1Department of Commerce, Aligarh Muslim University, Aligarh, Uttar Pradesh, India

2Department of Agricultural Economics and Business Management, Aligarh Muslim University, Aligarh, Uttar Pradesh, India

The present study investigates the determinants contributing to the continuous usage intentions of existing m-wallet users. The current study’s conceptual framework is based on the notion of stimulus organism response. Data from existing m-wallet users were collected using a carefully designed questionnaire. Once the data’s authenticity and reliability were confirmed, structural equation modelling (SEM) analysis was executed. The findings of the SEM analysis indicated that the users’ attitudes towards the m-wallet platform are positively influenced by cybersecurity knowledge, perceived usefulness, compatibility, facilitating conditions, convenience and touch-free transactions. Moreover, it has been shown that attitude has a beneficial influence on users’ intentions to continue using the m-wallet platform. The current study provides practical consequences and recommendations for m-wallet service providers and marketers. These suggestions can assist in developing strategies for m-wallet usage, holding onto current users and influencing potential users on the platform.

Mobile wallets, touch-free transactions, stimulus organism response model, cybersecurity knowledge, consumer attitude, continuous usage intention

Introduction

Recently, there has been substantial growth in modern payment methods such as e-banking and digital wallets (Shetu et al., 2022). The need for electronic, digital and cashless transactions has expanded worldwide due to the substantial changes in payment methods for products and services in recent decades (Fahad & Shahid, 2022). Additionally, digital financial systems have revolutionised the payment industry, and a mobile-based payment mechanism called a mobile wallet (m-wallet) has gained acceptance worldwide (Kaur et al., 2020). A mobile wallet is an innovative idea in today’s digital age, serving as a smartphone-based platform for conducting financial transactions and facilitating rapid payments (Esawe, 2022; Singh et al., 2017). Mobile wallets facilitate a wide range of transactions, including online purchases, expenditure payments, financial transactions, automated and fast cash transfers and expense management (Kapoor et al., 2022). Chawla and Joshi (2019) explained mobile wallets and their associated applications as digital platforms that store money and enable financial transactions through smartphones. Furthermore, proponents have contended that these payment systems surpass traditional ones in terms of user-friendliness and efficacy due to their ability to facilitate cashless transactions and support both local and remote transactions (Kapoor et al., 2022).

Furthermore, it is revealed that people have a positive reception towards digital payment technologies that are prompt, efficient and provide significant benefits (Fahad & Shahid, 2022). Standardisation, connectivity and simple approval processes are essential for rapidly adopting and continuously using digital payment systems (Mohd Thas Thaker et al., 2023; Shetu et al., 2022). In India, the proliferation of digital payments such as e-banking and m-wallets has been driven by the upsurge of electronic commerce, the widespread use of digital phones, affordable and accessible internet connections, and the willingness of users to embrace technological advancements (Afzal et al., 2024; Chawla & Joshi, 2021). The government’s ‘Digital India’ initiative aims to convert India into a digital economy (Fahad & Shahid, 2022). Therefore, digital services like m-wallet have gained a significant portion of digital payment platforms (Chawla & Joshi, 2021; Kaur et al., 2020).

Prior research has extensively explored several aspects that influence the acceptability of mobile wallets, particularly in the Indian context (Chawla & Joshi, 2019; Singh et al., 2017). Yet, earlier studies have concentrated explicitly on accepting mobile wallets (Chawla & Joshi, 2021; Singh et al., 2020). Prior research has examined several internal and external factors of mobile wallets that impact users’ decision to embrace and utilise them. Shin (2009) showed that users develop a favourable perception of the m-wallet platform due to its user-friendly nature and practicality. Additionally, a positive attitude, trust in the platform and perceived security all positively influence users’ intentions. Studies have shown that the users’ perceived utility, self-efficacy, trust in the platform and informal learning are some of the critical factors in the acceptance of the m-wallet (Shetu et al., 2022; Singh et al., 2020).

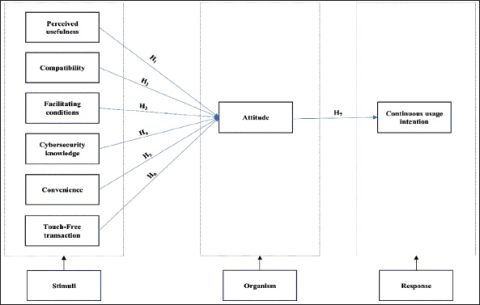

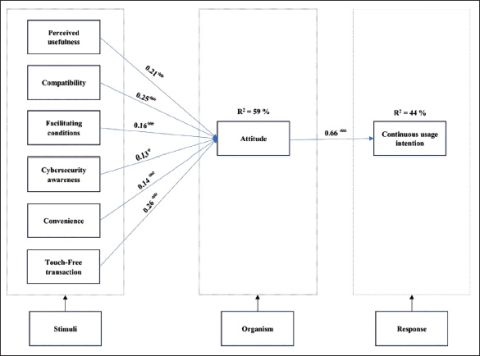

Upon conducting an extensive literature review, it has been discovered that a substantial body of research is available on m-wallets. The existing research primarily examined potential users’ adoption, usage and behaviour towards the m-wallet platform (Esawe, 2022; Madan & Yadav, 2016; Mombeuil, 2020; Singh et al., 2017). Since the introduction of the unified payment interface, a rival platform of m-wallets in India, many consumers are still using the m-wallet platform for financial dealings (Fahad & Shahid, 2022). Therefore, there is a need to empirically investigate the factors behind the continuous usage of m-wallets by existing users, because it will provide an understanding of the factors responsible for motivating users in the continuous usage of digital payment platforms like m-wallets. Moreover, past research has not sufficiently addressed the continuous usage intentions (CUI) of consumers in lower-middle income countries, such as Indian users. Hence, this study aims to employ the stimulus organism response (SOR) model in the conceptual model to address the research deficiencies in the existing literature on continuous usage of m-wallets from the perspective of a lower-middle income country. For this purpose, the users’ stimuli of the m-wallet platform include compatibility, convenience, perceived usefulness (PU), facilitating conditions, cybersecurity knowledge and touch-free transactions. The organism is represented by the users’ attitude. Ultimately, their ongoing intention to use is regarded as the answer (response). The present study is anticipated to contribute to the existing theory and offer valuable recommendations to marketers regarding the retention of current m-wallet users and the attraction of new users to the platform.

