1 G. R. Damodaran Academy of Management, Coimbatore, Tamil Nadu, India

2 Alagappa Institute of Management, Alagappa University, Karaikudi, Tamil Nadu, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed

This study explores the moderating effect of digital literacy on the relationship between digital financial services and financial behaviour in the context of manufacturing MSMEs. It highlights the transformative impact of digital financial services, including expanded access to formal financial services, financial inclusion, simplified payment processes, and improved credit accessibility for MSMEs. The study emphasizes the importance of digital literacy in effectively utilizing digital technologies and accessing digital financial services, which in turn influences financial behaviour, specifically in terms of savings, financing, and investment decisions. Drawing on the Technology Acceptance Model and Perceived Behavioural Control (PBC) theories, the research investigates the complex interplay among digital financial services, PBC, and financial behaviour among manufacturing MSME owners. The findings provide valuable insights for policymakers and financial institutions to enhance digital financial services and promote financial activities among MSMEs. Overall, this study underscores the significance of digital literacy and its role in empowering MSMEs and facilitating their financial growth in the digital era.

Digital literacy, financial behaviour, financial inclusion, investment decisions, digital era, financial growth

Introduction

Digital financial services (DFS) have revolutionized the financial sector for micro, small and medium enterprises (MSMEs), providing them with greater access to formal financial services, simplified processes and better financial management. These services have had a significant impact on MSMEs in several ways. First, they have expanded access to formal financial services, especially for those in remote areas or without physical bank branches (Beck et al., 2009). MSMEs can now open bank accounts, access credit, make payments and manage their finances online, bypassing traditional brick-and-mortar banks (Babajide et al., 2020). Second, DFS have played a critical role in promoting financial inclusion, particularly for MSMEs in developing countries who often face challenges in accessing formal financial services (Eton et al., 2021). They now have access to affordable and convenient banking services that allow them to safely save money, access credit and engage in digital transactions, ultimately increasing their economic participation (Klapper & Singer, 2014; Pazarbasioglu et al., 2020). Third, digital payment systems, such as mobile wallets and online payment platforms, have simplified payment processes for MSMEs, providing faster, safer and more convenient ways to accept and make payments. This efficiency helps MSMEs improve their cash flow management, reduce transaction costs and improve the customer experience (Kumar et al., 2022). Finally, DFS have facilitated access to credit for MSMEs, which have traditionally faced challenges in obtaining credit due to limited collateral and credit history (Buteau, 2021; Pandey & Gupta, 2018; Sudjatmoko et al., 2023).

The financial behaviour of MSMEs varies considerably depending on their circumstances and contexts. In the early stages, many rely on personal savings or funds from business owners to finance their operations. As businesses grow, they may seek external sources of finance. However, MSMEs often lack formal financial training or dedicated staff, leading to potential knowledge gaps in financial planning, accounting and taxation. Fortunately, there is a growing recognition of the importance of financial literacy and an increasing availability of resources to help MSMEs improve their financial management skills (Anshika & Singla, 2022; Atkinson, 2017). The adoption of digital technology and financial services is critical for MSMEs, providing improved financial management, access to digital banking services, online payment platforms and e-commerce channels (Achmad, 2023; Buteau, 2021). MSMEs that embrace technology are better positioned for growth and market competitiveness.

Digital literacy is essential for MSMEs to effectively use digital technologies, leading to improved operational efficiency, expanded market opportunities, enhanced customer engagement, cost savings, data-driven decision-making and overall adaptability. It is a key driver of MSME growth and competitiveness in the digital age, enabling them to use DFS such as online banking, mobile payments and digital lending platforms (Raj & Upadhyay, 2020). Digital literacy fosters an environment of adaptability and agility, encouraging employees to embrace technological advances, stay abreast of industry trends, and proactively seek out innovative digital solutions.

India’s manufacturing sector relies heavily on MSMEs for employment, industrial production and export earnings. The government has implemented policies and revised the definition of MSMEs in June 2020 to encourage their growth. Digital finance has had a significant impact on MSMEs, enabling them to access financial services and manage their finances efficiently (Hermawan et al., 2022).

The study aims to examine the impact of DFS on the financial behaviour of MSME owners, specifically in terms of savings, financing and investment (Amornkitvikai et al., 2021). A moderation analysis will also explore the role of digital literacy in this relationship (Erdem et al., 2023). The findings of the study could be valuable for government and financial institutions to improve DFS and encourage MSME owners to engage in financial activities such as saving, borrowing and investing (Candraningrat et al., 2020). Overall, there appears to be a gap between the use of DFS and the financial behaviour of MSME owners, which this study seeks to address (Monferrer et al., 2023).

