1 Department of Commerce and Financial Studies, Bharathidasan University, Tiruchirappalli, Tamil Nadu, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

This research investigates the adoption of Wealthtech among individual investors in India using Partial Least Squares Structural Equation Modeling (PLS-SEM). A convenience sample technique was employed, gathering data from 280 participants through an online survey. The study applies the Theory of Planned Behavior and the Technology Acceptance Model as the theoretical framework to examine the factors influencing the intention to use Wealthtech. Additionally, the role of perceived ease of use and perceived usefulness in shaping attitudes toward Wealthtech adoption is explored. The results from the PLS-SEM analysis show significant positive associations between Attitude and Perceived Behavioral Control with the intention to use Wealthtech. These insights can help financial institutions tailor Wealthtech platforms to meet investor preferences, fostering increased adoption among individual investors. Regulatory authorities can use these findings to enhance accessibility and acceptance of Wealthtech solutions by fostering a conducive environment for technological innovation.

Fintech, Wealthtech, technology adoption, technology acceptance model, theory of planned behavior

Introduction

In recent years, the financial services industry in India has witnessed a significant transformation with the rapid advancements in technology (Bhatia et al., 2020; Parthasarathy, 2021). One of the most important developments was the emergence of “Wealthtech,” an innovative field that leverages cutting-edge technology to deliver personalized and efficient wealth management solutions to individual investors. Wealthtech includes a wide range of digital platforms, automated advisors, investment apps, and online brokerage services, allowing investors to access a wide range of financial products and easily manage their portfolios (Belanche et al., 2019). Wealthtech adoption has exploded globally, changing the landscape of traditional investing practices. In India, a country known for its booming economy and booming investor population, there is huge potential for Wealthtech adoption (Manrai & Gupta, 2022).

Wealthtech has created several significant benefits and opportunities for individual investors in the Indian capital market. Democratizing access to financial markets is one of Wealthtech’s major contributions to the retail investor segment (Sood & Singh, 2022). Retail investors can conveniently access a wide range of investment choices through user-friendly mobile applications and online platforms, including stocks, mutual funds, bonds, and other financial instruments (Abroud et al., 2013). Retail investors, including those from smaller towns and distant locations, now have more access to the capital market, enabling them to invest and expand their wealth. Retail investors, particularly those from smaller towns and outlying places, are now more able to participate in the stock market and expand their wealth owing to this improved accessibility. Wealthtech platforms provide inexpensive and often commission-free investment solutions, lowering entry barriers and allowing investors to begin with small sums.

However, the acceptance and adoption of these technology-based financial solutions among individual investors in India are still subject to a number of complexities and behavioral patterns. Considering the opportunities created by Wealthtech for individual investors and the concerns about its slow adoption, it is critical for financial service providers, regulators, and researchers to gain a better understanding of the factors that drive Wealthtech adoption. In order to understand Wealthtech’s adoption by individual investors in India, it is imperative to understand the gap between its promise and its implementation. The purpose of this study is to better understand the complex interplay of factors influencing Wealthtech’s slower-than-expected adoption rate, despite its obvious advantages. It is essential to bridge this gap not only in order to fully utilize the benefits of technological innovations in the investment landscape, but also to inform tailored strategies for financial service providers and regulators.

There is a need for research that not only identifies the barriers preventing Wealthtech adoption but also explains the behavioral patterns and complexities shaping investor decisions within the current financial environment in India. It is imperative that this gap is addressed, as it directly impacts the optimal utilization of technological innovations and the formulation of strategic approaches by financial service providers and regulators. Additionally, this research seeks to provide a comprehensive understanding of the multifaceted determinants that influence Wealthtech adoption by integrating established frameworks such as the Theory of Planned Behavior (TPB) and the Technology Acceptance Model (TAM). Insights like these have the potential to catalyze innovation, shape regulatory frameworks, and foster symbiotic relationships between investors, service providers, and the broader financial ecosystem.

In view of these factors, this study is not only timely but also indispensable as a guide to navigating the evolving contours of the Indian financial system. By employing robust frameworks such as the TPB and the TAM, this research endeavors to unravel the behavioral factors guiding investors’ decisions. Ultimately, this study’s findings stand to drive innovation, refine policies, and optimize the integration of Wealthtech, benefiting investors, service providers, regulators, and the financial ecosystem as a whole.