Literature Review on the SOR Model and Mobile Wallets

SOR Model and Digital Platforms

Mehrabian and Russell (1974) elucidated that the SOR model examines users’ affective states towards a product or service, taking into account its intrinsic and extrinsic characteristics and, consequently, its influence on the user’s ultimate decision, generally referred to as the response. According to Islam et al. (2020), various stimuli can influence the psychological state of users and lead to specific behavioural responses. By considering the different aspects of a given product or service (stimuli), the user’s emotional state is shaped (organism); ultimately, individuals either express a favourable or unfavourable reaction (response). In the existing research, authors have examined various attributes as stimuli, diverse orgasmic states and varied forms of users’ responses (Islam et al., 2020).

Researchers have examined the technological and environmental factors of digital platforms as the stimulus, the emotional states of consumers as the organism, and the many sorts of user responses based on the study’s objectives. A study examining the interaction between banking consumers and banks’ websites identified five key features as stimuli: website interactivity, aesthetics, customisation, telepresence and simplicity of use. Simultaneously, customer engagement is seen as the core element, while banking customers’ trust and retention are considered as the resultant response. Furthermore, the findings validate that all five characteristics benefit consumer interaction with the bank’s website. This, in turn, leads to an improvement in customers’ trust and loyalty, as demonstrated by their response (Islam et al., 2020). When consumers intend to make a repeat purchase online, factors such as security concerns, promotions and website appearance are suggested to influence their decision. Trust is seen as the driving force behind their decision, and the actual repurchase is viewed as the consumers’ response. These outcomes demonstrate the explanatory capacity of the SOR framework. The study by Zhu et al. (2020) found that factors such as security issues, advertising and the look of the website have a favourable influence on users’ trust and, therefore, encourage them to intend to repurchase. The authors have confirmed the suitability of the SOR framework in the field of digital platforms, such as mobile auctions, online retailing by consumers and virtual tourism; this validation is supported by the results obtained in studies conducted by Kim and Lennon (2013) and Kim et al. (2020).

Related Work on M-wallet

Scholars have endeavoured to elucidate the diverse facets of the acceptance, utilisation and endorsement of m-wallets in various settings and geographical areas (Chawla & Joshi, 2021; Kapoor et al., 2022; Kaur et al., 2020; Mohd Thas Thaker et al., 2023). The existing literature on m-wallets presents many factors that contribute to the usage of m-wallets. For example, Singh et al. (2017) found that customers’ impression of the m-wallet is significantly influenced by their preference and satisfaction, which in turn affects their usage of the m-wallet. Millennials found the m-wallet platform beneficial due to its user-friendly interface; furthermore, their behavioural intentions are driven by the platform’s convenience and the trust they have in it (Sarmah et al., 2021). The users’ behavioural intentions to directly embrace m-wallets are found to be impacted by the platform’s ease of use, usefulness, compatibility and insecurity (Madan & Yadav, 2016; Mombeuil, 2020). Furthermore, there is a favourable relationship between the frequency of usage and the intention to use, as well as the level of insecurity, compatibility, utility and ease of use of the mobile wallet platform (Shetu et al., 2022). In most of the studies discussed above, continuous usage patterns of the users are not analysed adequately, especially from a lower-middle income country’s perspective of India; therefore, it is necessary to investigate because it will provide a robust understanding of the motivators of the platform, which keeps motivating the users to engage with the platform continuously. Hence, we have utilised the SOR model to gain a comprehensive understanding of consumer continuous usage patterns of the m-wallet platform. This model helps us analyse the attitude and conduct of existing consumers towards the m-wallet platform and their plans to continue using it (see Figure 1).

Hypothesis Development

Perceived Usefulness and Attitude

PU refers to the assumption that technology-based modern and digital platforms can enhance the user experience (Davis, 1989). Furthermore, PU is described as the conviction held by m-wallet users to improve their experience when utilising the m-wallet (Sharma et al., 2021). Earlier studies on implementing digital

Figure 1. Theoretical Model of the Study.

payment platforms have identified PU as the primary factor influencing consumers’ sentiments (Qu et al., 2022). The research on modern banking users has established a clear and robust relationship between PU and consumers’ attitudes (Chawla & Joshi, 2019). This finding confirms the importance of PU in the context of the digital platform of m-wallet (Chawla & Joshi, 2021). Consequently, we hypothesise that PU as a stimulus will result in a favourable correlation with the organism, specifically in the form of positive user attitudes. Thus, we propose the following hypothesis;

H1: PU will positively influence the attitude of the m-wallet users.

Compatibility and Attitude

Compatibility denotes the extent to which an invention meets the needs of potential consumers at a specific moment (Fahad & Shahid, 2022). Concerning the m-wallet, compatibility denotes the users’ confidence in the platform’s capability to meet their demands, suit their lifestyles and enhance their experiences (Hasan & Gupta, 2020; Kaur et al., 2020). Oliveira et al. (2016) presented the importance of compatibility in determining digital platform views and use intentions among potential consumers. The consumers’ attitudes towards a digital platform are contingent upon its alignment with their preferences and lifestyles (Chawla & Joshi, 2020). Kaur et al. (2020) verified that consumers are inclined to adopt the m-wallet platform due to its compatibility with their requirements. The consumers’ attitudes towards the m-wallet platform are contingent upon their perception of its compatibility with their lifestyle and current needs. If they perceive the m-wallet platform as compatible with meeting their needs, they will exhibit a positive attitude towards it. Thus, we formulated a hypothesis;

H2: Compatibility will positively affect the attitude of the m-wallet users.

