1ONE School of Business, Bengaluru, Karnataka, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

Over the years, since the financial opening up of the Indian economy in the early 1990s, under the previous government, there has been an overselling of a lot of financial products. This over selling has led to huge problems to the consumers in the form of mis-selling or overselling. There have also been issues with relation to lack of proper financial education to the consumers by the financial bodies. The present study looks into the problem of mis-selling and how different consumer factors lead to this problem. A conceptual framework to this problem is given and based on that, information is analysed.

mis-selling, financial products, cross-selling, financial regulation

Introduction

Mis-selling is a big issue in the financial services industry. Today’s financial institutions such as banks, mutual fund houses, insurance companies and so on are overloaded with data on customers through various data sources. The problem on mis-selling may reduce in the financial year beginning of 2020 April as a result of government policy changes made in the budget. The decision being that section 80C of salary insurance was taken out as a saving tool along with ELSS and 70 other exemptions.

The Insurance Regulatory and Development Authority has set a high target on the agents, which has led to agents not being able to achieve the target owing to high work pressure and lack of proper training.

Bali et al. (2011) mentioned that there is a lot of mis-selling happening over the last 1 year. According to the collection of data, a lot of multiple selling occurs in all the areas of insurance, for example, regarding getting benefits of insurance, wrong paper submission, fixing between the agent and customer and so on. Indian regulators works hard to reduce costs. One of its main focus areas to control or reduce costs is by proactively arresting mis-selling, which can be achieved through an effective mis-selling risk assessment programme, that is, verifying the agents and customers. Checking the proof of the agent claims on the customers, mystery shopping, that is, getting data relating to the various channel partners, brokers and so on compliance reviews including review of advertising expenses.

Baradhwaj (2011) had identified that client-related multiple selling can happen at variety of situations at the time of providing documents to the customers, such as wrongly mentioning of health, family history, occupation and so on in the offer documents (Ahmed & Hamdan, 2015). Distributor-related multiple selling could take by submitting fake documents, misappropriation of finances and so on. Tseng and Shih (2012) noted that at the agents lure customers by giving them fake promises at the time of obtaining the products and promoting these insurance products as investment products.

Sarkodie and Yusif (2012) noted in this study, the researcher tries to collect the different theories related to mis-selling and tries to analyse the factors that led to these theories being.

Problem Statement

The study aims to find the main factors behind mis-selling and the reasons why mis-selling occur in the financial services industry and the factors behind the growth of the same. Mis-selling is a malpractice used by salespeople to sell their products.

Objectives

Following are the objectives of the study:

Literature Review

Cross-selling

This is another issue faced by insurance companies wherein banks sell insurance products to existing customer and customers may buy the insurance products as they are having some contact or relation with the bank. Vladimir et al. (2013) noted that cross-selling is widely used by various financial institutions in reaching to their customers by utilizing the faith and trust of the previous products which have been sold successfully to the customers. According to Kumar (2012), in a study with special reference to State Bank of India (SBI), it was observed that SBI was in the process of doing cross-selling to customers who were availing savings account services from the bank. This cross-selling may be in the form of trying to sell mutual funds, insurance products and wealth management product.

Cross-selling insurance business also follows some methods to get the best possible sales from a customer based on various factors such as (a) customer’s ability to buy and (b) their profession and purchasing power.

Rekha (2015), in her study, observed that cross-selling can be really successful for insurance companies. Following are some of the reasons of higher number of cross-selling:

Li et al. (2011), in their study, have noted that companies that practice cross-selling have a higher percentage of sales than companies that do not practice cross-selling. Companies formulate cross-selling strategies in multicultural societies, which can be very effective in making companies very strong in reaching their target market and customers. Companies also attain better goodwill of the customers as both the customer and the employees are happy in the long run as both know each other on a better level, and companies in service industries build better relations with the customers.