Review of Literature

Many researchers have attempted to define Wealthtech and its constituent parts Belanche et al., 2019; Nair et al., 2022). According to Cao et al. (2021), it is a subset of fintech that uses technology like artificial intelligence, data analytics, and machine learning to offer tailored wealth management services. This comprises automated portfolio management tools, digital investing platforms, and robot advisers that cater to the demands of individual investors (Chong et al., 2021). Wealthtech provides investing solutions that are less expensive, more transparent, and user-focused than traditional financial advice services. Wealthtech has been recognized for its potential to democratize access to financial markets and wealth management services. According to Sood and Singh (2022), technology integration promotes financial inclusion by enabling retail investors of various financial backgrounds to take part in investment opportunities that were previously only open to institutional investors. Additionally, studies indicate that using digital platforms and robo-advisors can improve portfolio performance and result in lower management fees than using traditional advisory services (Lee & Wang, 2022).

Despite being relatively underexplored in existing research, Wealthtech, which encompasses technologies that offer investing, portfolio management, and tailored financial services, has the potential to revolutionize the financial industry, particularly wealth management. For a comprehensive understanding of the adoption dynamics of this emerging technology and its transformative impact, it is imperative to examine the factors driving its adoption among users.

The integration of TAM with TPB offers a comprehensive framework for predicting and understanding the adoption of technology among users (Hakimi et al., 2023; Nguyen-Phuoc et al., 2024). The TAM, which emphasizes perceived usefulness (PU) and perceived ease of use (PEU), provides insight into how individuals evaluate the benefits and ease of use of technological platforms (Davis, 1989). Technology may be attractive to users if they perceive that it enhances their investment decisions or if they find its interface to be intuitive and easy to use. TPB, on the other hand, focuses on the behavioral and normative dimensions of adoption (Ajzen, 1991). An individual’s decision to adopt a particular technology is influenced by factors such as subjective norms, where the beliefs of significant others play a significant role, and attitudes influenced by an awareness of its benefits (Ajzen, 1991). In addition, perceived behavioral control (PBC), which entails a person’s confidence in their ability to utilize Wealthtech tools effectively, plays a crucial role in the evaluation of the technology (Ajzen, 1991).

Extant studies have integrated TAM and TPB in different contexts, including social media acceptance (Armah & Jin-Fa, 2023), mHealth (Mao et al., 2023), and food delivery services (Leong & Koay, 2023). These studies consistently demonstrated the models’ strong predictive capabilities for technology adoption intentions. However, the integration of TAM and TPB in the Wealthtech context remains largely unexplored, pointing to an existing gap in the literature concerning the determinants of Wealthtech adoption. Drawing from this foundational literature, it is anticipated that applying the TAM and TPB integration to the realm of Wealthtech adoption will offer enhanced insights, addressing the current research gap in Wealthtech adoption literature. Thus, this study aims to analyse the factors affecting individuals’ Wealthtech adoption by integrating TAM and TPB in the theoretical framework.

Theoretical Framework and Hypothesis Development

Theory of Planned Behavior (TPB)

According to Icek Ajzen’s TPB, an individual’s behavioral intentions are influenced by three factors: attitudes toward the behavior, subjective norms, and PBC. According to TPB, these factors collectively shape an individual’s willingness to adopt a specific behavior (Ajzen, 1991). In the context of Wealthtech adoption, attitudes toward digital financial services, social and peer influence, and perceived behavior control of the technology are crucial components that may drive or hinder adoption.

Technology Acceptance Model (TAM)

The TAM, devised by Fred Davis, is a model that examines an individual’s perception and acceptance of technology. TAM emphasizes two primary factors: PU and PEU. As a result, the theory suggests that a positive attitude toward technology adoption is likely if the individual perceives the technology as useful and easy to use (Davis, 1989).

Perceived Usefulness (PU)

PU is the perception of how well a particular technology or innovation will assist an individual in achieving specific goals (Davis, 1989). It is likely that investors who perceive Wealthtech platforms as valuable tools that offer personalized and efficient wealth management solutions will consider them beneficial in their investment endeavors. PU encompasses factors such as improved investment decision-making, access to a diversified range of financial products, real-time monitoring, and enhanced portfolio performance. Investors perceive Wealthtech platforms to be useful and valuable tools for managing their wealth effectively, they are more likely to develop positive attitudes toward adopting these technologies (Chong et al., 2021; Laksamana et al., 2022).