Facilitating Condition and Attitude

Venkatesh et al. (2003) explained facilitating conditions (FC) as the extent to which individuals perceive that a framework is established at a technological and organisational level to facilitate the ease of system usage. In the realm of digital platforms for mobile wallets, factors such as familiarity with mobile devices, internet connectivity, accessibility and affordability of digital mobile devices, adherence to security and privacy regulations and other related components are seen as the FC of the platform (Chawla & Joshi, 2019). Authors have contended that in the current digital and modern technological era, FC substantially and directly influences consumers’ attitudes (Rahman et al., 2020). Therefore, a positive FC will encourage consumers to embrace and utilise new products or services (Baabdullah et al., 2019). A study on e-wallets has affirmed the significance of FC in influencing consumers’ attitudes towards embracing the platform and, ultimately, its value in determining consumers’ intentions to continue using it (Mohd Thas Thaker et al., 2023). Based on the reasons outlined earlier, we expect that the FC associated with the m-wallet platform will have a beneficial influence on existing consumers’ attitudes towards the platform. Thus, we formulated the following hypothesis;

H3: FC will positively influence the attitude of the m-wallet users.

Cybersecurity Knowledge and Attitude

Cybersecurity knowledge in digital banking platforms denotes the user’s understanding of the risks and consequences of cyber fraud related to internet operations (Abawajy, 2014). The significance of possessing cybersecurity knowledge has become apparent due to individuals’ potential risks and vulnerabilities while utilising internet-based digital services (Zwilling et al., 2022). Consequently, users of digital banking platforms must possess the necessary cybersecurity knowledge and skills across various facets of the platform because it shapes their attitudes and use behaviour (Limna et al., 2023). According to the earlier authors, cybersecurity knowledge has a considerable influence on consumers’ attitudes towards digital payment platforms (Afzal et al., 2024). Consequently, we assert that a greater understanding and knowledge of cybersecurity will have a beneficial influence on existing users’ attitudes towards the m-wallet platform. Therefore, we formulated the following hypothesis;

H4: Cybersecurity knowledge will positively affect the attitude of the m-wallet users.

Convenience and Attitude

An m-wallet offers clients various advantages besides card and cash payment options, including making purchases anywhere and accessing financial transactions in real time. It also eliminates the inconvenience of carrying physical cash and cards (Mallat, 2007). M-wallets are seen as convenient, as users are not obligated to input intricate login credentials during financial transactions, resulting in swift completion of transactions (Mombeuil, 2020). Adoption studies on m-wallets suggest that convenience plays a significant role in consumers’ embracing of them. Consumers find m-wallets comfortable due to the fast completion of financial transactions on the m-wallet platform (Kaur et al., 2020). Hence, we contend that if existing users see the m-wallet platform as comfortable due to its widespread availability and the seamless execution of financial transactions, they will exhibit a favourable attitude towards the platform. Thus, based on the aforementioned factors, we formulated the following hypothesis:

H5: Convenience will positively affect the attitude of the m-wallet users.

Touch-free Transaction and Attitudes

Auer et al. (2020) reported that the World Health Organisation has verified that exchanging coins, physical cards and paper money between customers and service providers facilitate coronavirus transmission. Touch-free or non-contact financial transactions offer numerous benefits from the user’s standpoint. For instance, contactless payments are regarded as more convenient, efficient, secure and environmentally friendly. The study conducted by Kapoor et al. (2022) found a positive association between the acceptance of m-wallets and touch-free transactions, indicating that users’ attitudes towards touch-free transactions were favourable. Given the COVID-19 outbreak, consumers currently prioritise their health and evaluate the advantages of touch-free purchases. Thus, we contend that the attributes and advantages of touch-free transactions on the m-wallet platform will continue to have a beneficial influence on the attitudes of existing m-wallet users. Thus, we formulated the following hypothesis;

H6: Touch-free transactions will positively affect the attitudes of the m-wallet users.

Attitude and Continuous Usage Intention

The user’s attitude and appraisal of a product or service determine the user’s conduct. Consequently, users develop attitudes by assessing the digital platform’s ease of use and usefulness (Afzal et al., 2024). Ultimately, they demonstrate a favourable mindset and a willingness to utilise the product or service through the platform (Shin, 2009). A study on m-wallets found that consumers who have trust in the platform, feel secure using it, find it beneficial, perceive it as supporting their needs and consider it compatible with their wants are probable to form a good attitude towards the platform; ultimately, a favourable mindset amplifies their inclination to utilise the platform (Chawla & Joshi, 2019). Earlier research has also validated a direct correlation between the attitudes of m-wallet platform users and their positive intentions towards the platform (Singh et al., 2020). Therefore, we contend that fostering a favourable disposition towards the m-wallet platform will incentivise existing users to utilise the platform persistently. Given the aforementioned considerations, we propose the following hypothesis:

H7: Attitude will positively influence the continuous usage intention of the m-wallet users.

