The 2008 Financial Crisis: Through the Lens of Phenomenology, Narratology, Metaphorology Methodology

1Xavier School of Management, XLRI, Jamshedpur, Jharkhand, India

2 The Commonwealth, Hauz Khas, New Delhi, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

Modern financial theories often fail to predict black swan events in the financial market because these financial theories are built on market participants’ typical behaviours in the last few decades. These theories have not captured the behaviour of market participants in black swan events. In the context of this study, qualitative research such as phenomenology, narratology and metaphorology can be deployed to study randomly from the perspective of uncertainty, risk and chaotic behaviour. These research methodologies remove the numerical assumptions used by the quantitative financial model but lighten the participants’ real experience, who witnessed the crisis very carefully. Thereby, the behaviour of market participants can be captured and examined. The employment of these qualitative research methodologies, along with the pure financial theories, will be more efficient to predict these events, which allows stakeholders to take necessary steps to avert this kind of crisis.

finance, black swan, metaphorology, phenomenology, narratology

Introduction

‘Black swan’, as a term pioneered by John Stuart Mill, the 21st-century philosopher, to test falsification, who later expanded the term in different aspects of life. Taleb (2007) made the term famous in the financial market by using this concept in his seminal book The Black Swan. According to him, ‘black swan’ is a concept that is related to uncertainty, unpredictable and highly impactful. He also linked it with investment in the financial market and opined that it is difficult to predict such events in the financial market. It is better for investors to adjust black swans in investment decision-making. Green (2011) further defined black swans as ‘unknown unknowns’, which can run havoc even if there is a plan to mitigate and control them.

The financial crisis of 2008 is a ‘black swan’ event as its impact was catastrophic, uncertain, risky and highly unpredictable. The crisis resulted in a crash in the stock market across the word, caused massive financial losses, homelessness across the United States. Economists recognize the 2008 financial crisis as the second worst economic crisis since the Great Depression of 1929 (Foster & Magdoff, 2009). The banking crisis, which followed the US housing market crisis, was so catastrophic that outsiders started doubting the banking system (Calomiris & Haber, 2014). The impact of the event was such that the soundness of modern economics was questioned (Carrick-Hagenbarth & Epstein, 2012). Krugman (2012) further accentuated that the financial crisis is an indication of the ‘failures of the economics profession’.

There were many research papers by scholars on the crisis, mostly on the origins of the crisis. Scholars blamed the low-interest policy followed by central banks that led to increase in asset prices (Ahrend et al., 2008), resulting in a surge in the housing demand (Ahearne et al., 2005) and increased credit supply in the economic system (Borio & Zhu, 2008). Maintaining low interest rate for a long time and excessive credit supply led to the mis-allocation of capital. The increase in asset price was giving a false signal on the right prices of the securities. Many emerging markets, China, in particular, due to its large exchange reserve, were buying the US treasury securities heavily, which resulted in a lower yield of the US treasury securities. The investors, who were earlier investing in treasury securities, moved their capital to high yield but high risky securitized bonds (Bertaut et al., 2012), which was assumed to be safe during that time. Some scholars also blamed the excess risk culture (Rajan, 2011), flawed incentive mechanisms in the financial system (Financial Services Authority, 2009), financial innovation (Kirkpatrick, 2009), moral hazard (Leaver, 2015), asymmetric information (Bhattacharya et al., 2011) and lax in regulation (Schoen, 2017).

The mainstream economic theories are facing the challenges of understanding and predicting these kinds of economic events (Krugman, 2009). Scholars have examined some of the modern finance theories, which predict the financial crisis ex-ante. Prominent economists among them are Fisher (1932), Kindleberger (1978) and Minsky (1977), whose work on the relationship between credit cycle and financial crisis gives a better understanding of financial crisis. However, it is challenging to predict the time and scale of the crisis.

Modern financial theories such as Capital Asset Pricing Model (CAPM), Value-at-Risk (VaR) and the Black-Scholes fail to predict these economic events because these theories are built on the typical behaviours of market participants in the last one or two decades. These models have not captured the behaviour of market participants in black swan events. Hence, it is tough to predict and prevent these events in the financial market.

