial literacy in significantly impacting investors’ investment decisions. This study is the first of its kind because previous studies completely ignored the need to assess the perceived financial literacy of investors and its association with the factors determining their investment decisions. Based on the study’s findings, fruitful suggestions are provided to various stakeholders.

Behavioural finance, financial planning, financial market, investment analysis, customer knowledge

Introduction

The expanding body of literature on financial literacy (FL) has established that FL is a crucial aspect of the financial system. Consequently, FL is gaining traction among governments, regulators, policymakers and several other organisations across the economies with a broader vision to educate the people financially and thereby help them optimise their financial resources (Suresh, 2024). The necessity of enhancing FL has grown due to the creation of innovative financial products, the intricacy of the financial markets and the complexity of using financial technology (Hassan Al-Tamimi & Anood Bin Kalli, 2009). Handling one’s finances is now more difficult than ever because of the economy’s changing environment and the difficulty in making financial decisions (Jariwala, 2015). Additionally, income and wealth inequality across economies has gained the attention of economic and political forums worldwide, and FL plays a vital role in explaining wealth inequality (Lusardi et al., 2017).

Due to the emergence of the COVID-19 pandemic, the participation of individual investors in the stock market increased significantly in 2020 and 2021 across several economies. Consequently, individual investors constituted a significant portion of the trading value. This could be attributed to their increased interest while staying or working from home during the COVID-19 pandemic shift in investments towards high-yielding securities due to a decline in real interest rates in a climate of easing monetary policy and rising inflation (Adil et al., 2022). Given these developments, the need for financial education is paramount. Moreover, several studies from different nations prove that the FL of an individual influences their financial behaviour and investment decision-making (Bernheim, 1998; Cole et al., 2011). FL is a significant factor in investors’ participation in the stock market and investment decisions. Financially educated individuals can make better investment decisions, secure their financial future and fulfil their objectives, thereby improving their economic stability (Amari & Anis, 2021; Hassan Al-Tamimi & Anood Bin Kalli, 2009; Van Rooij et al., 2011).

Decision-making is commonly defined as selecting a particular option from various available options. It is a task that follows after thoroughly assessing all the options. According to Karlsson et al. (2004), people make personal economic decisions regularly, and even though these decisions are essential for daily life, they may be challenging. Many researchers have extensively recognised the relevance of analysing consumers’ decisions (Jariwala, 2015).

The theories of standard finance assume that decision-makers are rational and capable of making the most of all the information at their disposal. However, behavioural finance theories hold that individuals tend to make irrational decisions. These theories challenge the assumption of absolute rationality. The psychological process that describes the irrational behaviour of investors is representativeness, heuristics, conservatism, overconfidence and self-attribution (Jariwala, 2015).

Several past and current studies examine the factors that affect individual investors’ decision-making (Ansari et al., 2023; Baker & Haslem, 1974; Chandra & Kumar, 2011; Hassan Al-Tamimi & Anood Bin Kalli, 2009; Merikas et al., 2004; Prasad et al., 2021). Although the measurement of FL has gained much consideration, researchers have paid less attention to investigating the empirical connection between perceived FL and determinants of investment decisions, warranting further studies to explore how individual investors’ FL affects their investment decisions, especially in the developing economy like India (Chawla et al., 2022). Therefore, this study is carried out to assess the perceptions of individual investors regarding their FL and its influence on their investment decisions.

The second section provides a detailed and thorough analysis of the literature on FL and determinants of investment decisions, as well as the method and description of the scales employed to evaluate the level of FL. The third section describes the research methodology used to achieve the stated objective of this study. The fourth section discusses the results and findings. Finally, the fifth section discusses the results, implications, limitations and future research scopes.

Review of Literature and Hypothesis Development

Financial Literacy

Noctor et al. (1992) stated, ‘financial literacy is the financial knowledge that leads to informed decision-making’. Here, it can be seen that this definition has two aspects. The first aspect relates to the financial knowledge that results from financial education programmes, and the other is the capability to use the acquired accounting information effectively to make better investment decisions (Rai et al., 2019). According to Adil et al. (2022), ‘financial literacy is creating awareness and understanding of the mechanisms of financial markets to choose financial products, manage risks, and optimise returns’. Lusardi and Mitchell’s (2014) definition goes beyond the financial knowledge taken into account by earlier definitions. They defined FL as ‘the ability of economic information analysis and informed financial decision-making’. According to Lusardi and Mitchell (2014), people are deemed financially illiterate if they possess financial information but cannot use it effectively to make better financial decisions.

