1Faculty of Management SRM Institute of Science and Technology, Chennai, Tamil Nadu, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

This research article tells us about the different types of retail food chains that are present in India in different geographical regions. Retail food chain investors only invest in those regions where there is per capita income in different states in India. People from tier 2-and tier-3 cities migrate towards metropolitan areas and better opportunities, better income and a source of livelihood. The circular flow of income is more dominant in the tier-1 cities due to the investors targeting the market and population with more per capita income. This article tells us about the challenges that retail food chains face in their business in certain states and regions in India. In India, retail food chains encounter a combination of opportunities and challenges that are influenced by regional diversity, regulatory frameworks, consumer behaviour and infrastructural variation. This article tells us how to solve the challenges faced by retail food chains and steps to eradicate customer churning and build and expand business in different regions of India.

Retail food chains, consumer behaviour, customer churn, business marketing

Introduction

Over the past decade, the retail food industry in India has experienced extraordinary development, solidifying its status as one of the most dynamic and rapidly evolving sectors in the country. Retail food chains have leveraged the distinctive opportunities in this diverse market, which are fuelled by evolving consumer preferences, an expanding middle class and technological advancements. This document explores the factors that have contributed to the growth of retail food chains in India, the obstacles they encounter and their future prospects.

The proliferation of retail food chains in India is propelled by multiple factors. Increasing disposable incomes within the expanding middle class have enhanced expenditure on branded food establishments providing a variety of cuisines. Accelerated urbanisation has facilitated the success of both domestic and international companies in places such as Bangalore, Hyderabad, Delhi and Mumbai, focusing on the youthful urban demographic. Shifts in lifestyles, particularly in urban regions, have heightened the desire for easy dining alternatives, resulting in the rise of casual dining and quick-service restaurants (QSRs). Technological innovations, such as app-based ordering and meal delivery services like Zomato and Swiggy, have optimised operations and enhanced accessibility. Furthermore, global culinary trends and the prominence of foreign chains such as McDonald’s and Starbucks have stimulated rivalry and innovation among local entities.

Challenges Faced by Retail Food Chains

Infrastructure and logistics: Although main urban centres are well-equipped for modern retail operations, numerous tier-2 and tier-3 cities continue to encounter infrastructure-related obstacles. Supply chains can be affected by factors such as transportation obstacles and unreliable refrigerated storage (Guttal, 2020; Smith & Jones, 2020).

Regulatory compliance: Retail food chains may encounter difficulties in navigating the diverse food safety regulations and procuring licenses in various states. Significant effort and investment are frequently necessary to ensure compliance with FSSAI standards and state-specific regulations.

Intense competition: The market is oversaturated with a diverse array of participants, including global titans and local startups, all of whom are vying for a share of the consumer’s wallet. In this rigorous competition, it is imperative to maintain competitive pricing, strategic marketing and continuous innovation.

Cultural diversity: The vast cultural diversity of India presents a challenge to food chains that are attempting to cater to local preferences. In order to maintain brand consistency while customising menus to appeal to a variety of regional palates, it is necessary to be adaptable (Guttal, 2020; Martin et al., 2020).

Problem Statement

The retail food market in India is seeing swift expansion, propelled by urbanisation, evolving customer preferences and rising disposable income. Nevertheless, despite this promise, the investment landscape continues to be beset by problems. Investors encounter challenges stemming from insufficient market information, variable regulatory conditions and fierce competition from both established entities and nascent companies. Moreover, there is an increasing customer desire for sustainable practices, requiring retail food chains to modify their operations and product offerings accordingly. This research seeks to examine the key determinants affecting investment decisions in retail food chains in India, emphasising market developments, customer behaviour, operational efficiencies and sustainability standards. The research aims to identify these characteristics to offer practical insights for investors seeking to manage the complexity of this dynamic sector, capitalise on its development potential and address the urgent need for sustainability in food retailing.

Significance of the Research

Importance of the Study

Comprehension of market dynamics: The research provides valuable insights into the complexities of the Indian retail food market, highlighting the influence of economic conditions, consumer behaviour and regional diversity on investment decisions. This understanding is indispensable for stakeholders who are endeavouring to effectively navigate this dynamic sector.

Challenges and opportunities identification: The research equips policymakers and investors with the knowledge required to devise strategies that can alleviate these concerns by identifying specific challenges, including regulatory obstacles, infrastructural deficiencies and cultural preferences. It also reveals opportunities for development in urban areas that are being driven by changing consumer preferences and rising disposable incomes.

Strategic investment advice: By emphasising regions with greater profitability potential, the findings can aid retail food chains in making well-informed investment decisions. This strategic focus has the potential to lead to more effective operational planning and resource allocation.

Policy implications: The research emphasises the importance of government policies that prioritise regulatory compliance and infrastructure development. In the end, policymakers who employ these insights to create a more favourable environment for retail food chain investments can benefit local economies.

Cultural adaptation strategies: By tailoring their menus to the culinary preferences of the region, retail food chains can enhance consumer satisfaction and loyalty. This cultural sensitivity is indispensable for the successful penetration of the Indian market in a diverse array of states.