Research Methodology

Instrument of Measurement

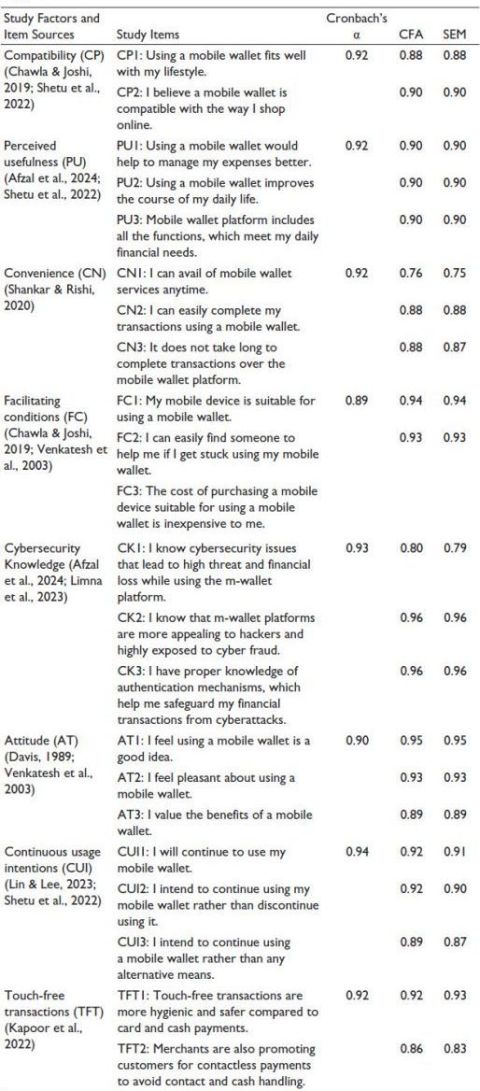

Prior research has indicated that maintaining the scale and content validity of items is crucial, as it is closely connected to the generalisability of the outcomes (Fahad & Shahid, 2022). Consequently, the questionnaire for the current study took into account items from previous studies (see Table 3). A questionnaire containing two sections was used to gather the necessary data from the current m-wallet users. The primary objective of the initial section of the questionnaire was to collect demographic details from the participants. The second component of the questionnaire collected responses pertaining to the study’s requirements, utilising a five-point Likert scale. Under the current work’s requirements, the second half of the questionnaire was kept intact, containing 22 items to collect study-specific information.

Questionnaire and Research Participants

The experts and scholars in the related subject were consulted regarding the study questionnaire and items, and as a result, some minor modifications were implemented. To assess the level of complexity and participants’ comprehension of the items in the questionnaire, a pilot survey was conducted with 25 existing m-wallet users. The preliminary survey findings indicated that the respondents perceived the survey items as comprehensible, confirming their appropriateness for the intended objective. Furthermore, it was discovered that slight modifications in the wording of specific items were required based on the advice supplied by experts and participants in the preliminary survey. Consequently, these necessary modifications were implemented before disseminating the questionnaire. Moreover, the data collected in the last stage and throughout the pilot survey stage were not combined to prevent potential bias. Additionally, it was found that Cronbach’s αduring the pilot survey phase exceeded 0.70, indicating the validity of the questionnaire and its items.

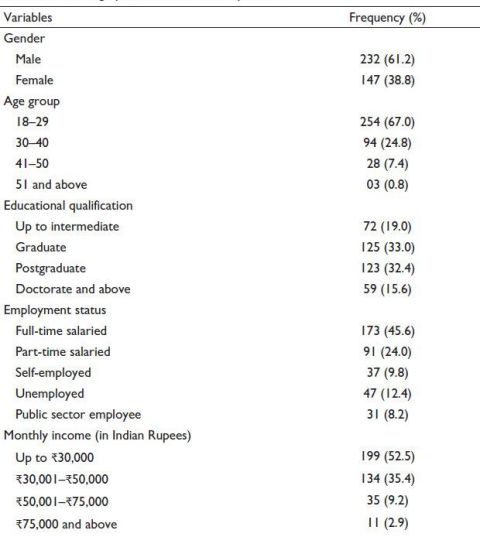

The required data for the current work were collected from existing users of m-wallets using a purposeful sampling technique, which was under the study’s requirements. Before gathering the necessary data from the participants, they were provided with information regarding the study’s objective, methods, findings and importance. To obtain accurate and inclusive data, the Delhi NCR region was selected to get the required data because earlier authors have argued that Delhi NCR is a cosmopolitan city and attracts population from all areas of the country (Madan & Yadav, 2016). As mentioned above, questionnaires were given to existing m-wallet users in the region. Out of the participants, 408 out of the 550 questionnaires were retrieved, resulting in a return rate of 74%. A multitude of unfinished questionnaires were discovered among the returned completed questionnaires; thus, they were meticulously extracted. Furthermore, after analysing the participants’ responses, it was discovered that the completed questionnaires might have included some data points significantly different from the rest. However, these outliers were also eliminated to safeguard the correctness and reliability of the study’s results. A total of 379 valid responses were included in the investigation. Most of the participants were young (67% approx.), graduates and postgraduates (65% approx.), and they mostly fell in the income group of ‘Up to Rs 30,000’. Further details of the respondents’ demographic information can be seen in Table A1 of the Appendix.

Data Analysis

In earlier works, authors have examined the study’s data using various analytical techniques (Chawla & Joshi, 2021; Fahad & Shahid, 2022). IBM SPSS Statistics 20.0 was employed for the descriptive assessment of the current study, and AMOS 23.0 was employed for the confirmatory factor analysis (CFA) as well as structural equation modelling (SEM) analyses. As postulated in prior studies, we used a two-step data analysis process (Anderson & Gerbing, 1988). At the initial stage, we examined the fit indices of the measurement model. Before the study’s hypotheses were analysed, the data’s validity and reliability were evaluated. Then, we examined the structural model to analyse the present study’s proposed hypotheses.

Findings

Common Method Bias (CMB)

According to Podsakoff and Organ (1986), the problem of CMB arises when the results of a study on the relationship between two or more variables are distorted due to the employment of the same measuring methods. Prior research has emphasised employing Harman’s single-factor test for analysing the CMB (Podsakoff et al., 2003). In the analysis of the CMB, all the items under study were entered into SPSS IBM Statistics 20.0 simultaneously. The test results revealed that the variance attributed to a single factor was 43.8%, below the threshold limit of less than 50% suggested in previous studies (Podsakoff et al., 2003). Therefore, CMB was not relevant to the present study.