Phenomenology

The assumption of the experience of persons is not as reliable as objective data; hence, researchers have rarely used the human experience as a research methodology to study an event (Neubauer et al., 2019). However, the experience of persons can be a vital source of information for scholars seeking a detailed study of a subject, which warrants discovery and understanding. Phenomenology, a research method, allows the researcher to explore the perspectives of the persons who experienced the phenomenon, which helps in understanding the phenomenon. Phenomenology also helps the researcher to study both ordinary, usual and extraordinary events (Jackson et al., 2018). This methodology also aids in exploring the rich experiences of the event (Finlay, 2008) with a focus on the individual’s experiences of the event (Kirillova, 2018).

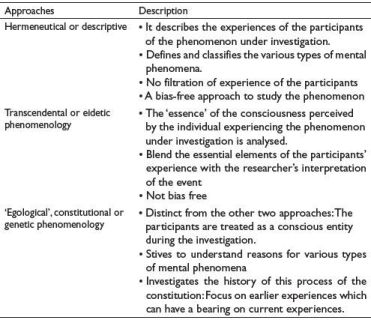

There are various kinds of approaches to phenomenology, and each method gives answers to ‘what and what kind of experience’ and how is the experience (Neubauer et al., 2019). Padilla-Díaz (2015) has split phenomenology into three categories, as discussed in Table 1.

I have chosen a descriptive methodology to study the event since this methodology is suited to explore a lived experience. This approach is also rigorous and scientific (Giorgi, 1997). The life experiences of the participants help the researchers to study the event through an understanding of the human experience (Dahlberg, 2008).

Phenomenology to Study the Randomness of the Event

There is no standardized meaning of randomness, given it is a new subject. Beltrami (1999) and Nickerson (2002) opine that it is challenging to define randomness theoretically since random sources generate outputs that do not seem to be random while unrandom sources create outputs that appear to be random (Zhao et al., 2014). A concept is considered to be complicated and multi-layered as interpreted by various researchers (Batanero et al., 1998; Saldanha & Liu, 2014).

Researchers have used different methodologies to study randomness, and there is a considerable variation among the methods (Zhao et al., 2014). Statistical and mathematical models have been used to study randomness such as the Bayesian approach, calculus of probability and Stochastic models. Wagenaar (1972) examined all these methodologies and concluded that a theory could not be built up by combining various methods. In the context of this study, phenomenology can be deployed to study randomly from the perspective of uncertainty, risk and chaotic behaviour.

Table 1. Phenomenology Approaches.

Source: The author’s analysis based on Padilla-Diaz (2015), Kortooms (2002) and Smith (2018).

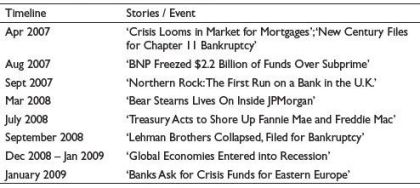

Table 2. Narration of 2008 Financial Crisis.

Source: Compiled by the author from various newspapers.

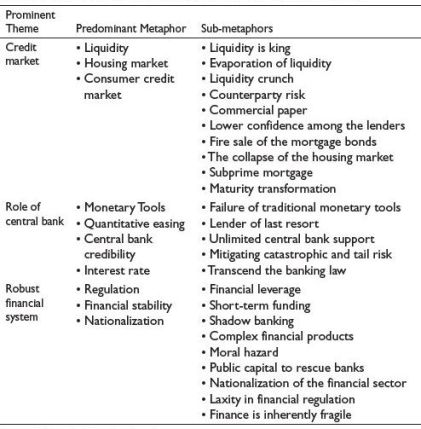

Table 3. Application of Root Metaphorology to Study Financial Crisis 2008.

Source: The author’s analysis based on various newspaper reports.

Application of Phenomenology to Study Black Swan in Financial Market

The financial market participants and real economic agents have different and ambiguous attitudes during economic turmoil. The financial crisis of 2008 occurred due to the actions of a large number of financial and market participants. The participants did not trusting each other during the financial crisis: Trust among financial market participants is a condition for the smooth operation of markets. The absence of trust leads to uncertainty, making the financial assets risky and causing chaotic behaviour among the participants. The element of trust emanates from human behaviour, and it can be studied through close observation and interaction with humans, particularly during the chaotic event. The conventional quantitative models failed to understand the behaviours of market participants during the financial market turmoil.