H1: Perceived usefulness is positively associated with the attitude toward Wealthtech adoption.

Perceived Ease of Use (PEU)

An individual’s perception of PEU refers to how much effort is required to use a particular technology or system. In the case of Wealthtech adoption, investors who perceive Wealthtech platforms as user-friendly, intuitive, and easy to navigate are more likely to view them as accessible and approachable tools for managing their investments. Factors influencing PEU may include the platform’s design, functionality, learning curve, and support resources available to users. The proposed hypothesis suggests that as investors perceive Wealthtech platforms to be easy to use and navigate, they are more likely to develop positive attitudes toward adopting these technologies (Chong et al., 2021; Laksamana et al., 2022).

H2: Perceived ease of use is positively associated with the attitude toward Wealthtech adoption.

Perceived Behavioral Control (PBC)

PBC refers to an individual’s belief in their ability to perform the behavior successfully. In the context of Wealthtech adoption, investors who perceive themselves to have sufficient technical skills, knowledge, and access to resources necessary to use Wealthtech platforms are more likely to have a higher intention to adopt these technologies. Higher PBC would lead to greater confidence and self-efficacy in navigating the digital financial landscape, encouraging investors to embrace Wealthtech solutions (Arkorful et al., 2022; Diéguez et al., 2023).

H3: Perceived behavioral control is positively associated with Wealthtech adoption.

Attitude (ATT)

Attitude in the TPB represents an individual’s overall evaluation or positive/negative feelings toward the behavior in question. In the case of Wealthtech adoption, investors with positive attitudes toward digital financial services, such as robo-advisors and online investment platforms, are more likely to express a stronger intention to adopt Wealthtech. Positive attitudes can be influenced by perceptions of convenience, ease of use, cost-effectiveness, and the potential for improved financial outcomes through technology-driven wealth management (Arkorful et al., 2022; Belanche et al., 2019).

H4: Attitude is positively associated with Wealthtech adoption.

Subjective Norms (SN)

Subjective Norms refer to an individual’s perception of social pressure or influence from significant others regarding the behavior. In the context of Wealthtech adoption, investors who perceive that their peers, family members, or financial advisors endorse or promote the use of Wealthtech are more likely to develop a positive intention to adopt such technologies. The influence of subjective norms can play a crucial role in shaping investors’ perceptions of the social acceptance and appropriateness of Wealthtech usage (Belanche et al., 2019; Diéguez et al., 2023).

H5: Subjective norm is positively associated with Wealthtech adoption.

Research Methodology

Measurement Development

We designed a survey instrument segmented into two sections: Part A and Part B. Part A focused on capturing respondent demographics, encompassing factors like gender, age, educational background, and awareness levels. Part B comprised 18 questions, addressing various constructs of the proposed model. To ensure content validity, we adapted all measurement tools from established literature sources. To measure all items, we used a five-point Likert scale ranging from “strongly disagree” to “strongly agree.” For measuring each variable three questions were asked. All the items for TPB variables were adapted from Wu and Chen (2005). The items for TAM and adoption intention are adapted from Belanche et al. (2019). Before the final survey, a pre-test was conducted among 20 Wealthtech users. This helped in ensuring the reliability and understandability of the questionnaire. Detailed information on the measurement items for each construct is given in Table 1.

Sample and Data Collection

We followed a quantitative, cross-sectional approach to conduct the empirical study. In this study, the population consists of investors who use Wealthtech platforms in India. Given the absence of a comprehensive sampling framework for Wealthtech users, as commonly indicated in prior Information System research, a convenience sampling method was adopted to select respondents (Khayer & Bao, 2019). A structured questionnaire is administrated using Google Forms and shared with social media groups of investors in India. The respondents were assured that their feedback would remain confidential and solely used for research purposes, ensuring that no information would be disclosed or used for other purposes.

Table 1. Measurement Items and Sources.

Before collecting data, minimum sampling criteria were calculated using G*Power software. The required sample size for this study is 138 based on an effect size of 0.015, a power level of 0.95, and a maximum allowable error of 0.05. Furthermore, a sample size of 200 responses is required to conduct Structural Equation Modeling (SEM) analysis effectively. Data were collected between April and May 2023. A total of 280 usable responses were received at the end of the survey which met the minimum sampling criteria. Hence, we proceeded with SEM analysis. A majority of the investors in this study are male (62.5%) and most of them are young investors from 18 to 25 years of age (42.5%). Nearly 79% of investors are aware of Wealthtech services.