Conceptual Framework

This study draws on the Technology Acceptance Model (TAM) and Perceived Behavioural Control (PBC) theories to examine the impact of DFS on the financial behaviour of MSME owners (Awe & Ertemel, 2021; Morales-Pérez et al., 2022). TAM research has identified perceived usefulness and perceived ease of use as primary predictors of technology acceptance, and digital finance has been shown to facilitate strategic decision-making to improve financial performance and sustainability (Al-Okaily et al., 2021; He et al., 2018). In addition, previous research has highlighted the convenience and security of online financial transactions through financial technology (Akinci et al., 2004; Laforet & Li, 2005; Singh & Srivastava, 2020). PBC, on the other hand, describes the factors that influence MSME owners’ financial decisions regarding savings, financing and investment. When individuals believe they have control over an action, they are more confident in their ability to achieve desired outcomes (Atkinson, 2017; Chanda et al., 2023; Mutengezanwa, 2018). Thus, PBC appears to be one of the most influential factors that could affect MSME owners’ savings, financing and investment decisions (Singh et al., 2018). Overall, this study aims to shed light on the complex relationship between DFS, PBC, and financial behaviour among MSME owners (Thathsarani & Jianguo, 2022).

Review of Literature

Fin-Tech

In recent years, Fintech companies have utilized technology to provide innovative financial products and services, such as mobile payments, peer-to-peer lending and robo-advisors (Puschmann, 2017). This transformative and disruptive innovation has challenged traditional financial markets, attracting a growing number of tech-savvy customers and spurring traditional financial institutions to innovate and adapt to the changing financial landscape (Lee & Shin, 2018).

To study the challenges associated with Fintech, it is crucial to adopt interdisciplinary research designs, theories and methodologies. Researchers can integrate existing knowledge from various interdisciplinary sources, such as finance and economics, strategy and organizations, marketing, statistics and data science, operations management and management science, and computer science, into new Fintech research (Gomber et al., 2018).

MSMEs can attain higher efficiency by adopting FinTechs. Therefore, it is essential for countries to introduce policies that support FinTech startups, which can enhance MSME efficiency (Abbasi et al., 2021).

Digital Services

According to Chanias et al. (2019), digital strategy making diverges from traditional strategic information systems planning as it embodies an extreme manifestation of emergent strategy development. Khin and Ho (2019) emphasize that the presence of both digital orientation and digital capability has a favourable influence on digital innovation, acting as an intermediary between technology orientation and financial/non-financial performance. Brunetti et al. (2020) emphasize that developing digital culture and skills before investing in digital infrastructure and technology is vital for successful transformation. The proposed pillars of strategies are (a) cultivate a digital-savvy culture and expertise, (b) invest in robust infrastructure and cutting-edge technologies and (c) foster collaborative ecosystems for sustained growth and innovation. Aziz and Naima (2021) argue that to achieve digital financial inclusion in developing countries, a comprehensive approach is needed. While digital services have improved access to financial services, their effectiveness is limited by connectivity, financial literacy and social awareness gaps. Abou-foul et al. (2021) suggest that manufacturers must blend physical and digital elements in their market offerings to fully harness the potential of the service model. Finally, Selimovi? et al. (2021) emphasize that active employee participation is crucial for a successful transformation, and workplace redesigns should be in sync with their expectations and requirements.

Digital Literacy

Digital literacy pertains to the adept and productive use of digital technologies, especially in empowering disadvantaged rural communities to access and utilize these tools for their advancement (Nedungadi et al., 2018). Digital literacy encompasses various domains, from health, financial and eSafety to technical and social aspects that enable individuals to learn not only technical skills but also essential life skills and services (Nedungadi et al., 2018). Cetindamar Kozanoglu and Abedin (2021) examined the realm of digital transformation and enterprise systems where employees play a pivotal role. It is imperative to evaluate their digital literacy at both individual and organizational levels to understand their proficiency and readiness to adapt to the evolving digital landscape. Sharma et al. (2016) Assessed policies that prioritize digital literacy, digital inclusion and digital participation in knowledge-based societies is essential for fostering sustainable development. Bejakovi? and Mrnjavac (2020) highlight that the policy interventions are of utmost importance in boosting digital literacy, fostering digital inclusion and providing comprehensive workforce training. On the other hand, Kass-Hanna et al. (2022) observed that the financial and digital literacy can have varying impacts across different populations and locations. However, both forms of literacy can enhance resilience by promoting sound financial behaviours. In addition, Sariwulan et al. (2020) indicated that digital literacy exerts the most significant influence on the performance of MSME entrepreneurs, thus necessitating its prioritization in performance development strategies. This includes fostering digital business relationships, utilizing online facilities and leveraging digital networks for optimal outcomes. Finally, MSMEs in rural and regional areas face challenges in adopting digital technologies for entrepreneurial growth, but training can transfer knowledge, develop skills and foster confidence in adopting digital tools (Ollerenshaw et al., 2021).