Through phenomenology, the behaviour of market participants can be captured and examined. Phenomenology removes the numerical assumptions used by the quantitative financial model (do not work in the chaotic event) but lightens the real experience of the participants, who witnessed the crisis very carefully. Phenomenology would also help in understating the behaviours of the participants’ actions and reactions (Courtenay et al., 2000); this could lead to having a deeper understanding of a complex phenomenon (Wilson, 2011).

Narratology

Narratives are ‘the reflective product of looking back and making sense of stories constructed to make sense of life’ (Flory & Iglesias, 2010). There is a difference between stories and narratives. The narrative comes after the story. The story is an account of incidents or events, but narrative comes after and adds ‘plot’ and ‘coherence’ to the story line (Boje, 2011). Both offer invaluable insights and enable addressing a wide range of organizational phenomena (Pentland & Feldman, 2007). Research designs using story or narrative analysis can provide better critical insights into individual mindsets than other research methods that are based on quantitative techniques (Flory & Iglesias, 2010; Gabriel, 1995; Polkinghorne, 2007).

Application of Narratology to Study Black Swan in Financial Market

The narrative research methodology is often used in social science but not considered a grounded theory (McAlpine, 2016). Scholars think that narrative research is not a robust approach in economics, hence not used by them to study economic events (Shiller, 2017). However, the narration of stories affects the decision-making of economic events, and thereby economic outcomes. Examining popular stories, particularly related to human emotions and desires, can help understand the economic fluctuation. In the context of the financial crisis, narration can be best described as bad stories, appeared in various media, which shook the confidence of economic agents in 2008 and after that. The low confidence level removed the animal spirits of economic agents; i.e., financial market participants that resulted in an economic/financial crisis (Table 2).

Metaphorology

A metaphor is a figure of speech that makes an implicit, implied or hidden comparison between two things that have nothing in common but have some common traits for comparison. According to Lakoff and Johnson (1980), ‘The essence of metaphor is understanding and experiencing one thing in terms of another’. Metaphorology method, used in qualitative research can help researchers in conducting research more effectively. In contrast to other qualitative research methodologies, metaphorology encourages scholars to think and act in novel ways (Morgan, 1998), extending the horizon of the study, giving new insights and opening doors to explore new possibilities.

Application of Metaphorology to Study Black Swan in Financial Market

The term metaphor is also used to describe several basic or general aspects of experience and cognition. Cornelissen (2004) argued that metaphors reveal creative and novel correlations of two or more concepts enabling researchers to make ‘semantic leaps’ in our understanding of reality. Schön (1979) advocates,

The essential difficulties in social policy have more to do with problem setting than with problem-solving, more to do with ways in which we frame the purposes to be achieved than with the selection of optimal means for achieving them … the framing of problems often depends upon metaphors underlying the stories which generate problem setting and set the direction for problem-solving.

Hence, the employment of metaphors can help in the framing of the issues. Metaphors can be used to frame issues concerning the financial market to study black swan events in the financial market.

I have used root metaphor—a component of metaphorology—which is the underlying worldview that shapes an individual’s understanding of a situation, including a black swan event in the financial market (Table 3). These root metaphors could then be used to derive first-order metaphors and second-order metaphors, and so on. The systematic use of root metaphors enables inferring conceptual knowledge based on the analysis of systematic patterns of linguistic structures such as metaphorical mappings (Gibbs, 1998). I have derived metaphors from interviews given by three important persons in the financial crisis. They are Timothy Geithner, President of the New York Fed, who became the Treasury Secretary during the financial crisis; Ben Bernanke, Federal Reserve chairman; and Henry Paulson, Treasury Secretary before Timothy Geithner.

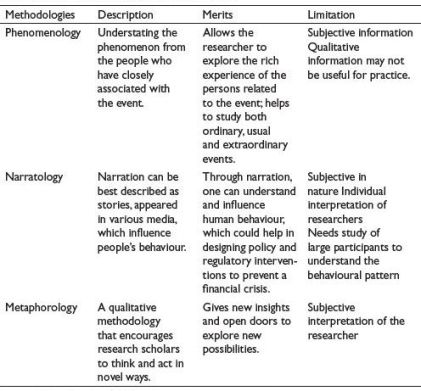

Comparative Analysis of the Methodologies

I have compared and contrasted these methodologies: phenomenology, randomness, black swan event, narratology and metaphorology. I have argued which methodology can best interpret and capture the chaotic market phenomenon and the unit of analysis. Table 4 provides a summary of the comparative study of these three methodologies.