According to Dalal and Sapkale (2018), banks regularly charge their customers a premium for insurance products without their knowledge. Banks also force their employees to meet the target in the achievement of the sales target for the various insurance products. This is a practice when banks sell insurance companies products that may not be needed along with the existing insurance products. For example, the customers may be purchasing a mutual fund and along with this product they sell insurance as well.

Unethical Practices of Agents

Agents themselves follow unethical practices on a regular basis and this affects the growth of any business or industry. Financial products by themselves are purchased as a result of the efforts of the agents and just advertisement done on the same by the companies. The majority of insurance policies are sold by the agents to their respective contacts with their knowledge of the existing known customers and friends. These friends and relations play an important role in influencing the customer to buy the insurance product and be a regular customer of the company (Singh et al., 2011). An insurance agent occupies a position of trust in the company and, on his word, the friends and family members invest in insurance and other related products. This trust may or may not be broken by the action of the agent in terms of good customer delivery or bad service, both of which may impact the sales of the insurance products in the long term (Balachandran, 2011). Agents try to sell insurance policies wrongly to customers to earn more commission and make the customer a victim of his sales practices. Agents are very successful in manipulating the thoughts of the customer through fear, coercion and other unethical practices.

The distribution channels in India can undergo multiple transformation with banking partnership and digital marketing from time to time. Anuj Agarwal (2011), in his study, noted this point.

As per Albert Schweitzer (2009), there is a requirement that agents’ behaviour should be good to the customers at all times and this good behaviour can result in attracting large number of customers for the agents in the long term. In order to sell insurance products, the agents may give the customer gifts such as cashback, coupons, premium discounts and so on.

Lack of Corporate Governance

In the insurance industry, most insurance companies lack governance at various levels of lower employee like agents, especially in developing countries. In the case of Bahrain, it was observed that agents regularly work in close connection with various top-level employees of insurance companies, and this was helpful in reduction of the mis-selling.

Lack of corporate governance is a practice of companies ensuring that the resources are not acquired unlawfully. Najjar (2012) noted that many companies have different methods for checking the accounts by chartered accountants, ensuring the investors are given details of the company functioning and so on. Indian companies listed in stock exchanges are in a better position.

Financial Regulations

The financial regulations from various insurance agencies in the United kingdom in the 1980s led to an issue of private pensions being part of the process of unnecessary burdening the customers with new products. In 1990s, there was an issue of private endowment policies, this whole product and the endowment product (insurance products were payment is made at the time of maturity) was illegal and as a result, the company had to pay huge amount in compensation to customers (Zepeda, 2012).

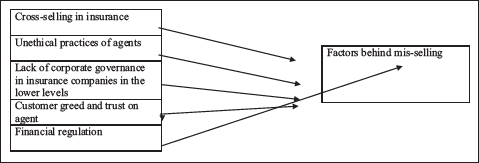

Figure 1. Mis-selling and Factors Influencing Mis-selling Based on the Above Concepts.

Aditya Nath Jha (2014) notes that since privatization in insurance field is allowing other companies to sell insurance, various channel partners have been allowed to sell insurance as well. Shivanand H. Lengti (2009), in his study, found out that the coverage of insurance customers have the choice to choose the perfect authority and forum. The article has found that the aggressive marketing of the insurance has changed over the years. The expectancies of customers have changed with respect to rules and technologies.

Conclusion and Implications

From the analysed studies, it was observed that many factors are responsible for mis-selling. These factors in total cannot be the only factors responsible for mis-selling. Mis-selling is a by-product of many internal and external factors in the industry and the company (Figure 1).

Factors such as cross-selling can make the customers temporarily buy the product and create thoughts of huge benefits to customer as a result of past experiences, but it is just temporary. Sometimes the insurance companies lack corporate governance as a result of huge internal division, and this can create benefits to the customers and agents for personal gains. Corporate governance can be a tool which is misused in developing countries and this can be an issue by itself for many insurance companies. Sometimes financial regulations can be put in place to control all the wrong practices in mis-selling in these countries and can create problems for insurance companies.