Financial Behaviour

The MSME industry exhibits a lack of adequate financial literacy, especially concerning financial decision-making and organizing behaviour. Thus, to enhance learning outcomes, it is essential to train MSMEs in financial literacy using virtual small cash management firms, with a particular focus on creating financial reports (Tolba et al., 2014). Investment decisions in MSMEs depend on the financial knowledge, confidence and attitude of their owners. Both financial literacy and attitude influence their capacity to manage future finances. The capability of MSME owners to handle resources for investment is a reflection of their financial behaviour, evident through their adeptness in budget planning (Pahlevi et al., 2020). However, relying solely on financial behaviour cannot fully mitigate the influence of financial attitudes on investment decisions. This implies that future financial management attitudes could pose challenges for MSMEs in accurately estimating operational costs, potentially affecting their long-term business success (Hanggraeni & Sinamo, 2021).

The MSME sector has a high acceptance rate for financial technology, with many considering themselves moderate fintech adopters. They possess a strong grasp of the different financial services offered by fintech companies and are increasingly incorporating fintech products and services into their financial management (Ratnawati et al., 2022). This emerging scenario creates a lucrative market opportunity for fintech companies, incumbents and non-financial organizations (Gupta et al., 2022). The root cause of this situation can be attributed to a lack of comprehension of financial concepts and products, coupled with limited access to financial management knowledge. MSME owners in this category also exhibit incomplete willingness and responsibility to manage their financial condition (Agustina et al., 2022).

Prior studies have identified a deficiency in digital literacy as a significant barrier to the adoption of DFS. Specifically, digital literacy refers to an individual’s knowledge and skill in using technology. According to the research by Lo Prete (2022), countries with higher levels of digital literacy and GDP per capita tend to have a greater prevalence of internet-based digital payment methods. However, the presence of these payment methods is not solely determined by digital literacy. On the other hand, countries with a larger proportion of technologically capable populations tend to exhibit higher levels of digital literacy. These findings highlight the importance of promoting digital literacy as a means of overcoming barriers to DFS adoption

The preceding literature suggests that DFS and digital literacy may have a substantial impact on the financial behaviour of MSME owners, thus, we hypothesize the following:

H1: The utilization of DFS significantly influences the financial behaviour of manufacturing MSME owners.

H2: The level of digital literacy significantly influences the financial behaviour of manufacturing MSME owners.

Drawing from the previous discussion, it is postulated that the financial behaviour of MSME owners can be significantly influenced by the implementation of DFS, alongside interventions that address digital literacy. As a result, we suggest the third hypothesis:

H3: The relationship between DFS and financial behaviour is moderated by digital literacy.

Methods

In this study, a causal research design and moderation analysis were utilized to investigate the interplay of digital literacy in the relationship between DFS and the financial behaviour of MSME owners in the manufacturing sector. A total of 732 manufacturing MSME owners from the southern region of India (Karnataka, Andhra Pradesh, Telangana, Kerala and Tamil Nadu) participated by completing an online survey administered through SurveyMonkey. The survey instrument employed a 5-point Likert Scale, focusing on assessing the usage and accessibility of DFS, as well as the financial behaviour of owners concerning saving, borrowing and investing. The data collection instrument was derived from Angeles (2022) and it was divided into three sections, with scales to measure DFS (access and use), digital literacy and financial behaviour. The manufacturing MSMEs’ financial behaviour was determined by assessing their saving, borrowing and investing practices.

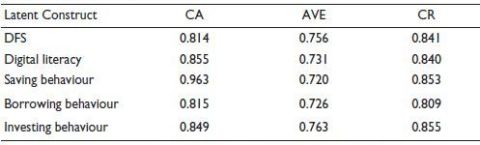

Table 1. Reliability and Validity Table.