Future research directions: The study offers the potential for further research into specific regions or demographic segments within India, thereby facilitating a more comprehensive analysis of localised strategies that can enhance the efficacy of retail food chains. To conclude, this research significantly contributes to the field of retail management by providing a nuanced understanding of the investment landscape for food chains in India. Consequently, it promotes the development of well-informed decision-making processes among investors and policymakers.

Literature Review

The retail food sector in India has undergone significant growth, propelled by a confluence of economic, cultural and technical influences. This review consolidates essential findings from current research, emphasising the determinants of growth, encountered hurdles and developing trends within the sector.

Factors Propelling Growth in the Retail Food Sector

Kumar and Sharma (2021) emphasise that increasing disposable incomes and the burgeoning middle class are critical factors propelling the retail food sector in India. These economic changes have prompted a move towards branded food franchises that provide both global and regional cuisines. Patel (2020) identifies urbanisation as a motivator, noting that metropolitan centres such as Bangalore and Mumbai have emerged as focal points for both domestic and foreign chains because of their dynamic demography.

The demand for convenience has significantly influenced the situation, as seen by Verma et al. (2019). Their research demonstrates the increasing popularity of QSRs among urban consumers who value expedience, flavour and diversity. Reddy and Gupta (2022) examine the technology improvements that have transformed the business, highlighting innovations such as mobile app-based ordering and online food delivery platforms like Zomato and Swiggy, which have become essential to operations.

Challenges in Retail Food Chains

Notwithstanding the optimistic growth trajectory, retail food chains in India have numerous hurdles. Guttal (2020) identifies infrastructural deficiencies in tier-2 and tier-3 cities, where logistics, cold storage and transportation constitute significant impediments. Regulatory compliance presents a challenge, as Smith and Jones (2020) examine the intricacies of adhering to food safety regulations and acquiring requisite permits.

Cultural diversity hampers operations, as Martin et al. (2020) emphasise the need for retail food chains to tailor menus to regional preferences while preserving brand consistency. Furthermore, vigorous market competition, as emphasised by Chopra and Mehta (2021), necessitates that both domestic and international entities perpetually innovate to maintain market share.

Ascendant Trends

The transition to sustainable methods is a notable trend in the sector. Consumers are progressively seeking environment-friendly packaging and ecologically sourced food, as noted by Salary Box (2023). This transition has compelled retail food companies to modify their operations to conform to environmental considerations. Fuchs et al. (2009) examine the global movement towards sustainability, highlighting the impact of retail power and private norms on the industry’s evolution.

Technological integration is a prevailing theme, as Chiu et al. (2021) investigate the efficacy of augmented reality applications in improving customer engagement. FranchiseBAZAR (2023) highlights the competitive environment in South India, where market saturation has compelled chains to implement creative techniques.

Regional Analysis

The geographical diversity of India poses distinct difficulties and opportunities for retail food businesses. The Economic Times (2023) underscores the differences between urban and rural communities, noting that investments are primarily concentrated in metropolitan districts. Sankalp Group (2023) highlights that tier-2 and tier-3 cities are becoming profitable marketplaces due to rising urbanisation and consumer expenditure.

Conversely, Minhas (2024) indicates that areas such as Bihar and Odisha persist in underperforming due to diminished per capita incomes and infrastructural deficiencies. Nevertheless, actions aimed at mitigating these discrepancies could unleash considerable growth potential in these regions.

The literature highlights the dynamic characteristics of the Indian retail food sector, propelled by changing consumer demands, technological progress and urbanisation. Nonetheless, obstacles including infrastructural deficiencies, regulatory intricacies and cultural heterogeneity endure. Resolving these challenges through innovation, regional adaptation and sustainable practices will be essential for the sector’s continued growth.

This review offers an in-depth analysis of the industry’s present situation and establishes a foundation for future research to investigate localised tactics and technical applications more thoroughly with implementing good managerial implications for business.

Objectives of the Research

Research Gap

Research Methodology

A Research Methodology for Investment in Retail Food Chains

This research technique delineates a systematic strategy to examining the investment potential in retail food chains. The analysis will concentrate on market trends, customer behaviour, operational efficiencies and financial performance to furnish insights for stakeholders contemplating investments in this area.

Research Design

The study will employ a mixed-methods research design, combining qualitative and quantitative methodologies to offer a thorough picture of the investment environment in retail food chains. The aims encompass the following.

Methods of Data Collection

Data will be collected using multiple methodologies.

Selection of Samples

The research will employ a stratified sampling method for surveys to guarantee representation across several demographics (age, income level, geographic area). A purposive sample strategy will be utilised to choose interview participants possessing pertinent experience in the retail food sector.

Analytical Methods for Data

The data analysis will encompass both quantitative and qualitative methodologies.