OECD (2005) presents the most extensive definition of FL as ‘a combination of awareness, knowledge, skill, attitude, and behaviour necessary to make sound financial decisions and ultimately achieve individual financial well-being’. The above definition covers several dimensions of FL, including financial knowledge, its comprehension, skills acquired and application of those skills, perceived knowledge (confidence to use it) and optimum decision-making. According to French and Mckillop (2016), the OECD’s definition is more comprehensive and encompasses all aspects of FL.

Lusardi and Mitchell (2007a) designed two modules to measure two different levels of FL, that is, basic FL and advanced FL. The first module is designed to assess the participant’s basic FL and consists of five questions relating to the following topics: (a) numeracy, (b) the concept of compound interest, (c) inflation, (d) the idea of the time value of money and (e) money illusion. The second list of items aims to assess advanced FL. It includes themes like the distinction between bonds and stocks, the workings of the stock market, the mechanisms of risk diversification and the link between bond price and interest rate. It is also important to note that academicians, researchers and institutions have broadly recognised and used these modules to measure FL. Similarly, OECD (2005) developed another set of questions to measure primary FL. They used seven distinct measuring items to determine the level of FL, including investment risk, compound interest and inflation. These measuring items align with the questions Lusardi and Mitchell (2007a) framed.

Furthermore, there are two measures by which the FL level of participants was assessed in the body of literature: objective and subjective measures (Allgood & Walstad, 2016; French & Mckillop, 2016). According to Ouachani et al. (2021), ‘objective measures are based on items assessing the actual financial knowledge and skills of the respondents’. This measure is referred to as a knowledge-based performance test (French & Mckillop, 2016). Subjective FL refers to the degree to which individuals are financially confident and evaluate their self-reported or perceived financial knowledge (Bellofatto et al., 2018). Subjective FL has been evaluated in the literature by asking questions using a Likert scale to assess how respondents perceive their level of FL (Lusardi & Mitchell, 2007b). Several studies estimate the FL of investors using objective FL measures, which is not the case for subjective FL.

Therefore, this research is undertaken to assess the perception of individual investors regarding their FL and its impact on their investment decisions. Moreover, given the complexity of this concept, Moore (2003) proposes that FL cannot be measured directly, but proxies have to be used. Therefore, we use conceptual knowledge, accounting knowledge, technical knowledge and market information as proxies to measure FL.

Determinants of Investment Decision

Numerous studies have explored the factors that influence investors’ decision-making. According to Baker and Haslem (1974), the critical elements for individual investors are the dividend, the expected return and the firm’s financial condition. Merikas et al. (2004) found 26 factors that affect investors’ decision-making in Greece. They classified these factors into categories: accounting information, subjective/personal, neutral information, advocate recommendation and personal financial needs. According to this study, accounting information, which includes the condition of financial statements, expected corporate earnings, expected dividends, the firm’s position in the industry, affordable share price and past performance, was found to be the most critical element affecting investors’ decisions.

According to Chandra and Kumar (2011), the investment decisions of retail investors are affected not merely by the recommendations of financial experts such as stock brokers, financial consultants and financial advisors but also by a range of other contextual factors. These factors include the company’s market share, reputation, accounting, financial information, information available in the public domain by various media, advocate recommendations and personal financial requirements. In addition, they mentioned that while making an investment decision, people look at a company’s market share, technical analysis and fundamentals (which include accounting and financial data). Hassan Al-Tamimi and Anood Bin Kalli (2009) explored 37 factors that influence the decisions made by individual investors in the United Arab Emirates. They discovered that the top four factors influencing investment decisions were religious motivations, firms’ reputation, perceived ethical standards and the need for diversification, while the bottom four were rumours, family members’ opinions, ease of borrowing money and recommendations from friends.

Subjective FL and Investment Decision

FL has been found to be a strong antecedent and predictor of determinants of investment decisions. A related work by Jariwala (2015) and Hassan Al-Tamimi and Anood Bin Kalli (2009) investigated the connection between objective FL and investment decisions among retail investors. The outcomes of their study demonstrated a strong association between FL and investment decisions. Also, investors’ FL level greatly affects their capability to make investment decisions (Jariwala, 2015). Low FL negatively affects investment decisions, and investors make irrational investment decisions (Bucher-Koenen & Ziegelmeyer, 2011). Those with high levels of FL make their investment decisions better (Hilgert et al., 2003).

It is necessary to highlight that despite an enormous number of related work investigating the association between objective FL and investment decisions, there is a dearth of research exploring the association between subjective FL and the factors determining investment decisions (Mathew et al., 2024). This is because subjective FL assessment depends on individual investors’ perception of their FL. It is assumed that respondents might get overconfident in the self-assessment of their accounting information and, as a result, overestimate how much they know. However, such subjective data could best capture the psychological factors influencing an individual’s decision-making process (Bellofatto et al., 2018). Despite the increasing number of articles that depend on surveys to elicit investors’ attributes, subjective data is still relatively infrequent in the financial literature (Glaser & Weber, 2007; Graham et al., 2009; Merkle & Weber, 2014).