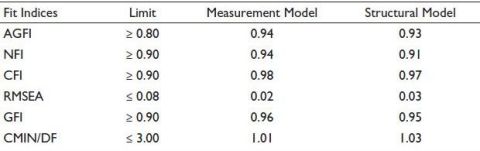

Measurement Model

According to previous studies, a CMIN/DF ratio of 3 or less indicates a robust model fit, whereas GFI, CFI and NFI values should be 0.90 or higher. Additionally, the AGFI value must be equal to or larger than 0.80. Furthermore, the RMSEA value needs to be less than or equal to 0.08. Table 1 presents the fit indices of the current investigation and compares them with the specified thresholds, and it was found that the aforementioned fit indices were within the recommended limits as stated by Hu and Bentler (1999).

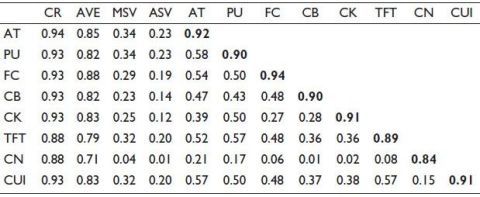

Convergent Validity and Discriminant Validity

As previously noted, to confirm content validity, the study items were carefully drawn from other pieces of related research. Table 3 presents the study items’ source, SEM and CFA loadings. Furthermore, to uphold convergent validity, the prescribed conditions outlined in prior investigations are as follows: To ensure sufficient convergent validity, it is recommended that the measuring items should have loadings over 0.50, the average extracted variance (AVE) for each construct should be larger than 0.50, and the composite reliability (CR) should also be above 0.70 (Hair et al., 2006). The data utilised in this investigation fulfilled the aforementioned criterion, providing support for the convergent validity (see Table 2).

Table 1. Fit Indices and Limits of the Measurement and Structural Model.

Table 2. Validity and Reliability of Data.

Notes: AVE: Average variance extracted; AT: Attitude; CB: Compatibility; MSV: Maximum shared variance; CN: Convenience; FC: Facilitating condition; CR: Composite reliability; CK: Cybersecurity knowledge; ASV: Average shared variance; PU: Perceived usefulness; TFT: Touch-free transactions; CUI: Continuous usage intention. Bold values represent the square root of the AVEs.

According to previous research, to demonstrate discriminant validity, three specific characteristics must be fulfilled (Fornell & Bookstein, 1982). The three prerequisites are: (a) The ASV and MSV should be smaller than the AVEs; (b) The square root of the AVEs of each construct must be bigger than the correlation values with other constructs (as indicated boldly in Table 2); (c) The correlation between any two constructs must be below 0.80. The data in the present study fulfil all the criteria mentioned before, hence establishing the study’s discriminant validity (see Table 2).

Structural Model Results

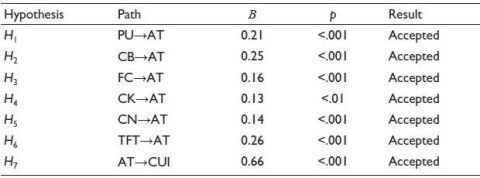

Following the data and measurement model authentication, the study employed SEM analysis to assess the hypotheses and structural model. The findings shown

Table 3. Study Factors and Items, Cronbach’s α Values and Item Loadings in CFA and SEM.

in Table 1 demonstrate that the SEM has a strong match, as all fit indices fall within the specified thresholds (Hu & Bentler, 1999). Furthermore, the results obtained from the SEM analysis provided evidence in favour of all hypotheses. The study found that PU (β = 0.21, p < .001), CB (β = 0.25, p < .001), FC (β = 0.16, p < .001), CK (β = 0.13, p < .01), CN (β = 0.14, p < .001) and TFT (β = 0.26, p < .001) are positively associated with the attitudes of existing m-wallet users. Moreover, the study reveals that attitude (β = 0.66, p < .001) has a significant and favourable impact on the CUI of m-wallet users, as depicted in Table 4 and Figure 2.

The respondent’s attitude, as indicated by R2 value (squared multiple correlation) of 59%, demonstrates a significant level of variance in the structural model analysis. In addition, the intention to use continuously (with an R2 of 44%) also exhibited substantial variance. The adequacy of the explained variance is supported by the R2 values and recommendations from previous studies on consumer behaviour (Hair et al., 2006).

Table 4. Findings of the Structural Model.

Notes: AT: Attitude; CB: Compatibility; CN: Convenience; FC: Facilitating condition; CK: Cybersecurity knowledge, PU: Perceived usefulness; TFT: Touch-free transactions; CUI: Continuous usage intentions.

Figure 2. Result of the Structural Model.

Discussion

In this study, we proposed six hypotheses (H1–H6) to examine the connection between various stimuli (PU, CB, FC, CK, CN and TFT) and the attitudes of existing m-wallet users (organism). The results obtained from applying SEM indicated that all the study hypotheses (H1–H6) were accepted as initially stated. This confirms that PU, CB, FC, CK, CN and TFT positively correlate with existing consumers’ attitudes towards the mobile wallet (see Table 4). Most of the aforementioned discoveries align with the contributions of previous studies in the relevant field. Therefore, it may be inferred that current m-wallet users perceive the platform as user-friendly, convenient and beneficial in everyday activities. They perceive the utilisation of m-wallets as compatible with their requirements and preferences. Existing users are familiar with the advantages and disadvantages of the m-wallet platform. These existing users have found the current FC of the m-wallet helpful.