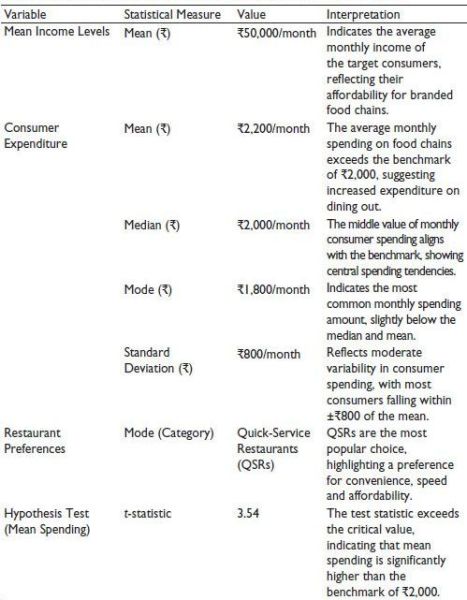

Quantitative analysis: Statistical software, such as SPSS or Excel, will be employed to analyse survey data. Descriptive statistics (mean, median, mode) will encapsulate consumer preferences, whereas inferential statistics (chi-square tests or regression analysis) will evaluate correlations between factors such as income level and spending behaviour.

Qualitative analysis: Thematic analysis will be utilised for interview transcripts and open-ended survey replies. This entails categorising the data into topics pertaining to investment prospects, market obstacles and customer perceptions of retail food chains.

Ethical Considerations

Ethical considerations encompass the following:

Informed consent: Participants will be apprised of the study's objective and their entitlement to withdraw at any moment without repercussions.

Confidentiality: All gathered data will remain confidential. Personal identifiers will be eliminated from reports to safeguard participant confidentiality.

Transparency: Participants will receive the findings at the study’s conclusion to ensure clarity regarding the utilisation of their contributions.

Research Questions

Interpretation: Outcomes and Analysis

Income levels: The target consumer demographic possesses an average income of .png/image(35)__12x17.png) 50,000 per month, signifying the capacity to afford branded food establishments.

50,000 per month, signifying the capacity to afford branded food establishments.

Expenditure patterns: The average consumer expenditure of .png/image(35)__12x17.png) 2,200 per month considerably exceeds the anticipated benchmark of

2,200 per month considerably exceeds the anticipated benchmark of .png/image(35)__12x17.png) 2,000, indicating an increase in spending on food establishments.

2,000, indicating an increase in spending on food establishments.

Consumer preferences are predominantly for QSRs, highlighting the importance of expediency, diversity and affordability.

Expenditure variability: Moderate variability indicates a rather stable spending pattern, with outliers likely signifying infrequent big spenders.

Analysis of Findings and Interpretation

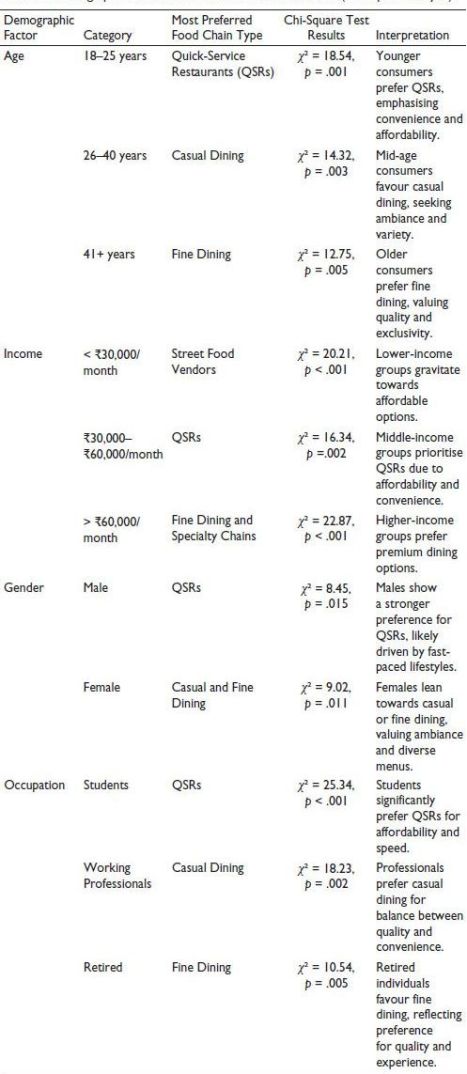

Demographics: Young consumers (18–25 years) exhibit a propensity for QSRs, indicating a preference for expediency and cost-effectiveness.

Older demographics exhibit a growing inclination towards casual and fine eating, prioritising ambiance and exclusivity.

Income: Low-income demographics favour street food and economical choices, whilst middle-income demographics prefer QSRs.

Affluent individuals prioritise exclusive experiences, such as gourmet eating and speciality establishments.

Gender: Men have a preference for QSRs, presumably motivated by the demand for expedient meals. Women exhibit a greater inclination for casual and fine eating, prioritising the complete dining experience.

Occupation: Students are the predominant demographic of QSR consumers, driven by financial limitations and the need for convenience. Working professionals enjoy casual dining, which harmonises quality with time efficiency. Retired individuals go towards upscale meals, desiring exceptional service and quality. Demographic considerations significantly impact food chain preferences. Businesses ought to categorise their offerings appropriately: to focus QSR promotions on younger demographics and students; create exclusive culinary experiences for affluent senior demographics; customise marketing strategies to correspond with gender-specific preferences and professional requirements.

The descriptive statistics of income levels and monthly consumer expenditure are presented in Table 1, highlighting spending behaviors that surpass the benchmark of .png/image(35)__12x17.png) 2,000 per month.

2,000 per month.

A chi-square test was conducted to examine the association between demographic variables and food chain preferences, and the results are detailed in Table 2.