To fill this void, the association between subjective FL and investors’ behaviour was examined by Bellofatto et al. (2018). He discovered that investors who report more excellent financial knowledge appear to invest prudently. Prasad et al. (2021) conducted a similar study exploring the association between subjective FL and the determinants of investment decisions. This study classified the factors influencing FL into four categories: accounting information, market information, broad overview and technical knowledge. A significant positive association between subjective FL and determinants of investment decisions was found in this related work.

Therefore, this study also embraces this notion and develops the hypothesis that a significant and positive association exists between subjective FL and determinants of investment decisions. In our study, subjective FL encompasses four dimensions, that is, conceptual knowledge, accounting information, technical knowledge and market information. Moreover, Maditinos et al. (2007) found that investors were more concerned with fundamental and technical analysis while making investment decisions. Therefore, we considered fundamental and technical analysis as determinants of investment decisions.

This study develops the following four hypotheses based on the logical connection found in our discussion of the literature review, which gave evidence that subjective FL is an antecedent of investment decision determinants (see Figure 1).

H1: Conceptual knowledge significantly impacts an individual’s investment decision.

H2: Accounting information significantly impacts an individual’s investment decision.

H3: Technical knowledge significantly impacts an individual’s investment decision.

H4: Market information significantly impacts an individual’s investment decision.

Research Methodology

Research Instrument

The measuring items were adopted from several past related works for data collection from individual retail investors in India. A self-administered questionnaire comprised three sections: demographic profile, FL and factors determining investment decisions. There were 26 items to collect study-related data, of which eight questions dealt with investment decisions, thirteen dealt with FL and five with demographic profiles. The questions based on FL were further categorised into factors where three items were related to conceptual knowledge, four were related to accounting information, three were related to technical knowledge, and three were related to market information. The items in the second and third sections of the questionnaire were graded on a Likert-type scale, with 1 denoting ‘strongly disagree’ and 5 denoting ‘strongly agree’. In order to check the reliability and validity of the scale, the pilot test was conducted in which a total of 53 participants took part, the result of which was favourable, prompting the researchers to put the questionnaire for the final survey. Contents of the measuring items are presented in Table 1.

Figure 1. The Conceptual Model of the Study.

Table 1. Study Items, Sources and SEM Loadings.

Sample Design and Data Collection

This research is undertaken to examine the influence of subjective FL on the factors affecting the investment decisions of individual investors. To achieve this objective, we have selected individual retail investors who participate in the Indian stock market as the target population for this study. Choosing the appropriate sample size is essential for any study to be high-quality and rigorous (Farooq et al., 2018). For this motive, Schreiber et al. (2006) proposed the 10 times rule, which was also suggested by Hair Jr et al. (2023) to figure out the minimum sample size required for data analysis in Partial Least Squares Structural Equation Modeling (PLS-SEM). As per this guideline, the minimum sample should be ‘10 times the largest number of structural paths directed at a particular construct in the structural model’. Accordingly, the minimum number of respondents for the sample should be 40, given that the structural model for this study consists of five constructs (four independent variables and one dependent variable).

However, based on the review of previous related studies, the sample size of our study was finalised. A purposive sampling procedure was used to distribute the questionnaire among 300 individual investors in India to collect the requisite data, and a total of 230 filled-in questionnaires were obtained, revealing a response rate of 76.67%. An identical response rate was obtained in the latest study by Adil et al. (2022), who got a 74% response rate while measuring the FL of individual investors.

Analytical Methods

The present study used IBM SPSS 23.0 and Smart PLS 3 software to analyse the data. Reflective measurement models are included in the conceptual framework of our research. We have employed PLS-SEM, which can also operate on a reflective measurement model apart from handling measured construct. Furthermore, PLS-SEM was selected based on its ability ‘to evaluate causal relationships among all latent constructs simultaneously while dealing with measurement errors in the structural model’ (Farooq & Radovic-Markovic, 2016; Hair Jr et al., 2023). Following Hair Jr et al. (2023) recommendation, the researchers began by assessing the measurement model before evaluating the structural model. However, before going for PLS-SEM analysis, we evaluated the data using prescribed statistical tests, including the common-method bias (CMB) test and data screening for missing values. These procedures and additional validity and reliability checks helped us determine the quality of the data.