Data Analysis and Results

The Partial Least Squares Structural Equation Modeling (PLS-SEM) approach was used to test the hypothesis. The hypothesis was tested using SmartPLS 4 software (Ringle et al., 2022).

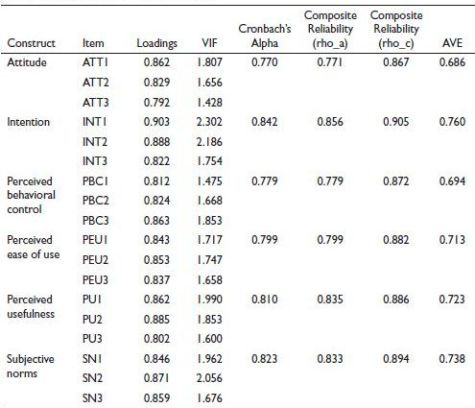

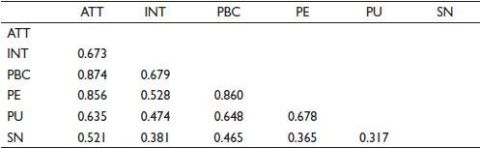

Assessment of Measurement Model

Before testing the hypothesis, we validated the convergent validity, reliability, and discriminant validity of the model. Convergent validity was assessed using factor loadings and Average Variance Extracted. As shown in Table 2 all the loading values are higher than the threshold value of 0.7 and AVE values are higher than the threshold value of 0.6, thus convergent validity of the model is ensured. In addition to that reliability is checked using Cronbach’s alpha and composite reliability. As posited in Table 2 the values of Cronbach’s alpha and composite reliability for all constructs are higher than the threshold value of 0.7. Further discriminant validity was assessed using the Heterotrait-Monotrait ratio (HTMT) approach. According to the results shown in Table 3, all HTMT values are lower than 0.90, as suggested by Henseler et al. (2016). Moreover, since the VIF values for all the items are less than the maximum allowable limit of three, we ensured there are no multicollinearity issues in the research model.

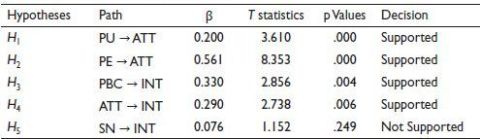

Assessment of Structural Model

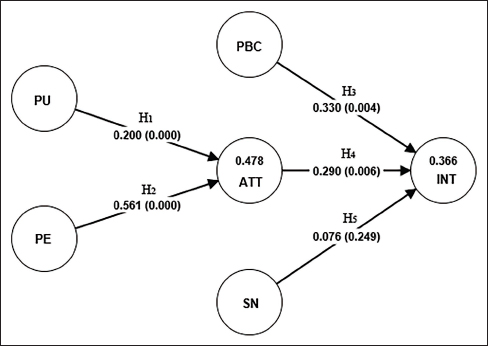

The structural model is assessed using the PLS-SEM approach by bootstrapping to 5,000 sub-samples. To test the structural model, R2, path coefficients, and t-values were used. Results are listed in Table 4 and Figure 1, which show that the research model explains 36.6% of the variance (R2) in the adoption intention of Wealthtech. All the hypotheses except H5 were supported. Table 3 shows that Attitude and PBC are positively associated with intention to use Wealthtech (β = 0.290, p < .001; β = 0.330, p < .001) supporting H3 and H4. PEU and PU are positively associated with Attitude toward Wealthtech adoption (β = 0.561, p < .001; β = 0.200, p < .001).

Discussions

Wealthtech platforms play a key role in reshaping traditional investment paradigms by offering a combination of efficiency and personalization. In parallel with the transformational impact of Artificial Intelligence in education, Wealthtech platforms present a promising avenue for modern investors. We explored factors that guide individual investors to Wealthtech platforms as the focus of this study. Using the TAM and TPB, the research aimed to decipher the intricate dynamics of attitude, PU, PEU, subjective norms, and PBC.

Table 2. Measurement Model Analysis.

Table 3. Heterotrait-Monotrait Ratio (HTMT).

Table 4. Assessment of Structural Model.

Figure 1. Hypothesis Testing Results.