Findings

This section delineates the conclusions from the research on investments in retail food chains in India, emphasising market trends, consumer behaviour, operational efficiencies and financial performance from the surveys and qualitative data collected from survey samples of tier-2 and tier-3 cities.

Table 1. Descriptive statistics of income and consumer expenditure patterns.

Market Dynamics

The Indian retail food business has experienced substantial expansion, with forecasts suggesting a compound annual growth rate of around 10%–12% during the forthcoming five years. This expansion is propelled by escalating urbanisation, increased disposable incomes and evolving customer preferences favouring convenience and quality in food goods.

The advent of e-commerce has revolutionised the retail food sector. The popularity of online grocery shopping is rising, particularly after the pandemic, resulting in increased investments in logistics and supply chain management to satisfy consumer needs.

Table 2. Demographic Correlates and Food Chain Preferences (Chi-Square Analysis).

Emphasis on Health and Wellness: A rising tendency is evident in customers’ inclination towards health-conscious dietary choices. Retail food chains specialising in organic, natural and health-oriented items are seeing growth, leading investors to view these sectors as profitable prospects.

Consumer Behaviour

Preference for convenience: Consumers are progressively prioritising QSRs and ready-to-eat meal alternatives as a result of their hectic lifestyles. This transition has resulted in heightened investments in fast-food establishments and delivery services.

Brand loyalty is prominent among Indian consumers, especially for well-established retail food businesses. Investments in branding and marketing techniques are essential for new entrants to acquire market share and establish a loyal consumer base.

Increasing consumer awareness of sustainability: Consumers are becoming increasingly cognisant of sustainability, impacting their buying choices. Retail food chains that implement sustainable sourcing and packaging techniques are likely to appeal to environmentally conscious consumers, rendering them appealing investment prospects.

Operational Efficiencies

Technological adoption: Investments in technology are crucial for improving operational efficiencies in retail food chains. Automation in inventory management, point-of-sale systems and customer relationship management applications is being utilised to enhance operational efficiency.

Supply chain optimisation: Effective supply-chain management is essential for minimising expenses and guaranteeing product availability. Retail food chains that invest in comprehensive supply chain solutions might improve their competitive advantage in the market.

Fiscal Performance

Return on investment (ROI): Retail food chains in India have demonstrated favourable ROI metrics, especially those that have effectively merged internet platforms with brick-and-mortar establishments. Investors are motivated by the prospect of substantial returns due to the growing market size.

Investment prospects: Venture capitalists and private equity firms are increasingly interested in the retail food business, especially in creative startups that utilise technology or concentrate on niche sectors like organic foods or plant-based items.

Obstacles

The intricate regulatory framework may present obstacles for investors. Adherence to food safety standards and regulations necessitates meticulous management, thereby affecting operational expenses.

The retail food sector is intensely competitive, with many participants contending for market share. New entrants must distinguish themselves by offering distinct value propositions to achieve success.

Quantitative Data Analysis

The statistical analysis highlights the crucial influence of income levels, expenditure patterns and dining tastes on the growth strategies of retail food chains. Businesses ought to prioritise QSR products and sustain competitive pricing while utilising information into consumer expenditure trends to improve market penetration.

Demographic considerations significantly affect food chain preferences. Businesses ought to categorise their offerings appropriately:

Study Analysis and Discussion

Retail food chains invest in Northern India, particularly in significant cities such as Delhi, Chandigarh and other regions of the National Capital Region (NCR). Nevertheless, these are some potential reasons why investment may be restricted in specific regions of Northern India, such as more rural or less economically developed states.

Economic inequality: Although Northern India boasts prosperous urban areas, specific regions experience diminished economic activity and income levels. This reduces the purchasing power of the population, rendering it less appealing for chains that depend on a greater number of middle-class and affluent consumers.

Infrastructure issues: In numerous rural regions of Northern India, there are still significant infrastructure deficiencies, such as insufficient refrigerated storage facilities, inconsistent electricity and inadequate road connectivity. The preservation of the quality and availability of dietary products is impeded by these logistical obstacles.

In numerous Northern states, the food market is still dominated by tiny independent enterprises, street food culture and local food vendors. This is known as market fragmentation. It may be challenging for large chains to compete with the established local preferences and price competitiveness of these smaller, often family-run operations (Guttal, 2020; Minhas, 2024).

Supply chain and logistics: The establishment of an efficient supply chain for perishable products can be a challenge due to the region’s size and diversity. The necessity for substantial investment in distribution networks to effectively serve smaller villages and cities may result in elevated operational costs.

Cultural preferences: The cuisine culture of Northern India is both robust and diverse, with substantial differences between states such as Punjab, Uttar Pradesh, Haryana and Rajasthan. The populace’s predilection for traditional and local dishes over the standardised offerings of large food franchises frequently restricts the demand in these regions.

Cost of operation: In certain underdeveloped regions, the cost of operating a chain outlet may exceed potential profits due to increased transportation and logistics expenses. As a result, organisations may opt to prioritise other regions that offer more favourable returns.

Regulatory environment: The significant variation between states can discourage chains from investing in regions where navigating permits and conformance is difficult or inconsistent due to the complexity and inconsistency of business regulations and red tape.