Limitations

There are various limitations to this study. Some of them are stated below:

Recommendations and Scope of Further Studies

Mis-selling can be a cause of concern, and a change in strategy is needed by financial institutions. Sales teams should ensure that mis-selling is minimized and successful marketing is done without the forcing the customers. This study can be further focused on the impact of mis-selling on customers and help companies to have a better understanding of the all sides of the story. The study can further focus on providing better training to the agent to improve their skills in selling the products.

Declaration of Conflicting Interests

The author declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The author received no financial support for the research, authorship and/or publication of this article.

Agarwal, A. (2011). Insurance distribution channels in India: A study of pre- and post-period of IRDA period. International Journal of economics and Management Thoughts, 2(2), 22–28.

Ahmed, E., & Hamdan, A. (2015). The impact of corporate governance on firms performance: Evidence from Bahrain stock exchange. European Journal of Research Training and Development, 3(5), 25–48. http://www.eajournals.org/wp-content/uploads/The-Impact-of-Corporate-Governance-on-Firm-Performance-Evidence-from-Bahrain-Stock-Exchange.pdf

Balachandran, S. (2011). Life insurance of India: New syllabus, IC 33. Insurance Institute of India.

Bali, S., Singh, A., Parekh, A., Indge, R., & Torpey, D. (2011). Fraud in insurance on rise. IRDA, 9(6), 29–35.

Baradhwaj, C. (2011). Arresting the trends. IRDA, 9(6), 29–35.

Dalal, S., & Sapkale, Y. (2018, October 15). Insurance cross selling: bank officers want restriction on targets, pressure for sales. MoneyLife. www.moneylife.in/article/insurance-cross-selling-bank-officers-want-restriction-on-targets-pressure-for-sales/55552.html

Jha, A. N. (2014). Analysis of distribution channels of life insurance. Global Journal for Research Analysis, 3(6).

Kumar, A. (2012). Cross selling (with special reference to State Bank of India). International Journal of Social Sciences & Interdisciplinary Research, 1(6), 30–35.

Lengti, S. H. (2009). Insurance disputes in India. The IUP Journal of Banking & Insurance Law, 7(3), 83–90.

Li, S., Sun, B., & Montgomery, A. L. (2011). Cross-selling the right product to the right customer at the right time. Journal of Marketing Research, 48(4), 683–700. https://doi.org/10.1509/jmkr.48.4.683

Najjar, N. (2012). The impact of corporate governance on the insurance firm’s performance in Bahrain. International Journal of Learning and Development, 2(2), 1–17.

Rekha, K. G. (2015). Cross selling of financial products: A study based on consumers in Kerala. International Journal of Science and Research, 4(3), 2428–2430. https://pdfs.semanticscholar.org/dee4/5b5fbd413cd238fc18cf1dbb88a2def67dcf.pdf

Sarkodie, E. E. & Yusif, H. M. (2012). Determinants of life insurance demand, consumer perspective: A case study of Ayeduase-Kumasi Community, Ghana. Business and Economics Journal, 6(3), 1–4.

Schweitzer, A. (2009). Modern management: Concepts and skills management (11th edition). Prentice Hall Publishing

Singh, M. P. Chakraborty, A. Raju, G. (2011). Contemporary issues in marketing of life insurance service in India. International Journal of Multidisciplinary Research, 1(7), 47–61.

Tseng, L.-M., & Shih, M.-F. (2012). Consumer attitudes toward false representation. Journal of Financial Crime, 19(2), 163–174.

Vladimir, K. K., Nielsen, J. P., & Thuring, F. (2013). Optimal customer selection for cross-selling of financial services products. Expert Systems with Applications, 40(5), 1748–1757. https://openaccess.city.ac.uk/id/eprint/15206/

Zepeda, R. (2013). Derivatives mis-selling by British banks and failed legacy of the FSA. Journal of International Banking Law and Regulation, 28(6), 209–220. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2270377