CA: Cronbach’s Alpha AVE: Average Variance Extracted CR: Composite Reliability.

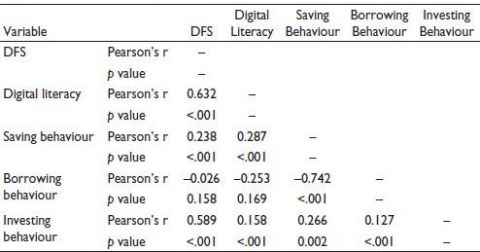

The researcher utilized Pearson’s correlation analysis to examine the relationship between each variable, and structural equation modelling (SEM) using AMOS was conducted to further test this relationship. To explore the impact of a moderating variable on the relationship between an independent variable and a dependent variable, the Hayes process macro was employed.

Table 1 gives the results of the reliability and validity tests. The items of the variables have Cronbach’s alpha coefficient greater than 0.08, indicating good reliability. Discriminant validity and congruent validity were assessed using average variance; extracted values are above 0.5 and the correlated factors are above 0.5 which is said to be satisfactory (Singh & Smith, 2006).

Results

The data from Table 2 reveals that 77.73% of the total respondents were male, while 22.27% were female. The largest age group among the participants was 25–34, comprising 33.20% of the respondents, followed by the 35–44-age group with 18.58% representation. Among the participants, 67.76% belonged to the micro-business category, while the small business category accounted for 20.90% and the medium business category for 11.34%. In terms of educational qualifications, the highest proportion of respondents had a bachelor’s degree (44.40%), followed by those with a diploma (29.51%). High school education was reported by 9.43% of the participants, and postgraduate degree holders accounted for 16.67%.

The results from the Table 3 indicate several significant correlations among the variables studied. Digital literacy shows a strong positive correlation with the usage of DFS. Saving behaviour is positively correlated with DFS and digital literacy, while exhibiting a significant negative correlation with borrowing behaviour. Investing behaviour demonstrates significant positive correlations with DFS, digital literacy and saving behaviour. However, there is no significant relationship between borrowing behaviour and the other variables, except for a weak positive correlation with investing behaviour. These findings emphasize the importance of digital literacy in influencing DFS and saving behaviour, providing valuable insights into the relationships between these variables.

Table 2. Demographic Profile (n = 732).

Table 3. Pearson Correlation Result.

Table 4 presents the goodness-of-fit measures for two models: Confirmatory Factor Analysis (CFA) and SEM. Both models have identical basic goodness-of-fit statistics, indicating a similar fit. The chi-square/degrees of freedom ratio for both models is 1.689, within an acceptable range. The RMSEA values suggest a good fit, with 0.049 for the CFA model and 0.063 for the SEM model. The GFI and AGFI values indicate acceptable fit for both models, with slightly higher values for the CFA model. The CFI is 0.961 for the CFA model and 0.983 for the SEM model, indicating a better fit for the SEM model. The RMR values are below the threshold of 0.08 for both models, indicating a good fit. The SRMR values are 0.036 for the CFA model and 0.007 for the SEM model, with a better fit for the SEM model. Overall, both models meet the commonly accepted criteria for a good fit, suggesting that they provide satisfactory fits to the observed data.

Table 4. Goodness-of-Fit Measures.

RMR < 0.08, RMSEA < 0.08, CFI > 0.95,GFI > 0.90, AGFI > 0.90, SRMR < 0.05.

Table 5. Evaluation of SEM.

*Significance at p < .05; FB – financial behaviour; DL – digital literacy.

Table 5 presents the findings regarding the relationships between DFS and financial behaviour, as well as digital literacy and financial behaviour. The standardized regression weights indicate positive associations, with DFS having a weight of 0.712 and digital literacy having a weight of 0.763. This means that an increase in DFS or digital literacy is associated with a positive change in financial behaviour. The standardized estimates further support these relationships, with DFS having an estimate of 0.168 and digital literacy having an estimate of 0.589. These values suggest that for everyone standard deviation increase in DFS or digital literacy, financial behaviour increases by the corresponding estimate. The p values of .00 for both relationships indicate statistical significance at the p < .05 level. The squared multiple correlation coefficients (R-squared) reveal that DFS explains 86.2% of the variance in financial behaviour, while digital literacy explains 83.1% of the variance. These results support the hypothesis that there is a significant relationship between DFS and financial behaviour, as well as between digital literacy and financial behaviour. Overall, the findings suggest that both DFS and digital literacy play important roles in shaping financial behaviour and provide empirical evidence for their associations with financial behaviour.