Urban–rural divide: Despite the fact that cities like Chandigarh and Delhi are well-developed and have a substantial consumer base for retail chains, rural areas often lack the urban infrastructure and economic conditions necessary to support large-scale operations (Guttal, 2020; Smith & Jones, 2020).

In summary, while retail food chains allocate resources to more developed and urbanised regions of Northern India, less economically developed regions encounter impediments that render them unsuitable for large-scale retail investments.

Investment in a Retail Cuisine Chain in Western India

Retail food corporations invest substantially in Western India, particularly in economically developed regions such as Mumbai, Pune and Ahmedabad. These cities are recognised for their robust consumer markets, urbanisation and infrastructure, which render them the epicentres of food chains. Nevertheless, if you are referring to less developed or more rural areas of Western India, where investment is restricted, the following are some potential explanations:

(i) Competition with local businesses: Smaller food businesses and vendors often have deep community roots and cater effectively to local tastes at lower prices. This competition makes it harder for retail chains to gain a foothold.

(ii) Regulatory hurdles: Navigating state-specific regulations, permits and compliance requirements can be more challenging in some parts of Western India, adding a layer of complexity for large chains looking to expand beyond major urban centres (Cooling India, 2024; The Economic Times, 2023).

While Western India does have significant retail food chain presence in its larger cities, the investment in smaller towns and rural areas remains limited due to these economic, logistical and cultural challenges.

Retail Food Chain Investments in Southern India

Retail food franchises are present in numerous regions of South India, with a particular concentration in urban centres such as Bangalore, Chennai, Hyderabad and Kochi. These cities are among the most developed in the country, and they have received substantial investments from both domestic and international culinary chains. Nevertheless, there are several reasons why investment may be restricted in specific rural areas or lesser cities in South India:

South India is home to a robust local food culture that is profoundly rooted in a variety of regional cuisines that are both popular and affordable. Idli, dosa, biryani and traditional thalis are the most popular dishes in the market and are frequently chosen over the standardised offerings of chain restaurants. This complicates the process of retail chains establishing a robust presence, particularly in regions where indigenous cuisine is an integral component of daily life (Franchise BAZAR, 2023).

Rural and semi-urban areas may still encounter operational challenges, such as unreliable electricity, limited refrigerated storage and transportation difficulties, despite the robust infrastructure of cities. This affects the capacity of food chains to preserve operational efficiency and supply quality in regions beyond major urban centres (Kouzina Food Tech, 2023).

Although there has been significant investment in major cities in South India, which have a vibrant food culture and economy, these factors may cause retail food chains to be hesitant to expand significantly into smaller or less economically developed regions of the same region.

States and Other Regions in India Where Retail

Food Chains Do Not Heavily Invest

Regions with higher population densities, improved infrastructure and greater purchasing power are the primary focus of retail food chains in India. Nevertheless, certain states may experience a decrease in investment from retail food chains as a result of factors such as limited market potential, economic challenges, or logistical issues. The following jurisdictions are included.

Bihar—Despite its substantial population, the state of Bihar is confronted with a number of obstacles, including a relatively low per capita income, less developed infrastructure and lower urbanisation. These factors may serve as a deterrent to investment from retail food franchises.

Uttar Pradesh is the most populous state; however, it is less appealing than more urbanised states due to the rural character of many areas and the lack of infrastructure necessary for large-scale retail operations.

Madhya Pradesh—Due to its substantial rural population and low levels of urbanisation, Madhya Pradesh may not be a top priority for retail food chains.

Odisha—Despite the state’s expanding economy, certain regions are still underdeveloped, and food chains frequently prioritise more urbanised and developed regions.

Chhattisgarh—Similar to Odisha, Chhattisgarh is characterised by a blend of urban and rural areas; however, it fails to achieve the same level of infrastructure and consumer purchasing power as more developed states.

Jharkhand—The market potential of Jharkhand is constrained by a combination of infrastructure challenges and a reduced purchasing power.

Currently, retail food chains prioritise states such as Maharashtra, Delhi NCR, Gujarat and Tamil Nadu, where urban markets and the middle-class population are significant generators of demand. However, these states may receive more attention as infrastructure improves.

Capitals in East India Where Retail Food Chains Invest

Kolkata, the capital of West Bengal, is a major hub for retail food chains. It has a large urban population, strong consumer demand and better infrastructure than many other eastern states. The state is home to various national and international retail brands like Big Bazaar, Reliance Fresh and Spencer’s.

Bhubaneswar in Orissa, Ranchi in Jharkhand and Patna in Bihar are attracting some retail food chains in recent years.

Retail food chains have been progressively expanding into the Northeastern states of India; however, the pace and scale of investment are much slower than in more developed regions. In comparison to other regions of India, this region faces infrastructure constraints, a lesser level of urbanisation and a smaller middle-class population. Nevertheless, the region’s undeveloped market and expanding consumer base present substantial potential.

Retail food chains are increasingly investing in the following major Northeastern states:

Retail food chains have made substantial investments in Assam, with a particular emphasis on Guwahati, the main city in the region. Spencer’s, Reliance Fresh and Big Bazaar have established stores in Guwahati and other urban centres in Assam. On account of its superior infrastructure and connectivity in comparison to other Northeastern states, the state is a primary focus for food retail chains.