Data Analysis and Results

Common-method Bias Test

A one-factor Harman test is carried out to determine if CMB exists among the variables. Moreover, suggestions by Podsakoff et al. (2003) were complied with while carrying out this test. For this reason, every element of the measurement scale was loaded into SPSS to perform principal axis factoring using varimax rotation. The result shows that while considering a single factor, it can describe inconsistency that accounts for 28.693%, which is lower than the 50% criteria and does not raise any concern for CMB in the current study. The outcome of the one-factor Harman test is shown in Table 2.

Table 2. Harman One-factor Test.

Data Screening and Pre-analysis

Extensive data scrutiny was conducted before the data analysis process. Researchers test the normality, outliers, missing values and demographic profiles of the data collected for any possibility of statistical error. However, no missing values were found in the data.

A quick overview of the demographic characteristics of respondents in terms of their gender, age group, educational qualification, employment status and monthly income is presented before starting data analysis and discussing the study’s findings. There were 230 respondents; out of the total, males and females were 64.35% and 35.65%, respectively. Nearly 81.7% of those who participated in the survey are aged 18–25. For educational qualification, 53.9% of the respondents had undergraduate degrees, 26.1% were postgraduates and 12.8% had passed intermediate. About 17.3% of the respondents were full-time salaried, 8.3% were part-time and 23.8% were students. Also, about 72.2% earn less than .png) 10,000, and 11.1% earn between

10,000, and 11.1% earn between .png) 10,000 and

10,000 and .png) 20,000. Appendix A gives descriptive statistics of the respondents (see the Appendix section).

20,000. Appendix A gives descriptive statistics of the respondents (see the Appendix section).

Analysis of Measurement Model

As mentioned earlier, the conceptual model of this research involves only reflective measurement models. All five constructs, that is, conceptual knowledge, accounting information, technical knowledge, market information and investment decisions are reflectively measured constructs. These reflective measurement models were independently analysed following Hair Jr et al. (2023) and Henseler et al. (2009) recommendations. All constructs’ reliability and validity were assessed to evaluate the reflective measurement models. The result showed that factor loadings, which is the simple correlation between indicators and constructs, are above the acceptable threshold of 0.50.

Moreover, composite reliability and Cronbach’s alpha values for all constructs were computed, and these measures were found to be above the 0.70 critical level recommended by Cohen (1988). The AVE value for each construct exceeded the specified limit of 0.50, as recommended by Hair Jr et al. (2023). Table 3 lists all constructs’ reliability and validity values.

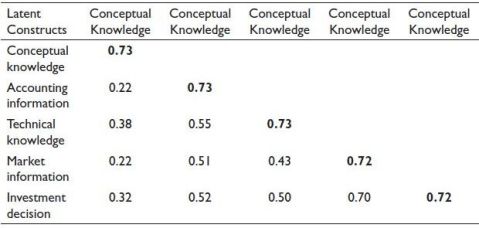

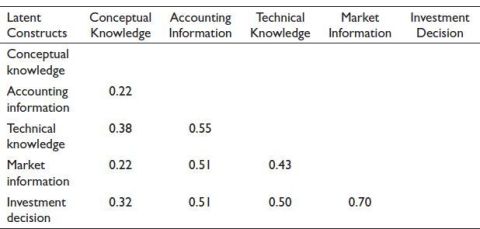

Furthermore, the Fornell–Larcker criterion was applied to examine the discriminant validity of all constructs, as illustrated in Table 4. The correlation coefficients are lower than the square root of AVE, which is shown in bold in Table 4, thus confirming the discriminant validity of the reflectively measured constructs (Hair Jr et al., 2023). As a result, all conditions for establishing the reliability and validity of the reflective measurement model are satisfied.

Table 3. Validity and Reliability of Latent Constructs.

Table 4. Discriminant Validity (Fornell–Larcker Criterion).

Note: Bold values signify that the correlation coefficients are lower than the square root of AVE.

To further examine the discriminant validity, we computed the HTMT ratio of correlations, following the recommendation of Henseler et al. (2015). According to the guidelines, ‘HTMT value greater than 0.85 indicates a potential problem of discriminant validity’ (Hair Jr et al., 2023). In this study, HTMT values were lying well below the critical value of 0.85, indicating no problem of discriminant validity (see Table 5).