Table 6. Evaluation of Moderation.

Int1: FB×DL.

Table 6 presents coefficients, t-values, p values and confidence intervals for multiple variables. The constant term and variables financial behaviour and DFS do not show statistically significant effects on the outcome variable based on their t-values. However, the variable Int1 has a statistically significant effect with a positive coefficient. There is a conditional influence of DFS on financial behaviour alters as a result of the adoption of digital literacy.

Discussion

The results from the reliability and validity tests demonstrate that the variables exhibit good reliability, as indicated by Cronbach’s alpha coefficients surpassing 0.8. Additionally, these tests establish satisfactory discriminant validity and convergent validity, supported by average variance extracted values and correlations exceeding 0.5. The demographic information reveals that the majority of participants are male, and the 25–34-age group is well-represented. Micro-businesses have the highest proportion, followed by small and medium businesses. Bachelor’s degrees are the most common educational qualification. Pearson’s correlation demonstrates significant correlations, indicating that digital literacy is positively correlated with DFS and saving behaviour, while saving behaviour has a negative correlation with borrowing behaviour. Investing behaviour shows significant positive correlations with all three variables. Additionally, SEM shows that both the CFA and SEM models have acceptable goodness-of-fit. SEM highlights the positive associations and statistical significance between DFS and financial behaviour as well as digital literacy and financial behaviour. Finally, moderation analysis presents coefficients and statistical results, indicating that the financial behaviour and DFS do not have significant effects, while the variable digital literacy does. In summary, these findings provide valuable insights into reliability, validity, demographics, correlations, model fit and the relationships between digital literacy and financial behaviour, underscoring the importance of digital literacy in shaping individuals’ financial behaviour.

Conclusion

This study examines how digital literacy moderates the relationship between DFS and financial behaviour among manufacturing MSMEs. It underscores the crucial role of digital literacy in effectively utilizing digital technologies and accessing DFS, which in turn affects financial behaviour. The research acknowledges the transformative potential of DFS, providing MSMEs with improved access to formal financial services, promoting financial inclusion, streamlining payment processes and enhancing credit accessibility. Furthermore, the findings emphasize the importance of digital literacy in shaping financial behaviour, particularly in relation to decisions regarding savings, financing and investment.

This research contributes significantly to a comprehensive understanding of the interplay between DFS, digital literacy and financial behaviour within the manufacturing MSME context. The findings hold valuable implications for government policymakers and financial institutions to enhance DFS and encourage active financial engagement among MSME owners, encompassing saving, borrowing and investing. The study emphasizes the necessity of bridging the gap between the utilization of DFS and the financial behaviour of MSME owners, highlighting the pivotal role of digital literacy in shaping financial conduct. Furthermore, the research lays a crucial foundation for future investigations and underscores the importance of digital literacy initiatives and targeted interventions to promote the adoption and effective use of DFS among MSMEs.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Vivek Vijayakumar  https://orcid.org/0000-0001-8255-5840

https://orcid.org/0000-0001-8255-5840

Abbasi, K., Alam, A., Du, M. (Anna), & Huynh, T. L. D. (2021). FinTech, SME efficiency and national culture: Evidence from OECD countries. Technological Forecasting and Social Change, 163, 120454. https://doi.org/10.1016/J.TECHFORE.2020.120454

Abou-foul, M., Ruiz-Alba, J. L., & Soares, A. (2021). The impact of digitalization and servitization on the financial performance of a firm: An empirical analysis. Production Planning and Control, 32(12), 975–989. https://doi.org/10.1080/09537287.2020.1780508

Achmad, W. (2023). MSMEs empowerment through digital innovation: The key to success of e-commerce in Indonesia. Daengku: Journal of Humanities and Social Sciences Innovation, 3(3), 469–475. https://doi.org/10.35877/454RI.DAENGKU1742

Agustina, Y. Subagyo & Nurulistanti, L. (2022). How money circulates in Indonesian SMEs: An analysis of financial literacy, business performance, financial management behavior, and financial attitude. Educational Administration: Theory and Practice, 28(2), 122–132. https://doi.org/10.17762/KUEY.V28I02.425