The retail food sector has encountered some expansion in Shillong, the capital of Meghalaya. While the market is smaller, Spencer’s and Reliance Fresh have established a presence by capitalising on the region’s increasing urbanisation and higher disposable incomes.

Imphal, the capital of Manipur, is also experiencing an increase in retail investments. However, the retail food chains’ presence is still restricted in comparison to Assam and Meghalaya, primarily due to consumer demand and infrastructure constraints.

In recent years, Agartala, the metropolis of Tripura, has garnered the attention of retail food chains. Despite the fact that the market is still in its infancy in comparison to larger metropolitan locations, brands like Spencer’s and Big Bazaar are making an effort to establish a presence.

Kohima, the capital of Nagaland, is a smaller market with a reduced number of significant retail food chains. The sector is primarily underdeveloped in the larger urban areas, with only a small number of competitors entering the market.

The investment in the retail food chain has been limited in Arunachal Pradesh, Mizoram and Sikkim as a result of the smaller urban centres, lower population densities and infrastructure challenges. Sikkim, conversely, has some potential due to its expanding tourism sector and its proximity to important markets like Darjeeling.

Obstacles for Retail Food Chains in the Northeast

Infrastructure and connectivity: Insufficient logistical support and road networks may present challenges for retail chains in ensuring a consistent supply of fresh food products.

Market size and consumer behaviour: The diverse cuisine preferences of various states and the smaller urban populations present challenges for chains in rapidly targeting a large customer base.

Cultural factors: The region is home to a diverse array of food cultures, and chains may need to modify their offerings to accommodate local preferences and dietary practices.

In spite of these obstacles, the region is progressively attracting a greater number of retail food chains, which are motivated by the potential for long-term expansion, particularly in urban centres such as Shillong and Guwahati. In the future, Northeastern India may become a more significant focus for retail food chains as the middle class expands and infrastructure improves.

Tourist-centric locations, including the Andaman and Nicobar Islands, Lakshadweep and prominent coastal islands in Maharashtra and Kerala, are the most common locations for retail food chain restaurants in various Indian islands. Although logistical challenges, urbanisation and smaller markets may limit the expansion of large national and international food chains, certain major fast-food chains and restaurants have increased their presence in these regions, particularly in larger towns and tourist destinations.

Some of the islands in India are home to the following prominent retail food chain restaurants:

McDonald’s operates an establishment in Port Blair, the capital city of the Andaman and Nicobar Islands. This is one of the few international fast-food chains in the region that primarily serves both locals and travellers.

Domino’s Pizza—Domino’s provides its renowned pizza and delivery services in Port Blair. The demand for fast-food chains such as Domino’s has been on the rise as the tourism sector in the Andaman Islands continues to expand.

Café Coffee Day is a local cafe chain that serves both local and tourist clients in some of the more urbanised areas of Port Blair.

Barista has a presence in the Andaman Islands, particularly in tourist-friendly areas, despite not being as prevalent as other chains.

The small population and relatively low urbanisation in Lakshadweep are the primary reasons for the limited availability of retail food chains. Nevertheless, the expansion of tourism has resulted in the establishment of local culinary outlets and smaller chains that cater to both locals and visitors, particularly on the larger islands of Kavaratti and Agatti.

Local Seafood and Restaurant Chains—Tourists are particularly fond of local seafood restaurants and establishments, despite the absence of large chains such as McDonald’s or Domino’s. These are frequently family-owned or included in resort culinary options.

Resort Dining—A significant number of the islands’ resorts, including those on Agatti Island and Kadmat Island, provide dining experiences that frequently include international cuisines in addition to local delicacies.

The Sundarbans region is primarily rural, and there is a scarcity of retail food franchise restaurants. Nevertheless, Kolkata, the closest urban hub, is home to a diverse selection of food chains, at least some of which may be of interest to travellers travelling to the Sundarbans. Some of the most popular chains in Kolkata are Domino’s Pizza, KFC, McDonald’s and Burger King.

Local eateries and smaller restaurants predominate within the islands of the Sundarbans, while these chains typically cater to visitors travelling to the region.

Mumbai is home to a diverse array of national and international retail food chain restaurants, many of which have expanded their services to the neighbouring islands of Alibaug and Elephanta Island.

Kochi, a significant port city, is encircled by numerous islands and is home to a variety of retail food chain restaurants that serve the city’s substantial tourist population.

McDonald’s—McDonald’s has outlets in Kochi, and although it does not have a direct presence on the smaller islands, tourists can readily access it in the city. The urban and tourist population in Kochi are served by Domino’s Pizza, which is extensively available. Another fast-food chain that is extensively available in Kochi is KFC, which is a popular choice among both locals and tourists. Pizza Hut is a Kochi-based restaurant that is readily accessible in urban areas, despite the absence of outlets on the islands. Chains that specialise in local Kerala cuisine, such as Sree Krishna Bhavan or Bismillah, serve traditional delicacies such as sadya, appam and seafood to both locals and tourists in Kochi. In the city and adjacent islands, these chains frequently provide affordable dining options.

Obstacles for Retail Food Chains in the Islands

Logistics and supply chain: The limited transport infrastructure of islands frequently presents logistical challenges, which make it challenging to ensure a consistent supply of fresh ingredients for large-scale food chains.