Analysis of the Structural Model

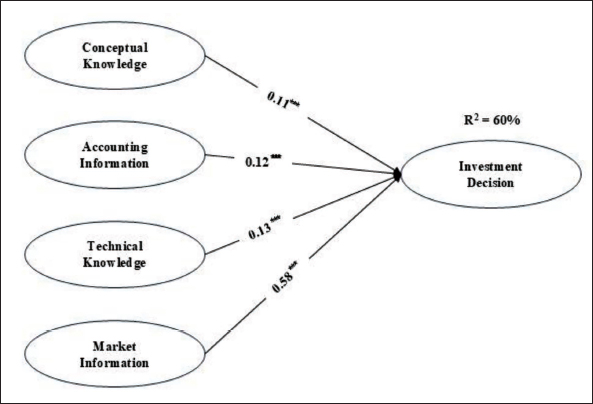

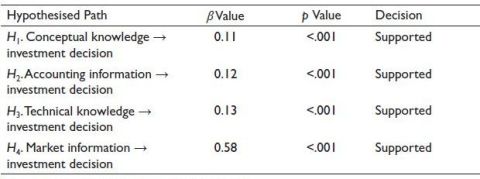

For the purpose of evaluating the structural model in this study, overall explanatory power (represented by R2 value), predictive relevance (shown by Q2 value) and path coefficient beta values are examined. The outcome of the structural model is shown in Figure 2.

Table 5. Discriminant Validity (HTMT Ratio).

Figure 2. Results of the Structural Model.

Table 6. Hypothesis Assessment.

Note: β represents standardised regression weights.

The result shows that R2 = 0.60, demonstrating that the proposed model can explain 60% of the variance in the investment decision. Moreover, the relationship between conceptual knowledge and investment decision (β = 0.11; p < .001) is found to be positive and statistically significant, confirming H1. Likewise, H2 is also accepted, indicating a positively significant association between accounting information and investment decisions (β = 0.12; p < .001). Similarly, H3 is also supported, demonstrating a significant association between technical knowledge and investment decisions (β = 0.13; p < .001). Lastly, a significant and positive association between market information and investment decisions is also found, thus supporting H4 (β = 0.58; p < .001). Table 6 presents the findings of the hypothesis assessment (see Figure 2).

According to Figure 2, our proposed model has an R2 value of 60%, indicating sufficient explanatory power. Here, caution is warranted, as it is not a good viewpoint to endorse the model simply relying on the R2 value (Farooq & Radovic-Markovic, 2016; Hair Jr et al., 2023). Therefore, the predictive relevance of the structural model should also be examined using Wold and Bertholet’s (1982) Q2 value. Accordingly, latent exogenous constructs in the structural model are generally agreed upon to have predictive relevance for latent endogenous constructs if the Q2 value exceeds zero (Chin, 1998; Hair Jr et al., 2023). In this study, Q2 value = 0.254 indicates strong predictive relevance in the endogenous construct (investment decisions), thus supporting the underlying assumptions of this study. This analysis also found no issue of collinearity. This achieves the overall predictive relevance of our model.

Discussion and Conclusion

The current work tries to explain the influence of subjective FL on the investment decisions of individual investors in India. Therefore, after a thorough review of the literature, the conceptual framework of the current work was grounded on the four crucial aspects of FL, that is, Conceptual knowledge, accounting information, technical knowledge and market information were taken as independent factors influencing the dependent factor, that is, investment decisions. The acceptance of all the study hypotheses (H1–H4) in SEM analysis indicated that FL is crucial when making an informed investment decision; these findings align with the contributions of the prior related works (Fedorova et al., 2015; Hilgert et al., 2003; Jariwala, 2015; Prasad et al., 2021). These outcomes indicated that the degree of FL of investors influences their ability to make investment decisions to a large extent, as Jariwala (2015) has shown. Financially literate investors tend to make wiser investment decisions (Hilgert et al., 2003). Also, the SEM analysis showed that the four main factors of FL: conceptual knowledge, accounting information, technical knowledge and market information explained 60% variance (R2 of 60%) in the investment decisions of the investors, indicating the explanatory power of the conceptual model of the study.

Considering the findings of the SEM analysis, all proposed hypotheses are accepted, supporting the outcomes of the prior related studies; the present work has shown that all the mentioned dimensions of FL influence investors’ investment decisions in India (Hassan Al-Tamimi & Anood Bin Kalli, 2009; Jariwala, 2015; Prasad et al., 2021). Acceptance of H1 confirms that conceptually sound investors’ investment decisions are not irrational because their investments are grounded on their conceptual knowledge of the associated risk and return. Also, the acceptance of H2 confirms that enhanced accounting information leads to better investment decision-making by individual investors. This indicates that individual investors’ investment decisions are rational and sound because they prefer to analyse the company’s balance sheets before investing in its stock. These findings are consistent with the previous studies in this area. For example, Nagy and Obenberger (1994) and Prasad et al. (2021) also reported that individual investor behaviour is impacted by the quality of accounting information they possess.