Narratology methodology can best interpret, study, capture and examine the chaotic market phenomenon. Any chaotic aspect, like the 2008 financial crisis, is not only created by rational economic decision-making but also by the narration of the events in the media. The significant advantage of narratology over other research methodologies is the application of a mathematical model, which can be useful for practical use (Shiller, 2017). Data science, which captures stories, can be obtained through narratology methodology and mathematically modelled to understand the behaviour of the population and also suggest efficient interventions to change people’s behaviour. The past financial crisis can be studied and examined through narratology. The lessons learned, policy measures that are useful and efficient can be captured through narratology; these policy actions could be deployed to avert a financial crisis.

Table 4. Comparative Analysis of Methodologies.

Source: The author’s analysis based on various newspaper reports.

Conclusion and Way Forward

Modern financial theories often fail to predict these economic events because these theories are built on the typical behaviours of market participants in the last one or two decades. These models have not captured the behaviour of market participants in the black swan events. Qualitative research methodologies such as phenomenology, narratology and metaphorology methodologies can be deployed to study random events from the perspective of uncertainty, risk and chaotic behaviour. Through these methodologies, the behaviour of market participants can be captured and examined. There is a vast potential for further research on this subject as the modern financial theories have limitations to predict black swan events in the financial system.

Declaration of Conflicting Interests

The author declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The author received no financial support for the research, authorship and/or publication of this article.

Ahearne, A. G., Ammer, J., Doyle, B. M., Kole, L. S., & Martin, R. F. (2005). House prices and monetary policy: A cross-country study [International Finance discussion papers]. Board of Governors of the Federal Reserve System.

Ahrend, R., Cournède, B., & Pric, R. (2008). Monetary policy, market excesses and financial turmoil [Working paper]. OECD Economics Department.

Batanero, C., Green, D. R., Green, D. R., & Romero, L. S. (1998). Randomness, its meanings and educational implications. International Journal of Mathematical Education in Science and Technology, 29(1), 113–123.

Beltrami, E. (1999). What is Random Chance and order in mathematics and life. Copernicus.

Bertaut, C., DeMarco, L. P., Kamin, S., & Tryon, R. (2012). ABS inflows to the United States and the global financial crisis. Journal of International Economics, 88(2), 219–234.

Bhattacharya, S., Chabakauri, G., & Nyborg, K. G. (2011). Securitized lending, asymmetric information, and financial crisis. LSE Research Online.

Boje, D. M. (2011). The future of storytelling in organizations: An ante-narrative handbook. Routledge.

Borio, C., & Zhu, H. (2008). Capital regulation, risk-taking and monetary policy: A missing link in the transmission mechanism [working paper]. Bank for International Settlements.

Calomiris, C. W., & Haber, S. (2014). Fragile by design: The political origins of banking crises and scarce credit. Princeton University Press.

Carrick-Hagenbarth, J., & Epstein, G. A. (2012). Dangerous interconnectedness: Economists’ conflicts of interest, ideology and financial crisis. Cambridge Journal of Economics, 36(1), 43–63.

Cornelissen, J. P. (2004). What are we playing at Theatre, organization and the use of metaphor. Organization Studies, 25(5), 705–726.

Courtenay, B. C., Merriam, S., Reeves, P., & Baumgartner, L. (2000). Perspective transformation over time: A 2-year follow-up study of HIV-positive adults. Adult Education Quarterly, 50(2), 102–119.

Dahlberg, K. (2008). Reflective life-world research. Indo-Pacific Journal of Phenomenology, 9, 1–3.

Fisher, I. (1932). The debt deflation theory of great depressions. Econometrica, 1, 337–57.

Financial Services Authority. (2009). A regulatory response to the global banking crisis.

Finlay, L. (2008). Reflecting on ‘reflective practice’. Practice-based professional learning centre. The Open University.

Flory, M., & Iglesias, O. (2010). Once upon a time: The role of rhetoric and narratives in management research and practice. Journal of Organizational Change Management.

Foster, J. B., & Magdoff, F. (2009). The great financial crisis: Causes and consequences. NYU Press.

Gabriel, Y. (1995). The unmanaged organization: Stories, fantasies and subjectivity. Organizational Studies, 16(3), 477–501.