Market size: Prior to making substantial investments in these regions, food chains must meticulously evaluate the demand due to the seasonal nature of tourism and the lesser population of numerous islands.

Cultural preferences: The flavour and dietary habits of island residents and tourists can differ significantly from those of mainland India, necessitating that food chains adjust their offerings to accommodate these differences.

McDonald’s, Domino’s, KFC and local restaurant chains have established a presence in significant urban or tourist areas such as Port Blair, Kochi, Mumbai and Alibaug, despite the fact that the presence of retail food chain restaurants is limited in many of India’s islands. In the less urbanised islands, there is also a preference for resort-based dining alternatives and smaller, local eateries.

The retail food chain restaurant industry in India is evolving, but significant research gaps remain in areas such as consumer behaviour, technological integration, market expansion, sustainability and competitive strategies. Filling these gaps could provide valuable insights for businesses looking to optimize their operations, enhance customer experience and grow their market share in a competitive and diverse market. Ultimately, research into these areas can assist food chains in adapting to evolving consumer demands, infrastructure challenges and regional preferences, thereby fostering development in India’s dynamic food service sector.

Resolving Issues and Providing Recommendations

In order to overcome the primary impediments to the enhancement of investments in retail food chains in India, strategic interventions are required. The subsequent suggestions are practical suggestions for overcoming challenges and fostering growth:

Develop cold-chain infrastructure: Public–private partnerships to establish refrigerated transport networks and cold storage facilities, with a particular focus on rural areas and tier-2 and tier-3 cities.

Simplify logistics: Collaborate with local delivery partners to optimise inventory and routes by implementing technology-enabled supply chain solutions, including AI and IoT.

Adapt to local tastes: Offer menu items that are influenced by the cultural traditions of the area, such as vegetarian options in Gujarat or spice-heavy items in Andhra Pradesh.

Franchise partnerships: Form partnerships with local enterprises that have a thorough comprehension of consumer behaviour and can help in the effective adaptation of offerings.

Innovative formats: In order to mitigate administrative expenses, it may be advantageous to implement kiosk-style outlets or cloud kitchens as an alternative to full-service restaurants in high-rent regions.

Tier-2 and tier-3 cities: Focus investments on cities that are experiencing lower real estate costs and increasing urbanisation.

Single window clearance: Encourage the establishment of a centralised system for the management of compliance requirements, permits and licensing.

Employ technology: Utilise AI-driven analytics to optimise pricing strategies, anticipate trends and understand customer preferences.

Digital payments: Improve the convenience and consumer retention of digital payment systems and loyalty applications.

Online platforms: Enhance visibility on food delivery applications and integrate with e-commerce platforms to broaden the audience.

Localised marketing: Develop brand loyalty by implementing region-specific campaigns, such as local festivals and cultural events.

Consumer engagement: Utilise influencer collaborations, community programmes and social media to engage consumers in a manner that is specific to their local preferences.

Transparency: To entice both domestic and foreign investors, furnish transparent financial projections, market potential and growth strategies.

Tax incentives: Collaborate with government entities to obtain tax incentives for the establishment of enterprises in underdeveloped regions.

Green investments: Emphasise sustainability (e.g., local procurement, eco-friendly packaging) to attract environmentally conscious investors.

Training programmes: Establish training centres to improve the skills of product safety, customer service and supply chain management.

Job creation: Emphasise the potential for job creation in unexplored markets to motivate local government support.

Procurement models: Collaborate with local producers and suppliers to minimise transportation expenses and guarantee quality and freshness.

Equitable trade practices: Encourage the establishment of long-term contracts and equitable pricing to ensure the stability of supply chains and the support of the local economy.

Encourage the provision of subsidies for the development of infrastructure in rural and semi-urban areas to support food chains.

Simplify the GST structures and import/export norms for fundamental materials and food-related equipment to simplify business operations. By implementing these strategies, retail food chains in India can effectively navigate challenges, attract investments and unlock new growth opportunities across diverse regions.

Managerial Implications

Managerial Implications for Investment in Retail Food Chains

The research findings about investments in retail food chains present numerous management implications that might inform decision-making and strategic planning for players in this industry.

Prioritisation of sustainable practices: Managers must emphasise sustainability in their operations by using eco-friendly practices. This includes the responsible procurement of ingredients, waste reduction and the use of sustainable packaging. Adopting these measures can improve brand reputation and draw environmentally aware consumers.

Investment in sustainable products: Consumer demand is increasingly favouring health-conscious and sustainable food options. Retail food chains ought to contemplate broadening their product offerings to encompass organic, plant-based and locally sourced foods to satisfy this demand.

Technological integration: Managers ought to allocate resources towards technology to optimise operations and enhance customer experience. This entails the implementation of sophisticated inventory management systems, data analytics for consumer insights and e-commerce platforms to enable online buying.

Improving supply-chain efficiency: Leveraging technology to optimise supply-chain operations can save expenses and enhance product availability. Managers ought to investigate automation and data-centric solutions to improve operational efficiency.

Conducting market research and analysing consumer insights regularly to comprehend evolving customer preferences are vital. Managers want to employ surveys and focus groups to obtain insights that guide product development and marketing tactics.