Acceptance of H3 and H4 confirmed that technical knowledge and market information significantly affect the investment decisions of individual investors, indicating that technically sound investors with proper details of the financial markets tend to perform technical analysis of the stocks using mean, variance and SD before investing in the selected stocks. Additionally, they tend to compare different alternatives available for investment, and for this purpose, they analyse the overall market in general and particular industry in specific. Moreover, they analyse all the available information on the market, including interest rates and prices of bonds. These results endorse the findings of Prasad et al. (2021), who also reported that technical knowledge and market information were significantly associated with investment decisions. Additionally, our research found that the top three influencing factors affecting investment decisions were the past performance of the firm’s stock, the result of fundamental analysis and the condition of the financial statement. Also, focusing on the demographics of the study participants, it is evident that most young investors are willing to invest in the stock market after analysing the market and performing fundamental and technical analyses. They prefer to look into the stocks and market capitalisation of the company, and they tend to examine the economic policies and conditions of the economy before finalising their investment.

Furthermore, the R2 value obtained in the SEM analysis indicated the robustness and explanatory capabilities of the present study’s conceptual model. Therefore, we argue that the current study’s conceptual framework has fulfilled its objective of explaining individual investors’ investment decisions by focusing on FL. Hence, the proposed framework can be applied in studies on individual investors’ decisions in other economies, specifically developing economies similar to India, such as Bhutan, Sri Lanka and Bangladesh.

Implications

This research has multiple practical implications for the government, policymakers, financial advisors and individual investors. This study showed that the dimensions of FL have a significant and positive association with investment decisions. Therefore, it is suggested that the concerned stakeholders, like managers and policymakers in government, should focus on appropriate measures to improve individual investors’ FL, considering its various dimensions like conceptual knowledge, accounting information, technical knowledge and market information that could help them in better investment decision-making. Furthermore, the necessity of enhancing FL has grown as a result of the creation of innovative financial products, the intricacy of the financial markets and the complexity of using financial technology to help investors manage their finances and safeguard them from substantial financial loss in future (Hassan Al-Tamimi & Anood Bin Kalli, 2009). The government should incorporate voluntary FL programmes in the curriculum for school/college students to equip them with the required knowledge and skills to make profitable investment decisions and achieve their financial well-being. They may also use social media to reach the masses and enhance their FL.

It is worth mentioning that although savings in India are the highest in the world, the engagement of Indian investors in the stock market is shallow (Sivaramakrishnan et al., 2017). The major reason why investors do not participate in the stock market is because they do not comprehend movement in the market and information, rise and fall in stock, stock market trends, legal procedures and other prerequisites for participation in the stock market (Adil et al., 2022). Hence, this study explains that FL can help individual investors make better investment decisions and increase their participation in the stock market (de Bassa Scheresberg, 2013).

Limitations and Future Research Directions

This research evaluates individual investors’ perception of their FL and how it affects their investment decisions. This research may be extended by examining how FL impacts saving and credit decisions. The sample of the present work was gathered from individual Indian investors only; therefore, future research may be conceptualised on a cross-cultural, cross-national or cross-state basis better to understand the investor’s behaviour from different segments of populations, as the same was found in earlier related works (Manocha et al., 2023). The same research may also be conducted in India’s other states and regions, as well as in nations where the issue of FL has not been thoroughly examined by academicians or policymakers or where only preliminary research has been conducted. The conceptual model of the present work can also be used in future research by including important investor-related factors like awareness, perceptions and so on. (Kaur & Kaushik, 2016). Retail individual investors with investments under .png) 200,000 were the target population for this study. Future studies can approach high-net-worth individuals to determine whether FL affects investment decisions.

200,000 were the target population for this study. Future studies can approach high-net-worth individuals to determine whether FL affects investment decisions.

Appendix

Appendix A. Investors Demographics Attributes.

Acknowledgements

The authors are grateful to the journal referees for their constructive suggestions to improve the quality of the article.

Declaration of Conflicting Interest

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Adil, M., Singh, Y., & Ansari, M. S. (2022). Does financial literacy affect investor’s planned behavior as a moderator? Managerial Finance, 48(9/10), 1372–1390.

Allgood, S., & Walstad, W. B. (2016). The effects of perceived and actual financial literacy on financial behaviors. Economic Inquiry, 54(1), 675–697.

Amari, M., & Anis, J. (2021). Exploring the impact of socio-demographic characteristics on financial inclusion: Empirical evidence from Tunisia. International Journal of Social Economics, 48(9), 1331–1346.

Ansari, Y., Albarrak, M. S., Sherfudeen, N., & Aman, A. (2023). Examining the relationship between financial literacy and demographic factors and the overconfidence of Saudi investors. Finance Research Letters, 52, 103582.