Furthermore, users’ understanding and knowledge of cybersecurity significantly improves their attitude towards the digital platform of m-wallet. The results of the SEM analysis were unexpected as they showed that H6 was accepted. This suggests that TFT made through the m-wallet platform still influence users’ attitudes towards the platform. The majority of the aforementioned results are consistent with previous research that has focused on the digital payment sector (Afzal et al., 2024; Kapoor et al., 2022; Sarmah et al., 2021; Shetu et al., 2022).

In this study, we hypothesised (H7) that there is a connection between the attitude of current m-wallet users and their plans to continue using the platform. According to the results of the SEM investigation, it is believed that attitude has a favourable influence on the ongoing usage intentions of existing m-wallet users. It emphasised the significance of users’ favourable attitudes when utilising digital payment platforms such as the m-wallet. Consistent with previous research, the current study’s results also demonstrated that users with a favourable attitude desire to consistently utilise the digital payment platform (George & Sunny, 2021; Sarmah et al., 2021). Therefore, this study further validates the significance of a favourable attitude in influencing the usage patterns of users.

This study is a distinctive attempt to utilise the SOR framework to examine the continuous usage intents of existing m-wallet users in India. Based on the SOR framework, the study’s conceptual model incorporates PU, compatibility, FC, cybersecurity knowledge, convenience and TFT as stimuli that influence the user’s attitude (organism). The users’ continual intention to use the m-wallet (in the form of response) is determined by their orgasmic states, that is, attitude. Prior research has concentrated on users’ adoption and usage patterns towards the m-wallet platform. Most of these studies utilised technology adoption models such as TAM, UTAUT and DOI in their conceptual frameworks (Chawla & Joshi, 2020; Kaur et al., 2020). In our view, this study is one of the initial investigations on m-wallets that utilised the SOR model to establish a connection between the stimuli of the m-wallet platform, organism and response of the current m-wallet users. The study’s findings showed the explanatory power of the SOR model in the ongoing utilisation of contemporary digital payment platforms.

Contributions of the Study

Theoretical and Practical Contributions

The current study has provided more value to the m-wallet field and contributed to the SOR framework in the following ways. The study has utilised users’ cybersecurity knowledge as a factor influencing the attitudes of existing m-wallet users, which was not adequately used in prior related studies on m-wallets. Cybersecurity knowledge, PU, compatibility, FC, convenience and TFT were not previously considered in studies on m-wallet continuous usage (Chawla & Joshi, 2019; George & Sunny, 2021). Furthermore, the present work revealed that users’ attitudes had a positive and influential impact on customers’ intention to persist in using m-wallet services. Previous research only identified these factors as significant in the initial adoption of m-wallets. These findings will assist in advancing contemporary payment research, specifically concerning the continued usage of mobile wallets.

Furthermore, this study has demonstrated the explanatory potential of the SOR model in the context of digital payment platforms such as m-wallet. Moreover, we consider this study to be among the initial ones empirically examining the SOR model by integrating elements from various technology acceptance models. The study’s conceptual model included the TAM model’s PU and the DOI model’s compatibility. The results have demonstrated the adaptability of the SOR model. Due to its adaptable nature, this study has allowed subsequent researchers to incorporate more elements into the SOR model in their ongoing technology or service consumption research.

It is one of the pioneering works that identifies the factors influencing the attitudes and intentions of existing m-wallet users in a lower-middle income country. Therefore, the potential contributions of the current study are as follows: Managers and policymakers worldwide of m-wallet service providers can consider the results of the present work in effectively managing their platforms and services. The current study has demonstrated the significance of cybersecurity knowledge, compatibility, convenience, TFT, perceived utility and FC in shaping the attitudes of current users of the m-wallet service. Therefore, marketers are advised to organise campaigns to improve the cybersecurity knowledge and awareness of current and prospective users. Moreover, it is recommended that managers and policymakers develop strategies to enhance the compatibility, convenience and usefulness of the m-wallet platform for users. This can be achieved by offering multiple language options and implementing a mechanism that provides round-the-clock assistance in resolving consumer issues. They may provide cashback and other incentives for transacting over the platform to retain loyal users and attract more potential users. Such measures will have a positive impact on user attitudes. In addition, the m-wallet application developer should consider the stimuli that have been found to impact the users’ attitudes towards the m-wallet when building applications connected to it.

Limitations and Future Scope

Despite the excellent contribution, the present study has discovered certain limitations that can guide future research. The current work employs a theoretical model that incorporates the SOR framework. This model focuses on a limited number of stimuli to precisely predict the attitudes of m-wallet users. Hence, it is recommended to incorporate additional significant factors such as trust, security and safety in future research, as they have a pivotal influence on consumer decision-making (George & Sunny, 2021; Prasad et al., 2017; Sankaran & Chakraborty, 2022). Furthermore, the m-wallet is a digital system that operates on mobile devices to facilitate financial transactions. As a result, it is natural for customers to have concerns regarding the security and privacy measures used on the platform. The current study does not encompass the aforementioned components of customer apprehension. Therefore, it is recommended that these essential factors be taken into account in future research. In future research, it may be beneficial to utilise a combination of several behavioural models to explain the continuous usage patterns of m-wallet users. For instance, when examining QR-code payment, a comprehensive model was determined to be satisfactory in describing the situation (Le, 2021).

Similarly, while investigating the ongoing utilisation of contemporary services, studies have found it advantageous to employ an integrated approach (Ng et al., 2024; Pattnaik & Shukla, 2021). Regarding mobile-based financial services, various factors affect urban and rural populations differently; age and generational differences play a significant role in adopting and continuously using financial innovations (Hameed & Nigam, 2023; Karjaluoto et al., 2021). Therefore, future research should focus on conducting a comparative analysis to understand these dynamics better.