As was the case in previous studies and in accordance with TAM (Belanche et al., 2019; Davis, 1989; Himel et al., 2021), the study’s findings highlighted the key role that PU plays in influencing users’ attitudes toward Wealthtech platforms. This correlation is supported by the broader literature on technological adoption (Cordero et al., 2023; Kumari & Devi, 2022), which highlights the users’ preference for tools that enable them to gain greater financial insight as well as improve their decision-making skills. Furthermore, the study emphasized the importance of PEU in influencing user attitudes toward adoption intention. Similar to existing research (Belanche et al., 2019; Himel et al., 2021), users preferred platforms with user-friendly interfaces and streamlined experiences, emphasizing the importance of intuitive design in technology. The study confirmed the relationship between attitude and intention, which was a notable contribution. In accordance with TAM and TPB’s emphasis on behavioral intention (Ajzen, 1991; Cordero et al., 2023; Davis, 1989; Kumari & Devi, 2022), the findings revealed a significant positive correlation between attitude and adoption intentions, indicating the crucial role of attitudes and inclinations in shaping adoption behavior. Using these findings, financial service providers can develop marketing strategies that highlight Wealthtech’s advantages and benefits, enhancing investors’ overall attitude toward the technology.

However, subjective norms showed an intriguing deviation from the TPB framework. In contrast, the expected relationship between subjective norms and adoption intentions did not reach statistical significance in the study. This result is contradictory to the existing literature (Aggarwal et al., 2023; Mazambani & Mutambara, 2019). While social influences play an important role in the adoption of many technologies, Wealthtech adoption may be more intrinsically motivated due to its highly individualized nature. Additionally, the study shed light on the role of PBC. Consistent with extant studies (Arkorful et al., 2022; Cordero et al., 2023; Kumari & Devi, 2022), PBC was positively associated with adoption intentions, emphasizing the key role of users’ perceived confidence and proficiency in navigating Wealthtech platforms. As a result of this finding, it is crucial to provide educational resources and support to individual investors in order to enable them to develop confidence and competence when using digital financial services.

In summary, the study provides nuanced insights into the dynamics of Wealthtech adoption among individual investors in appose to the tenets of TAM and TPB. As the financial ecosystem undergoes a digital metamorphosis, these insights are indispensable to defining user-centric strategies and ensuring a seamless integration of technology and finance.

Implications

The theoretical implications of this study include refining existing paradigms of technology adoption and behavioral economics within the financial landscape. First, this study attempted to provide a theoretical framework to understand the adoption drivers of Wealthtech in a broader context which encompasses investment platforms, robo-advisory, and personal financial management technology. Second, as a result of this research, a greater understanding of how individual investor behaviors interact with technological innovations in financial services is gained by exploring the intricate factors influencing Wealthtech adoption through established models such as the TPB and TAM. This insight enhances the theoretical frameworks guiding the assessment of technology adoption patterns and behavioral decision-making processes within the financial sector.

The findings of this research have significant practical implications for financial service providers, regulators, and individual investors in India. A better understanding of the behavioral determinants driving Wealthtech adoption will enable service providers to develop more user-friendly platforms and marketing strategies that highlight the advantages of using these digital financial services. Regulators can use this information in order to formulate policies that promote the responsible and secure adoption of technology in the financial sector. Due to Wealthtech’s ease of use and PU, individual investors can make informed decisions about their wealth management strategies.

Limitations and Future Research

Despite the fact that the study provides valuable insights, it is important to acknowledge its limitations. First, this study focused on individual investors in India through a cross-sectional analysis. Second, to measure the adoption intention we used a few constructs only which limit the broader understanding of the context. Finally, the present research was conducted in a particular region only which limits the generalization of the study’s results and findings. Future research can expand the scope to include diverse demographic groups and global perspectives. A longitudinal study will also yield better results. Additionally, reliance on self-reported data may introduce response bias, warranting the inclusion of objective measures in future investigations. Future research can also use well-established theories such as UTAUT, Innovation Diffusion Theory, and Task Technology Fit model to better understand user adoption of Wealthtech. The integration of these theories into a single theoretical framework may also help to understand the Wealthtech adoption factor better.