Baker, H. K., & Haslem, J. A. (1974). Toward the development of client-specified valuation models. The Journal of Finance, 29(4), 1255–1263.

Bellofatto, A., D’Hondt, C., & De Winne, R. (2018). Subjective financial literacy and retail investors’ behavior. Journal of Banking and Finance, 92, 168–181.

Bernheim, D. (1998). Financial illiteracy, education and retirement saving. Living with defined contribution pensions. University of Pennsylvania.

Bucher-Koenen, T., & Ziegelmeyer, M. (2011). Who lost the most? Financial literacy, cognitive abilities, and the financial crisis [Working Paper Series, No. 1299, European Central Bank].

Calcagno, R., & Monticone, C. (2015). Financial literacy and the demand for financial advice. Journal of Banking & Finance, 50, 363–380.

Chandra, A., & Kumar, R. (2011). Determinants of individual investor behaviour: An orthogonal linear transformation approach. https://ssrn.com/abstract=1790713

Chawla, D., Bhatia, S., & Singh, S. (2022). Parental influence, financial literacy and investment behaviour of young adults. Journal of Indian Business Research, 14(4), 520–539.

Chin, W. W. (1998). The partial least squares approach to structural equation modeling. Modern Methods for Business Research, 295(2), 295–336.

Cohen, J. (1988). Statistical power analysis for the behavioural sciences (2nd ed.). Lawrence Erlbaum Associates.

Cole, S., Sampson, T., & Zia, B. (2011). Prices or knowledge? What drives demand for financial services in emerging markets? The Journal of Finance, 66(6), 1933–1967.

de Bassa Scheresberg, C. (2013). Financial literacy and financial behavior among young adults: Evidence and implications. Numeracy, 6(2), 5.

Farooq, M. S., & Radovic-Markovic, M. (2016). Modeling entrepreneurial education and entrepreneurial skills as antecedents of intention towards entrepreneurial behaviour in single mothers: A PLS-SEM approach. Entrepreneurship: Types, Current Trends and Future Perspectives, 198, 216.

Farooq, M. S., Salam, M., Fayolle, A., Jaafar, N., & Ayupp, K. (2018). Impact of service quality on customer satisfaction in Malaysia airlines: A PLS-SEM approach. Journal of Air Transport Management, 67(September 2017), 169–180.

Fedorova, E. A. E., Nekhaenko, V. V., & Dovzhenko, S. E. E. (2015). Impact of financial literacy of the population of the Russian Federation on behavior on financial market: Empirical evaluation. Studies on Russian Economic Development, 26, 394–402.

French, D., & McKillop, D. (2016). Financial literacy and over-indebtedness in low-income households. International Review of Financial Analysis, 48, 1–11.

Glaser, M., & Weber, M. (2007). Overconfidence and trading volume. The Geneva Risk and Insurance Review, 32, 1–36.

Graham, J. R., Harvey, C. R., & Huang, H. (2009). Investor competence, trading frequency, and home bias. Management Science, 55(7), 1094–1106.

Hair Jr, J. F., Hair, J., Sarstedt, M., Ringle, C. M., & Gudergan, S. P. (2023). Advanced issues in partial least squares structural equation modeling. Sage Publications.

Hassan Al-Tamimi, H. A., & Anood Bin Kalli, A. (2009). Financial literacy and investment decisions of UAE investors. The Journal of Risk Finance, 10(5), 500–516.

Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43, 115–135.

Henseler, J., Ringle, C. M., & Sinkovics, R. R. (2009). The use of partial least squares path modeling in international marketing. New challenges to international marketing. Emerald Group Publishing Limited.

Heshmat, N. A. (2012). Analysis of the capital asset pricing model in the Saudi stock market. International Journal of Management, 29(2), 504.

Hilgert, M. A., Hogarth, J. M., & Beverly, S. G. (2003). Household financial management: The connection between knowledge and behavior. Federal Reserve Bulletin, 89, 309.

Islamo?lu, M., Apan, M., & Ayval?, A. (2015). Determination of factors affecting individual investor behaviours: A study on bankers. International Journal of Economics and Financial Issues, 5(2), 531–543.

Jappelli, T., & Padula, M. (2015). Investment in financial literacy, social security, and portfolio choice. Journal of Pension Economics & Finance, 14(4), 369–411.

Jariwala, H. V. (2015). Analysis of financial literacy level of retail individual investors of Gujarat state and its effect on investment decision. Journal of Business and Finance Librarianship, 20, 133–158.

Karlsson, N., Dellgran, P., Klingander, B., & Gärling, T. (2004). Household consumption: Influences of aspiration level, social comparison, and money management. Journal of Economic Psychology, 25(6), 753–769.