Furthermore, the participants in the current investigation are identified as individuals who are younger and possess higher levels of education from a particular region of Delhi NCR, potentially impacting the outcomes of the study. Hence, it is advisable to employ a deliberate multi-stage sampling method in future studies to gather data from diverse age groups and users with varied backgrounds to extrapolate the obtained findings. Additionally, the study’s legitimate responses are limited in number. It is recommended that future studies gather a more comprehensive dataset to enable the generalisation of the conclusions drawn. Due to the current study’s cross-sectional nature, the results’ reliability may be compromised. Therefore, it is recommended that future research on the ongoing use of m-wallets should be conducted longitudinally.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iDs

Fahad  https://orcid.org/0000-0001-8755-5284

https://orcid.org/0000-0001-8755-5284

Naseem Ahmad  https://orcid.org/0009-0000-5015-548X

https://orcid.org/0009-0000-5015-548X

Abawajy, J. (2014). User preference of cyber security awareness delivery methods. Behaviour & Information Technology, 33(3), 237–248. https://doi.org/10.1080/0144929X.2012.708787

Afzal, M., Ansari, Mohd. S., Ahmad, N., Shahid, M., & Shoeb, Mohd. (2024). Cyberfraud, usage intention, and cybersecurity awareness among e-banking users in India: An integrated model approach. Journal of Financial Services Marketing, 29(4), 1503–1523. https://doi.org/10.1057/s41264-024-00279-3

Anderson, J. C., & Gerbing, D. W. (1988). Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin, 103(3), 411.

Auer, R., Cornelli, G., & Frost, J. (2020). Covid-19, cash, and the future of payments. Bank for International Settlements.

Baabdullah, A. M., Alalwan, A. A., Rana, N. P., Kizgin, H., & Patil, P. (2019). Consumer use of mobile banking (m-banking) in Saudi Arabia: Towards an integrated model. International Journal of Information Management, 44, 38–52.

Chawla, D., & Joshi, H. (2019). Consumer attitude and intention to adopt mobile wallet in India–An empirical study. International Journal of Bank Marketing, 37(7), 1590–1618.

Chawla, D., & Joshi, H. (2020). The moderating role of gender and age in the adoption of mobile wallet. Foresight, 22(4), 483–504.

Chawla, D., & Joshi, H. (2021). Importance-performance map analysis to enhance the performance of attitude towards mobile wallet adoption among Indian consumer segments. Aslib Journal of Information Management, 73(6), 946–966.

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3), 319–340.

Esawe, A. T. (2022). Understanding mobile e-wallet consumers’ intentions and user behavior. Spanish Journal of Marketing-ESIC, 26(3), 363–384.

Fahad, & Shahid, M. (2022). Exploring the determinants of adoption of Unified Payment Interface (UPI) in India: A study based on diffusion of innovation theory. Digital Business, 2(2), 100040. https://doi.org/10.1016/j.digbus.2022.100040

Fornell, C., & Bookstein, F. L. (1982). Two structural equation models: LISREL and PLS applied to consumer exit-voice theory. Journal of Marketing Research, 19(4), 440–452.

George, A., & Sunny, P. (2021). Developing a research model for mobile wallet adoption and usage. IIM Kozhikode Society & Management Review, 10(1), 82–98.

Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2006). Multivariate data analysis

(6th ed.). Pearson Prentice Hall.

Hameed, S., & Nigam, A. (2023). Exploring India’s generation Z perspective on AI enabled internet banking services. Foresight, 25(2), 287–302.

Hasan, A., & Gupta, S. K. (2020). Exploring tourists’ behavioural intentions towards use of select mobile wallets for digital payments. Paradigm, 24(2), 177–194.

Hu, L., & Bentler, P. M. (1999). Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modeling: A Multidisciplinary Journal, 6(1), 1–55.

Islam, J. U., Shahid, S., Rasool, A., Rahman, Z., Khan, I., & Rather, R. A. (2020). Impact of website attributes on customer engagement in banking: A solicitation of stimulus-organism-response theory. International Journal of Bank Marketing, 38(6), 1279–1303. https://doi.org/10.1108/IJBM-12-2019-0460

Kapoor, A., Sindwani, R., Goel, M., & Shankar, A. (2022). Mobile wallet adoption intention amid COVID-19 pandemic outbreak: A novel conceptual framework. Computers & Industrial Engineering, 172, 108646. https://doi.org/10.1016/j.cie.2022.108646

Karjaluoto, H., Glavee-Geo, R., Ramdhony, D., Shaikh, A. A., & Hurpaul, A. (2021). Consumption values and mobile banking services: Understanding the urban–rural dichotomy in a developing economy. International Journal of Bank Marketing, 39(2), 272–293. https://doi.org/10.1108/IJBM-03-2020-0129

Kaur, P., Dhir, A., Bodhi, R., Singh, T., & Almotairi, M. (2020). Why do people use and recommend m-wallets? Journal of Retailing and Consumer Services, 56, 102091. https://doi.org/10.1016/j.jretconser.2020.102091

Kim, J., & Lennon, S. J. (2013). Effects of reputation and website quality on online consumers’ emotion, perceived risk and purchase intention: Based on the stimulus-organism-response model. Journal of Research in Interactive Marketing, 7(1), 33–56. https://doi.org/10.1108/17505931311316734

Kim, M. J., Lee, C.-K., & Jung, T. (2020). Exploring consumer behavior in virtual reality tourism using an extended stimulus-organism-response model. Journal of Travel Research, 59(1), 69–89. https://doi.org/10.1177/0047287518818915

Le, X. C. (2021). The diffusion of mobile QR-code payment: An empirical evaluation for a pandemic. Asia-Pacific Journal of Business Administration, 14(4), 617–636. https://doi.org/10.1108/APJBA-07-2021-0329

Limna, P., Kraiwanit, T., & Siripipattanakul, S. (2023). The relationship between cyber security knowledge, awareness and behavioural choice protection among mobile banking users in Thailand. International Journal of Computing Sciences Research, 7, 1133–1151.