Customisation of consumer experience: Retail food chains can enhance the purchasing experience by leveraging consumer data for personalisation. Customising campaigns and product suggestions can enhance client loyalty and boost revenue.

Site selection analysis: Managers must perform comprehensive evaluations of prospective locations for new establishments. Demographic trends, foot traffic and competition must be evaluated to optimise visibility and accessibility.

Expansion into emerging markets: There exists substantial potential for expansion in tier-2 and tier-3 cities in India. Managers must assess prospects for expansion into markets exhibiting rising consumer expenditure on retail food.

Differentiation strategies: To distinguish themselves in a competitive market, managers must formulate unique selling propositions that set their services apart from those of competitors. This may entail concentrating on specialised markets or delivering outstanding customer service.

Loyalty programmes: The use of loyalty programmes helps foster a robust consumer base. Managers ought to develop reward programmes that encourage repeat purchases and cultivate brand loyalty among consumers.

Awareness of economic sensitivity: Managers must recognise economic swings that could affect customer-spending behaviours. Formulating adaptable corporate strategies that can respond to fluctuating economic situations will be essential for maintaining growth.

Regulatory compliance: It is imperative to remain apprised of regulatory modifications pertaining to food safety and environmental requirements. Managers must ensure adherence to regulations to prevent potential legal complications and uphold operational integrity.

The managerial implications from the research underscore the significance of sustainability, technological integration, customer insight, strategic planning, competitive differentiation and risk management in facilitating successful investments in retail food chains. By focusing on these aspects, managers can improve operational efficiency, satisfy consumer wants and ultimately attain sustainable growth in the retail food industry.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Hridayama Dev Varma  https://orcid.org/0009-0002-9198-7084

https://orcid.org/0009-0002-9198-7084

Chiu, C. L., Ho, H. C., Yu, T., Liu, Y., & Mo, Y. (2021). Exploring information technology success of augmented reality retail applications in retail food chains. Journal of Retailing and Consumer Services, 61, 102561. https://doi.org/10.1016/j.jretconser.2021.102561

Chopra, R., & Mehta, N. (2021). Global food trends and their influence on Indian consumers: A competitive analysis of international chains in India. British Food Journal, 123(7), 2345–2360. https://doi.org/10.1108/BFJ-06-2020-0451

Cooling India. (2024). Solving India’s food chain challenges. Cooling India Journal. https://www.coolingindia.in/solving-indias-food-chain-challenges/

FranchiseBAZAR. (2023). Competitive landscape for retail food chains in South India: Market saturation and consumer preferences analysis. FranchiseBAZAR Report. https://franchisebazar.com/blogs/

Fuchs, D., Kalfagianni, A., & Arentsen, M. (2009). Retail power, private standards, and sustainability in the global food system. Journal of Food Systems and Sustainability, 4(2), 35–50.

Guttal, V. (2020). Infrastructure challenges for retail food chains in tier-2 and tier-3 cities: An analysis of logistics issues in India. Journal of Supply Chain Management, 56(4), 45–60. https://doi.org/10.1111/jscm.12180

Idli Xpress. (2023). Local versus international food chains in smaller Indian towns. Food Industry Review, 12(3), 45–50.

Kouzina Food Tech. (2023). Regional food preferences and their impact on retail food chains in South India. Kouzina Tech Journal. https://www.kouzinafoodtech.com/

Kumar, A., & Sharma, R. (2021). Growth factors driving the retail food industry in India. Journal of Retailing and Consumer Services, 58, 102–110. https://doi.org/10.1016/j.jretconser.2020.102110

Martin, L., Gupta, S., & Rao, K. (2020). Cultural diversity and menu customization strategies for retail food chains in India: Balancing local tastes with brand consistency. Journal of Consumer Marketing, 37(5), 565–578.

Minhas, A. (2024). Food retail in India—statistics & facts. Statista Insights. https://www.statista.com/topics/5615/food-retail-in-india/

Patel, S. (2020). The impact of urbanization on retail food chains in India: A case study of Bangalore and Mumbai. International Journal of Retail & Distribution Management, 48(5), 543–558. https://doi.org/10.1108/IJRDM-09-2019-0273

Reddy, S., & Gupta, M. (2022). Technological advancements in the retail food sector: The role of mobile apps and online delivery platforms. Journal of Business Research, 139, 123–134. https://doi.org/10.1016/j.jbusres.2021.09.052

Salary Box. (2023). Challenges and opportunities in the Indian retail sector. Salary Box Report. https://www.salarybox.in/blog/challenges-and-opportunities-in-the-indian-retail-sector/

Sankalp Group. (2023). Challenges of expanding retail food chains in South Indian cities. Sankalp Report. https://sankalp-group.org/

Smith, J., & Jones, L. (2020). Regulatory compliance challenges for retail food chains in India: Navigating the FSSAI landscape. International Journal of Food Safety and Nutrition, 5(2), 77–89.

The Economic Times. (2023). Investment trends in Western India: Challenges and opportunities for retail food chains.

Verma, P., Singh, R., & Joshi, A. (2019). Changing lifestyles and preferences: The rise of quick-service restaurants in urban India. Food Quality and Preference, 75, 1–10. https://doi.org/10.1016/j.foodqual.2019.03.005