Kaur, I., & Kaushik, K. P. (2016). Determinants of investment behaviour of investors towards mutual funds. Journal of Indian Business Research, 8(1), 19–42.

Lusardi, A., & Mitchell, O. S. (2007a). Baby boomer retirement security: The roles of planning, financial literacy, and housing wealth. Journal of Monetary Economics, 54(1), 205–224.

Lusardi, A., & Mitchelli, O. S. (2007b). Financial literacy and retirement preparedness: Evidence and implications for financial education: The problems are serious, and remedies are not simple. Business Economics, 42, 35–44.

Lusardi, A., & Mitchell, O. S. (2014). The economic importance of financial literacy: Theory and evidence. American Economic Journal: Journal of Economic Literature, 52(1), 5–44.

Lusardi, A., Michaud, P. C., & Mitchell, O. S. (2017). Optimal financial knowledge and wealth inequality. Journal of Political Economy, 125(2), 431–477.

Maditinos, D. I., Ševi?, Ž., & Theriou, N. G. (2007). Investors’ behaviour in the Athens Stock Exchange (ASE). Studies in Economics and Finance, 24(1), 32–50.

Manocha, S., Bhullar, P. S., & Sachdeva, T. (2023). Factors determining the investment behaviour of farmers—The moderating role of socioeconomic demographics. Journal of Indian Business Research, 15(3), 301–317.

Mathew, V., PK, S. K., & Sanjeev, M. A. (2024). Financial well-being and its psychological determinants—An emerging country perspective. FIIB Business Review, 13(1), 42–55.

Merikas, A. A., Merikas, A. G., Vozikis, G. S., & Prasad, D. (2004). Economic factors and individual investor behavior: The case of the Greek stock exchange. Journal of Applied Business Research (JABR), 20(4). https://doi.org/10.19030/jabr.v20i4.2227

Merkle, C., & Weber, M. (2014). Do investors put their money where their mouth is? Stock market expectations and investing behavior. Journal of Banking and Finance, 46, 372–386.

Moore, D. L. (2003). Survey of financial literacy in Washington State: Knowledge, behavior, attitudes, and experiences. Washington State Department of Financial Institutions.

Mouna, A., & Anis, J. (2017). Financial literacy in Tunisia: Its determinants and its implications on investment behavior. Research in International Business and Finance, 39, 568–577.

Nagy, R. A., & Obenberger, R. W. (1994). Factors influencing individual investor behavior. Financial Analysts Journal, 50(4), 63–68.

Noctor, M., Stoney, S., & Stradling, R. (1992). Financial literacy: Discussion of concepts and competences of financial literacy and opportunities for its introduction into young people’s learning. National Foundation for Educational Research.

OECD. (2005). Improving financial literacy: Analysis of issues and policies. OECD. https://doi.org/10.1787/9789264012578-en

Ouachani, S., Belhassine, O., & Kammoun, A. (2021). Measuring financial literacy: A literature review. Managerial Finance, 47(2), 266–281.

Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879.

Prasad, S., Kiran, R., & Sharma, R. K. (2021). Influence of financial literacy on retail investors’ decisions in relation to return, risk and market analysis. International Journal of Finance and Economics, 26(2), 2548–2559.

Rai, K., Dua, S., & Yadav, M. (2019). Association of financial attitude, financial behaviour and financial knowledge towards financial literacy: A structural equation modeling approach. FIIB Business Review, 8(1), 51–60.

Raut, R. K. (2020). Past behaviour, financial literacy and investment decision-making process of individual investors. International Journal of Emerging Markets, 15(6), 1243–1263.

Schreiber, J. B., Nora, A., Stage, F. K., Barlow, E. A., & King, J. (2006). Reporting structural equation modeling and confirmatory factor analysis results: A review. The Journal of Educational Research, 99(6), 323–338.

Sivaramakrishnan, S., Srivastava, M., & Rastogi, A. (2017). Attitudinal factors, financial literacy, and stock market participation. International Journal of Bank Marketing, 35(5), 818–841.

Suresh, G. (2024). Impact of financial literacy and behavioural biases on investment decision-making. FIIB Business Review, 13(1), 72–86.

Van Rooij, M., Lusardi, A., & Alessie, R. (2011). Financial literacy and stock market participation. Journal of Financial Economics, 101(2), 449–472.

Wold, H., & Bertholet, J. L. (1982). The PLS (partial least squares) approach to multidimensional contingency tables. Metron, 40(1–2), 303–326.

Worthington, A. C. (2013). Financial literacy and financial literacy programmes in Australia. Journal of Financial Services Marketing, 18, 227–240.