Conclusion

Using the TPB and the TAM, this study examined the adoption of Wealthtech by individual investors in India. These findings provide valuable insight into the factors that influence the intention to adopt Wealthtech and the role that PEU and PU play in shaping attitudes toward its adoption. The study’s findings showed that Attitude and PBC are positively associated with the intention to adopt Wealthtech, showing that individual investors who have favorable views about the technology and believe they have control over its use are more inclined to use it. It is clear that PEU and PU are important factors in influencing individual attitudes toward Wealthtech.

In conclusion, the study serves as a stepping stone in understanding the complexities of Wealthtech adoption in India and lays the groundwork for future research in the domain of technology acceptance and behavioral finance. As technology continues to revolutionize the financial services landscape, recognizing the factors that drive individual investors’ adoption of Wealthtech becomes increasingly crucial. The integration of the TPB and TAM has provided a holistic framework to comprehend investors’ intentions and decision-making processes in the context of digital financial services. Ultimately, by harnessing these insights, stakeholders can collectively foster the growth of the Wealthtech sector, promote financial inclusivity, and empower individual investors in India to make well-informed decisions about their financial future. As the financial industry evolves in tandem with technology, continuous research, and analysis will be imperative to keep pace with the changing dynamics and capitalize on the benefits offered by Wealthtech to both investors and the economy at large.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

ORCID iD

Muhammed Jisham  https://orcid.org/0000-0001-7968-6751

https://orcid.org/0000-0001-7968-6751

Abroud, A., Choong, Y. V., Muthaiyah, S., & Fie, D. Y. G. (2013). Adopting e-finance: Decomposing the technology acceptance model for investors. Service Business, 9(1), 161–182. https://doi.org/10.1007/s11628-013-0214-x

Aggarwal, M., Nayak, K. M., & Bhatt, V. (2023). Examining the factors influencing fintech adoption behaviour of gen Y in India. Cogent Economics & Finance, 11(1). https://doi.org/10.1080/23322039.2023.2197699

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179–211. https://doi.org/10.1016/0749-5978(91)90020-t

Arkorful, V. E., Zhao, S., Lugu, B. K., & Chu, J. (2022). Consumers’ mobile health adoption intention prediction utilizing an extended version of the theory of planned behavior. ACM SIGMIS Database, 53(2), 96–114. https://doi.org/10.1145/3533692.3533699

Armah, A. K., & Jin-Fa, L. (2023). Generational cohorts’ social media acceptance as a delivery tool in sub-Sahara Africa motorcycle industry: The role of cohort technical know-how in technology acceptance. Technology in Society, 75(102390). https://doi.org/10.1016/j.techsoc.2023.102390

Belanche, D., Casaló, L. V., & Flavián, C. (2019). Artificial intelligence in FinTech: Understanding robo-advisors adoption among customers. Industrial Management and Data Systems, 119(7), 1411–1430. https://doi.org/10.1108/imds-08-2018-0368

Bhatia, A., Chandani, A., & Chhateja, J. (2020). Robo advisory and its potential in addressing the behavioral biases of investors—A qualitative study in Indian context. Journal of Behavioral and Experimental Finance, 25(100281). https://doi.org/10.1016/j.jbef.2020.100281

Cao, L., Yang, Q., & Yu, P. S. (2021). Data science and AI in FinTech: An overview. International Journal of Data Science and Analytics, 12(2), 81–99. https://doi.org/10.1007/s41060-021-00278-w

Chong, L. L., Ong, H., & Tan, S. (2021). Acceptability of mobile stock trading application: A study of young investors in Malaysia. Technology in Society, 64(101497). https://doi.org/10.1016/j.techsoc.2020.101497

Cordero, D., Altamirano, K. L., Parra, J. O., & Espinoza, W. S. (2023). Intention to adopt industry 4.0 by organizations in Colombia, Ecuador, Mexico, Panama, and Peru. IEEE Access, 11, 8362–8386. https://doi.org/10.1109/access.2023.3238384

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. Management Information Systems Quarterly, 13(3), 319. https://doi.org/10.2307/249008

Diéguez, A. I. I., Velicia-Martín, F., & Aguayo-Camacho, M. (2023). Predicting Fintech innovation adoption: The mediator role of social norms and attitudes. Financial Innovation, 9(1). https://doi.org/10.1186/s40854-022-00434-6

Hakimi, T. I., Jaafar, J. A., & Aziz, N. A. A. (2023). What factors influence the usage of mobile banking among digital natives? Journal of Financial Services Marketing, 28(4), 763–778. https://doi.org/10.1057/s41264-023-00212-0