Akinci, S., Aksoy, ., & Atilgan, E. (2004). Adoption of internet banking among sophisticated consumer segments in an advanced developing country. International Journal of Bank Marketing, 22(3), 212–232. https://doi.org/10.1108/02652320410530322/FULL/HTML

Al-Okaily, M., Natour, A. Al, & Shishan, F. (2021). Sustainable FinTech innovation orientation: A moderated model. Sustainability, 13(24), 13591. https://doi.org/10.3390/su132413591

Amornkitvikai, Y., Tham, S. Y., & Tangpoolcharoen, J. (2021). Barriers and factors affecting e-commerce utilization of Thai small and medium-sized enterprises in food and beverage and retail services. Global Business Review. https://doi.org/10.1177/09721509211036294

Angeles, I. T. (2022). The moderating effect of digital and financial literacy on the digital financial services and financial behavior of MSMEs. Review of Economics and Finance, 20, 505–515. https://doi.org/10.55365/1923.X2022.20.57

Anshika & Singla, A. (2022). Financial literacy of entrepreneurs: A systematic review. Managerial Finance, 48(9–10), 1352–1371. https://doi.org/10.1108/MF-06-2021-0260

Atkinson, A. (2017). Financial education for MSMEs and potential entrepreneurs. https://doi.org/10.1787/bb2cd70c-en

Awe, Y., & Ertemel, V. A. (2021). Enhancement of micro small businesses in the Gambia through digitalization: Investigating youth entrepreneurs perception, use and inhibitor of e-commerce technology. Working Paper Series, 2(3), 25–42. https://doi.org/10.5281/zenodo.5519304

Aziz, A., & Naima, U. (2021). Rethinking digital financial inclusion: Evidence from Bangladesh. Technology in Society, 64. https://doi.org/10.1016/J.TECHSOC.2020.101509

Babajide, A., Oluwaseye, E. O., Lawal, A. I., & Isibor, A. A. (2020). Financial technology, financial inclusion and MSMEs financing in the south-west of Nigeria. Academy of Entrepreneurship Journal, 26(3), 1–17. https://www.academia.edu/download/79129656/Financial-technology-financial-inclusion-and-msmes-financing-in-the-south-west-of-nigeria-1528-2686-26-3-357.pdf

Beck, T., Demirgüç-Kunt, A., & Honohan, P. (2009). Access to financial services: Measurement, impact, and policies. World Bank Research Observer, 24(1), 119–145. https://doi.org/10.1093/WBRO/LKN008

Bejakovi?, P., & Mrnjavac, Ž. (2020). The importance of digital literacy on the labour market. Employee Relations, 42(4), 921–932. https://doi.org/10.1108/ER-07-2019-0274

Brunetti, F., Matt, D. T., Bonfanti, A., De Longhi, A., Pedrini, G., & Orzes, G. (2020). Digital transformation challenges: strategies emerging from a multi-stakeholder approach. TQM Journal, 32(4), 697–724. https://doi.org/10.1108/TQM-12-2019-0309

Buteau, S. (2021). Roadmap for digital technology to foster India’s MSME ecosystem—Opportunities and challenges. CSI Transactions on ICT, 9(4), 233–244. https://doi.org/10.1007/S40012-021-00345-4

Candraningrat, I., Abundanti, N., Mujiati, N., & Erlangga, R. (2020). The role of financial technology on development of MSMEs. Accounting, 7(1), 225–230. http://dx.doi.org/10.5267/j.ac.2020.9.014

Cetindamar Kozanoglu, D., &Abedin, B. (2021). Understanding the role of employees in digital transformation: Conceptualization of digital literacy of employees as a multi-dimensional organizational affordance. Journal of Enterprise Information Management, 34(6), 1649–1672. https://doi.org/10.1108/JEIM-01-2020-0010

Chanda, R. C., Vafaei-Zadeh, A., Hanifah, H., & Ramayah, T. (2023). Investigating factors influencing individual user’s intention to adopt cloud computing: A hybrid approach using PLS-SEM and fsQCA. Kybernetes. https://doi.org/10.1108/K-01-2023-0133

Chanias, S., Myers, M. D., & Hess, T. (2019). Digital transformation strategy making in pre-digital organizations: The case of a financial services provider. Journal of Strategic Information Systems, 28(1), 17–33. https://doi.org/10.1016/J.JSIS.2018.11.003