Giorgi, A. (1997). The theory, practice, and evaluation of the phenomenological method as a qualitative research procedure. Journal of Phenomenological Psychology, 28(2), 235–260.

Green, N. (2011). Keys to success in managing a black swan event. Aon Risk Solutions.

Gibbs, R. W. Jr. (1998). The fight over metaphor in thought and language. In A. N. Katz, C. Cacciari, & M. Turner (Eds.), Figurative language and thought (pp. 88–118). Oxford University Press.

Jackson, C., Vaughan, D. R., & Brown, L. (2018). Discovering lived experiences through descriptive phenomenology. International Journal of Contemporary Hospitality Management, 30(11), 3309–3325.

Kindleberger, C. (1978). Manias, panics and crashes: A history of financial crises. Basic Books.

Kirillova, K. (2018). Phenomenology for hospitality: Theoretical premises and practical applications. International Journal of Contemporary Hospitality Management, 30(11), 3326–3345.

Kirkpatrick, G. (2009). The corporate governance lessons from the financial crisis. OECD.

Kortooms, T. (2002). The perspective of genetic phenomenology. In T. Kortooms & A. J. M. Kortooms (Eds.), Phenomenology of Time: Edmund Husserl's analysis of time-consciousness (Vol. 161, pp. 175–223). Springer Science & Business Media.

Krugman, P. (2012, February 27). Economics in the Crisis. New York Times. http://krugman.blogs.nytimes.com/2012/03/05/economics-in-the-crisis/_r=0

Lakoff, G., & Johnson, M. (1980). Metaphors we live by. University of Chicago Press.

Leaver, A. (2015). Fuzzy knowledge: An historical exploration of moral hazard and its variability. Economy and Society, 44(1), 91–109.

McAlpine, L. (2016). Why might you use narrative methodology A story about narrative. Estonian Journal of Education, 4(1), 32–57.

Minsky, H. P. (1977). A theory of systemic fragility. In E. Altman & A. Sametz, Financial crises: Institutions and markets in a fragile environment. John Wiley and Sons.

Morgan, D. (1998). Practical strategies for combining qualitative and quantitative methods: Applications to health research. Qualitative Health Research, 8(3), 362–376.

Neubauer, B. E., Witkop, C. T., & Varpio, L. (2019). How phenomenology can help us learn from the experiences of others. Perspectives on Medical Education, 8(2), 90–97.

Nickerson, R. S. (2002). The production and perception of randomness. Psychological Review, 109(2), 330–357.

Padilla-Díaz, M. (2015). Phenomenology in educational qualitative research: Philosophy as science or philosophical science. International Journal of Educational Excellence, 1(2), 101–110.

Pentland, B. T., & Feldman, M. S. (2007). Narrative networks: Patterns of technology and organization. Organization Science, 18(5), 781–795.

Polkinghorne, D. E. (2007). Validity issues in narrative research. Qualitative Inquiry, 13(4), 471–486.

Rajan, R. (2011). Fault lines: How hidden fractures still threaten the world economy. Princeton University Press.

Saldanha, L., & Liu, Y. (2014). Challenges of developing coherent probabilistic reasoning: Rethinking randomness and probability from a stochastic perspective. In E. Chernoff & B. Sriraman (Eds.), Probabilistic thinking: Advances in mathematics education (pp. 367–396). Springer.

Schoen, E. J. (2017). The 2007–2009 financial crisis: An erosion of ethics—A case study. Journal of Business Ethics, 146(4), 805–830.

Schön, D. (1979). Generative metaphor: A perspective on problem-setting in social policy. In A. Ortony (Ed.), Metaphor and thought (2nd edition, pp. 137–163). Cambridge University Press.

Shiller, R. J. (2017). Narrative economics [discussion paper]. Cowles Foundation.

Smith, D. W. (2018). Phenomenology. In The Stanford Encyclopedia of Philosophy.

Taleb, N. (2007). The black swan: The impact of the highly improbable. Random House.

Wagenaar, W. A. (1972). Generation of random sequences by human subjects: A critical survey of the literature. Psychological Bulletin, 77(1), 65–72.

Wilson, M. S. (2011). Phenomenological research and its potential for understanding financial models. Investment Management and Financial Innovations, 8(1–1).

Zhao, J., Hahn, U., & Osherson, D. (2014). Perception and identification of random events. Journal of Experimental Psychology Human Perception and Performance, 40(4), 1358–1371.