Himel, M. T. A., Ashraf, S., Bappy, T. A., Abir, T., Morshed, K., & Hossain, M. N. (2021). Users’ attitude and intention to use mobile financial services in Bangladesh: An empirical study. South Asian Journal of Marketing, 2(1), 72–96. https://doi.org/10.1108/sajm-02-2021-0015

Henseler, J., Hubona, G. S., & Ray, P. A. (2016). Using PLS path modeling in new technology research: updated guidelines. Industrial Management & Data Systems, 116(1), 2–20. https://doi.org/10.1108/imds-09-2015-0382

Khayer, A., & Bao, Y. (2019). The continuance usage intention of Alipay. The Bottom Line: Managing Library Finances, 32(3), 211–229. https://doi.org/10.1108/bl-07-2019-0097

Kumari, A., & Devi, N. C. (2022). Blockchain technology acceptance by investment professionals: A decomposed TPB model. Journal of Financial Reporting and Accounting, 21(1), 45–59. https://doi.org/10.1108/jfra-12-2021-0466

Laksamana, P., Suharyanto, S., & Cahaya, Y. F. (2022). Determining factors of continuance intention in mobile payment: Fintech industry perspective. Asia Pacific Journal of Marketing and Logistics, 35(7), 1699–1718. https://doi.org/10.1108/apjml-11-2021-0851

Lee, J. C., & Wang, J. (2022). From offline to online: understanding users’ switching intentions from traditional wealth management services to mobile wealth management applications. International Journal of Bank Marketing, 41(2), 369–394. https://doi.org/10.1108/ijbm-08-2022-0345

Leong, M. K., & Koay, K. Y. (2023). Towards a unified model of consumers’ intentions to use drone food delivery services. International Journal of Hospitality Management, 113(103539). https://doi.org/10.1016/j.ijhm.2023.103539

Manrai, R., & Gupta, K. P. (2022). Investor’s perceptions on artificial intelligence (AI) technology adoption in investment services in India. Journal of Financial Services Marketing, 28(1), 1–14. https://doi.org/10.1057/s41264-021-00134-9

Mao, C., Bayer, J. B., Ross, M. Q., Rhee, L., Le, H., Mount, J., Chang, H. -C., Chang, Y., Hedstrom, A., & Hovick, S. R. (2023). Perceived vs. observed mHealth behavior: A naturalistic investigation of tracking apps and daily movement. Mobile Media & Communication, 11(3), 526–548. https://doi.org/10.1177/20501579221149823

Mazambani, L., & Mutambara, E. (2019). Predicting FinTech innovation adoption in South Africa: The case of cryptocurrency. African Journal of Economic and Management Studies, 11(1), 30–50. https://doi.org/10.1108/ajems-04-2019-0152

Nair, P. S., Shiva, A., Yadav, N. K., & Tandon, P. (2022). Determinants of mobile apps adoption by retail investors for online trading in emerging financial markets. Benchmarking: An International Journal, 30(5), 1623–1648. https://doi.org/10.1108/bij-01-2022-0019

Nguyen-Phuoc, D. Q., Truong, T. M., Nguyen, M. H., Pham, H. G., Li, Z., & Oviedo-Trespalacios, Ó. (2024). What factors influence the intention to use electric motorcycles in motorcycle-dominated countries? An empirical study in Vietnam. Transport Policy, 146, 193–204. https://doi.org/10.1016/j.tranpol.2023.11.013

Parthasarathy, B. (2021, September 23). 5 Ways Fintech is transforming banking in India. Forbes Advisor India. https://www.forbes.com/advisor/in/banking/5-ways-fintech-is-transforming-banking-in-india/

Ringle, C. M., Wende, S., & Becker, J. -M. (2022). SmartPLS 4. Oststeinbek: SmartPLS. https://www.smartpls.com

Sood, K., & Singh, S. (2022). Marin Laboure and Nicolas Deffrennes (2022): Democratizing finance – the radical promises of Fintech. Journal of Evolutionary Economics, 32(5), 1581–1586. https://doi.org/10.1007/s00191-022-00789-0

Wu, I., & Chen, J. (2005). An extension of trust and TAM model with TPB in the initial adoption of on-line tax: An empirical study. International Journal of Human-computer Studies, 62(6), 784–808. https://doi.org/10.1016/j.ijhcs.2005.03.003