Erdem, C., Oruç, E., Atar, C., & Ba?c?, H. (2023). The mediating effect of digital literacy in the relationship between media literacy and digital citizenship. Education and Information Technologies, 28(5), 4875–4891. https://doi.org/10.1007/S10639-022-11354-4

Eton, M., Mwosi, F., Okello-Obura, C., Turyehebwa, A., & Uwonda, G. (2021). Financial inclusion and the growth of small medium enterprises in Uganda: empirical evidence from selected districts in Lango sub-region. Journal of Innovation and Entrepreneurship, 10(1). https://doi.org/10.1186/S13731-021-00168-2

Gomber, P., Kauffman, R. J., Parker, C., & Weber, B. W. (2018). On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. Journal of Management Information Systems, 35(1), 220–265. https://doi.org/10.1080/07421222.2018.1440766

Gupta, U., Agarwal, B., & Nautiyal, N. (2022). Financial technology adoption: A case of Indian MSMEs. Finance: Theory and Practice, 26(6), 192–211. https://doi.org/10.26794/2587-5671-2022-26-6-192-211

Hanggraeni, D., & Sinamo, T. (2021). Quality of entrepreneurship and micro-, small-and medium-sized enterprises’ (MSMEs) financial performance in Indonesia. Journal of Asian Finance, Economics and Business, 8(4), 897–907. https://doi.org/10.13106/JAFEB.2021.VOL8.NO4.0897

He, Y., Chen, Q., & Kitkuakul, S. (2018). Regulatory focus and technology acceptance: Perceived ease of use and usefulness as efficacy. Cogent Business and Management, 5(1). https://doi.org/10.1080/23311975.2018.1459006

Hermawan, A., Gunardi, A., & Sari, L. M. (2022). Intention to use digital finance MSMEs: The impact of financial literacy and financial inclusion. Jurnal Ilmiah Akuntansi Dan Bisnis, 17(1), 171–182. https://doi.org/10.24843/JIAB.2022.v17.i01.p12

Kass-Hanna, J., Lyons, A. C., & Liu, F. (2022). Building financial resilience through financial and digital literacy in South Asia and Sub-Saharan Africa. Emerging Markets Review, 51. https://doi.org/10.1016/J.EMEMAR.2021.100846

Khin, S., & Ho, T. C. F. (2019). Digital technology, digital capability and organizational performance: A mediating role of digital innovation. International Journal of Innovation Science, 11(2), 177–195. https://doi.org/10.1108/IJIS-08-2018-0083

Klapper, L., & Singer, D. (2014). The opportunities of digitizing payments. World Bank. https://openknowledge.worldbank.org/handle/10986/19917

Kumar, P., Kushwaha, A. K., Kar, A. K., Dwivedi, Y. K., & Rana, N. P. (2022). Managing buyer experience in a buyer–supplier relationship in MSMEs and SMEs. Annals of Operations Research. https://doi.org/10.1007/S10479-022-04954-3

Laforet, S., & Li, X. (2005). Consumers’ attitudes towards online and mobile banking in China. International Journal of Bank Marketing, 23(5), 362–380. https://doi.org/10.1108/02652320510629250

Lee, I., & Shin, Y. J. (2018). Fintech: Ecosystem, business models, investment decisions, and challenges. Business Horizons, 61(1), 35–46. https://doi.org/10.1016/J.BUSHOR.2017.09.003

Lo Prete, A. (2022). Digital and financial literacy as determinants of digital payments and personal finance. Economics Letters, 213, 110378. https://doi.org/10.1016/J.ECONLET.2022.110378

Monferrer, D., Li, J., Bruce, E., Shurong, Z., Ying, D., Yaqi, M., Amoah, J., & Bankuoru Egala, S. (2023). The effect of digital marketing adoption on SMEs sustainable growth: Empirical evidence from Ghana. Sustainability, 15(6), 4760. https://doi.org/10.3390/SU15064760

Morales-Pérez, S., Garay-Tamajón, L. A., Corrons-Giménez, A., & Pacheco-Bernal, C. (2022). The antecedents of entrepreneurial behaviour in the creation of platform economy initiatives: An analysis based on the decomposed theory of planned behaviour. Heliyon, 8(10). https://www.cell.com/heliyon/pdf/S2405-8440(22)02366-0.pdf

Mutengezanwa, M. (2018). Financial literacy among small and medium enterprises in Zimbabwe. https://ukzn-dspace.ukzn.ac.za/handle/10413/17669