Lin, R.-R., & Lee, J.-C. (2023). The supports provided by artificial intelligence to continuous usage intention of mobile banking: Evidence from China. Aslib Journal of Information Management, 76(1). https://doi.org/10.1108/AJIM-07-2022-0337

Madan, K., & Yadav, R. (2016). Behavioural intention to adopt mobile wallet: A developing country perspective. Journal of Indian Business Research, 8(3), 227–244.

Mallat, N. (2007). Exploring consumer adoption of mobile payments: A qualitative study. The Journal of Strategic Information Systems, 16(4), 413–432. https://doi.org/10.1016/j.jsis.2007.08.001

Mehrabian, A., & Russell, J. A. (1974). An approach to environmental psychology. The MIT Press.

Mohd Thas Thaker, H., Subramaniam, N. R., Qoyum, A., & Iqbal Hussain, H. (2023). Cashless society, e-wallets and continuous adoption. International Journal of Finance & Economics, 28(3), 3349–3369.

Mombeuil, C. (2020). An exploratory investigation of factors affecting and best predicting the renewed adoption of mobile wallets. Journal of Retailing and Consumer Services, 55, 102127. https://doi.org/10.1016/j.jretconser.2020.102127

Ng, S. L., Rezaei, S., Valaei, N., & Iranmanesh, M. (2024). Modelling services continuance intention: Evidence from apps stores. Asia-Pacific Journal of Business Administration, 16(2), 256–281. https://doi.org/10.1108/APJBA-08-2021-0408

Oliveira, T., Thomas, M., Baptista, G., & Campos, F. (2016). Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Computers in Human Behavior, 61, 404–414. https://doi.org/10.1016/j.chb.2016.03.030

Pattnaik, P. N., & Shukla, M. K. (2021). Examining the impact of relational benefits on continuance intention of PBS services: Mediating roles of user satisfaction and engagement. Asia-Pacific Journal of Business Administration, 14(4), 637–657. https://doi.org/10.1108/APJBA-03-2021-0123

Podsakoff, P. M., MacKenzie, S. B., Lee, J.-Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879–903. https://doi.org/10.1037/0021-9010.88.5.879

Podsakoff, P. M., & Organ, D. W. (1986). Self-reports in organisational research: Problems and prospects. Journal of Management, 12(4), 531–544.

Prasad, S., Gupta, I. C., & Totala, N. K. (2017). Social media usage, electronic word of mouth and purchase-decision involvement. Asia-Pacific Journal of Business Administration, 9(2), 134–145. https://doi.org/10.1108/APJBA-06-2016-0063

Qu, B., Wei, L., & Zhang, Y. (2022). Factors affecting consumer acceptance of electronic cash in China: An empirical study. Financial Innovation, 8(1), 1–19.

Rahman, M., Ismail, I., & Bahri, S. (2020). Analysing consumer adoption of cashless payment in Malaysia. Digital Business, 1(1), 100004. https://doi.org/10.1016/j.digbus.2021.100004

Sankaran, R., & Chakraborty, S. (2022). Factors impacting mobile banking in India: Empirical approach extending UTAUT2 with perceived value and trust. IIM Kozhikode Society & Management Review, 11(1), 7–24. https://doi.org/10.1177/2277975220975219

Sarmah, R., Dhiman, N., & Kanojia, H. (2021). Understanding intentions and actual use of mobile wallets by millennial: An extended TAM model perspective. Journal of Indian Business Research, 13(3), 361–381.

Shankar, A., & Rishi, B. (2020). Convenience matter in mobile banking adoption intention? Australasian Marketing Journal, 28(4), 273–285.

Sharma, A., Dwivedi, Y. K., Arya, V., & Siddiqui, M. Q. (2021). Does SMS advertising still have relevance to increase consumer purchase intention? A hybrid PLS-SEM-neural network modelling approach. Computers in Human Behavior, 124, 106919. https://doi.org/10.1016/j.chb.2021.106919

Shetu, S. N., Islam, Md. M., & Promi, S. I. (2022). An empirical investigation of the continued usage intention of digital wallets: The moderating role of perceived technological innovativeness. Future Business Journal, 8(1), 43. https://doi.org/10.1186/s43093-022-00158-0

Shin, D.-H. (2009). Towards an understanding of the consumer acceptance of mobile wallet. Computers in Human Behavior, 25(6), 1343–1354. https://doi.org/10.1016/j.chb.2009.06.001

Singh, N., Sinha, N., & Liébana-Cabanillas, F. J. (2020). Determining factors in the adoption and recommendation of mobile wallet services in India: Analysis of the effect of innovativeness, stress to use and social influence. International Journal of Information Management, 50, 191–205. https://doi.org/10.1016/j.ijinfomgt.2019.05.022

Singh, N., Srivastava, S., & Sinha, N. (2017). Consumer preference and satisfaction of M-wallets: A study on North Indian consumers. International Journal of Bank Marketing, 35(6), 944–965.

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 27(3), 425–478. https://doi.org/10.2307/30036540

Zhu, B., Kowatthanakul, S., & Satanasavapak, P. (2020). Generation Y consumer online repurchase intention in Bangkok: Based on stimulus-organism-response (SOR) model. International Journal of Retail & Distribution Management, 48(1), 53–69. https://doi.org/10.1108/IJRDM-04-2018-0071

Zwilling, M., Klien, G., Lesjak, D., Wiechetek, .png) ., Cetin, F., & Basim, H. N. (2022). Cyber security awareness, knowledge and behavior: A comparative study. Journal of Computer Information Systems, 62(1), 82–97. https://doi.org/10.1080/08874417.2020.1712269

., Cetin, F., & Basim, H. N. (2022). Cyber security awareness, knowledge and behavior: A comparative study. Journal of Computer Information Systems, 62(1), 82–97. https://doi.org/10.1080/08874417.2020.1712269

Appendix

Table A1. Demographic Details of the Respondents.