Nedungadi, P. P., Menon, R., Gutjahr, G., Erickson, L., & Raman, R. (2018). Towards an inclusive digital literacy framework for digital India. Education and Training, 60(6), 516–528. https://doi.org/10.1108/ET-03-2018-0061

Ollerenshaw, A., Corbett, J., & Thompson, H. (2021). Increasing the digital literacy skills of regional SMEs through high-speed broadband access. Small Enterprise Research, 28(2), 115–133. https://doi.org/10.1080/13215906.2021.1919913

Pahlevi, T., Suratman, B., Wulandari, S. S., & Sudarwanto, T. (2020). The influence of financial literacy on financial attitudes of small and medium enterprises regarding eggplant flour. International Journal of Innovation, Creativity and Change, 6, 367–380.

Pandey, A., & Gupta, R. (2018). Entrepreneur’s performance and financial literacy – A critical review. International Journal of Management Studies, 5(3), 1–14. https://www.researchgate.net/profile/Rekha-Gupta-1

Pazarbasioglu, C., Mora, A. G., Uttamchandani, M., Natarajan, H., Feyen, E., & Saal, M. (2020). Digital financial services. World Bank. http://pubdocs.worldbank.org/en/230281588169110691/Digital-Financial-Services.pdf

Puschmann, T. (2017). Fintech. Business and Information Systems Engineering, 59(1), 69–76. https://doi.org/10.1007/S12599-017-0464-6

Raj, B., & Upadhyay, V. (2020). Role of FinTech in accelerating financial inclusion in India [paper presentation]. 3rd International Conference on Economics and Finance organised by the Nepal Rastra Bank at Kathmandu, Nepal during February (pp. 28–29). https://doi.org/10.2139/SSRN.3591018

Ratnawati, Sudarmiatin, Soetjipto, B. E., & Restuningdiah, N. (2022). The role of financial behavior as a mediator of the influence of financial literacy and financial attitudes on MSMEs investment decisions in Indonesia. Journal of Social Economics Research, 9(4), 193–203. https://doi.org/10.18488/35.V9I4.3231

Sariwulan, T., Suparno, S., Disman, D., Ahman, E., & Suwatno, S. (2020). Entrepreneurial performance: The role of literacy and skills. Journal of Asian Finance, Economics and Business, 7(11), 269–280. https://doi.org/10.13106/JAFEB.2020.VOL7.NO11.269

Selimovi?, J., Pilav-Veli?, A., & Krndžija, L. (2021). Digital workplace transformation in the financial service sector: Investigating the relationship between employees’ expectations and intentions. Technology in Society, 66. https://doi.org/10.1016/J.TECHSOC.2021.101640

Sharma, R., Fantin, A. R., Prabhu, N., Guan, C., & Dattakumar, A. (2016). Digital literacy and knowledge societies: A grounded theory investigation of sustainable development. Telecommunications Policy, 40(7), 628–643. https://doi.org/10.1016/J.TELPOL.2016.05.003

Singh, M. P., Chakraborty, A., & Roy, M. (2018). Developing an extended theory of planned behavior model to explore circular economy readiness in manufacturing MSMEs, India. Resources, Conservation and Recycling, 135, 313–322. https://doi.org/10.1016/j.resconrec.2017.07.015

Singh, P. J., & Smith, A. (2006). An empirically validated quality management measurement instrument. Benchmarking: An International Journal, 13(4), 493–522.

Singh, S., & Srivastava, R. K. (2020). Understanding the intention to use mobile banking by existing online banking customers: An empirical study. Journal of Financial Services Marketing, 25(3–4), 86–96. https://doi.org/10.1057/S41264-020-00074-W

Sudjatmoko, A., Ichsan, M., Astriani, M. Mariani & Clairine, A. (2023). The impact of COVID-19 pandemic on the performance of Indonesian MSME with innovation as mediation. Cogent Business and Management, 10(1). https://doi.org/10.1080/23311975.2023.2179962

Thathsarani, U. S., & Jianguo, W. (2022). Do digital finance and the technology acceptance model strengthen financial inclusion and SME performance? Information, 13(8), 390. https://doi.org/10.3390/INFO13080390

Tolba, A., Seoudi, I., & Fahmy, K. (2014). Factors influencing intentions of Egyptian MSME owners in taking commercial bank loans. Journal of Small Business and Entrepreneurship, 27(6), 497–518. https://doi.org/10.1080/08276331.2015.1102478