1REVA Business School, REVA University, Bangalore, Karnataka, India

2GITAM School of Business (GSB-H)—Hyderabad, GITAM Deemed to Be University, Hyderabad, Telangana, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

This study investigates herd behaviour in the Indian Stock Market from 2011 to 2020, analysing daily returns of stocks listed in the S&P BSE 500 index. By employing the Chang, Cheng and Khorana model, the research assesses the presence and impact of herding behaviour across various market conditions, industry sectors and timeframes. The findings reveal nuanced patterns of investor behaviour, with evidence of herd behaviour particularly pronounced during down-market conditions, as indicated by negative and statistically significant coefficients of cross-sectional absolute dispersion returns. Sector-specific analysis unveils varying degrees of herd behaviour, with strong evidence observed in the capital goods and IT sectors, while banking displays a propensity for independent decision-making. The study identifies market capitalization and year-wise variations in herd behaviour, highlighting the dynamic nature of investor sentiment and its implications for market functioning and stability. This comprehensive empirical analysis contributes to a deeper understanding of herd behaviour in the Indian Stock Market, offering valuable insights for investors, policymakers and market participants. The study underscores the importance of considering contextual factors, such as market conditions and industry dynamics, in analysing investor behaviour and its impact on market dynamics. The findings have practical implications for informed decision-making and regulatory interventions aimed at promoting market efficiency and resilience. By elucidating the drivers and consequences of herd behaviour across different dimensions, this research enhances our knowledge of investor behaviour and lays the groundwork for further studies in this area, emphasizing the need for ongoing research to navigate the complexities of financial markets and ensure their stability and integrity.

CSAD returns, Chang model, herd behaviour, Indian Stock Market, S&P BSE 500 Index

Introduction

The study investigates herd behaviour in the Indian Stock Market through an empirical analysis of daily returns for a comprehensive sample of stocks over a period spanning from 2011 to 2020. By examining the presence and impact of herd behaviour across different market conditions, industry sectors, and timeframes, the study aims to provide insights into the dynamics of investor behaviour and its implications for market functioning and stability. Herd behaviour, wherein investors imitate the actions of others rather than independently evaluating market information, has been widely studied in financial markets worldwide. However, its prevalence, drivers and consequences vary across different contexts, making it a subject of ongoing research and debate. In the Indian Stock Market, previous studies have provided insights into herd behaviour, but a comprehensive analysis spanning multiple dimensions is lacking.

To address this gap, the present study conducts a detailed examination of herd behaviour using a diverse set of methodologies and datasets. The analysis begins with a review of existing literature on herd behaviour in financial markets, synthesizing findings from studies conducted in various regions, sectors and timeframes. By drawing on this rich body of research, the study establishes a framework for understanding the nuanced nature of herd behaviour and its implications for market dynamics. The empirical analysis focuses on daily returns for a sample of stocks listed on the Indian Stock Market, encompassing different market capitalizations, industry sectors and time periods. Regression analysis is employed to assess the impact of market conditions, such as up and down-market phases, on the manifestation of herd behaviour. Additionally, the study examines industry-specific patterns of herd behaviour to identify sectoral differences in investor behaviour.

The findings of the study provide valuable insights into the dynamics of herd behaviour in the Indian Stock Market. By elucidating the presence, drivers and consequences of herd behaviour across different dimensions, the study contributes to a deeper understanding of investor behaviour and its implications for market functioning and stability. Moreover, the study offers practical implications for investors, policymakers and market participants, informing decision-making processes and regulatory interventions aimed at promoting market efficiency and resilience. Overall, the study advances our knowledge of herd behaviour in the Indian Stock Market and underscores the importance of considering contextual factors and methodological approaches in studying investor behaviour. Through its rigorous empirical analysis and comprehensive review of literature, the study enhances our understanding of the complexities inherent in financial markets and lays the groundwork for further research in this area.

Literature Review

Herding behaviour in financial markets has been a subject of significant interest and investigation, with numerous studies exploring its presence, dynamics and implications across different markets and periods. This review synthesizes findings from a diverse range of studies spanning various regions, methodologies and timeframes, shedding light on the nuanced nature of herding behaviour and its impact on market dynamics.

Several studies focus on specific regional markets, such as European markets (Brendea et al., 2019; Mobarek et al., 2014) or emerging markets like South Africa (Sarpong, 2014), India (Ansari & Ansari, 2021; Kumar & Bharti, 2017; Prosad et al., 2012), Malaysia (Brahmana et al., 2012), Pakistan (Ahmad & Wu, 2022), Sri Lanka (Abeysekera et al., 2020), Jordan (Ramadan, 2015) and Taiwan (Demirer et al., 2010), providing insights into the prevalence and drivers of herding behaviour in these contexts. These studies highlight the influence of market conditions, regulatory frameworks, and investor behaviour on herd formation, with implications for market stability and investor returns. European stock markets, Caporale et al. (2008) studied Athens Stock Market and found evidence for herd behaviour in extreme market conditions. Khan et al. (2011) investigate herding behaviour in French, German, Italian and English markets, finding its prevalence during normal market fluctuations but noting its absence during periods of market turmoil. However, the study’s limited focus on four markets highlights the need for broader research encompassing diverse market conditions and geographical regions.

Others explore herding behaviour across multiple markets, securities or sectors, revealing cross-market tendencies (BenMabrouk, 2018; Chiang & Zheng, 2010), or sector-specific variations (Musah et al., 2022), Private Equity Industry (Buchner et al., 2020), commodity markets (Steen & Gjolberg, 2013) or options markets (Bernales et al., 2015). Such studies underscore the interconnectedness of global financial markets and the differential impact of herding across industries and securities, offering valuable insights for investors and policymakers. Further exploration into market-specific herding dynamics reveals nuanced patterns. Litimi (2017) focuses on the French stock market during crisis periods, uncovering sector-specific herding behaviour and its impact on market volatility. Similarly, Hudson et al. (2018) delve into UK fund managers’ herding behaviour, emphasizing the role of investor sentiment in shaping institutional herding and its implications for market stability and regulation.

Methodological innovations also feature prominently in the literature, with studies introducing novel measures (Hwang et al., 2001), testing methodologies (Ganesh et al., 2018), Monday irrationality (Brahmana et al., 2012), pension funds (Koetsier & Bikker, 2023), sub-prime crisis in the emerging European markets (Filip et al., 2015) or exploring intraday herding (Henker et al., 2006), enhancing our understanding of herd behaviour and its drivers. Additionally, experimental studies (Azofra et al., 2006) provide controlled environments to examine herding tendencies, offering complementary insights into investor decision-making. Theoretical frameworks, such as those proposed by Hirshleifer and Teoh (2001), offer insights into the underlying mechanisms driving herding behaviour. By delineating incentives for herding and cascading and emphasizing rational social learning models, these frameworks provide a broader perspective on capital market behaviours. Moreover, Saumitra and Sidharth (2014) used cross-sectional distribution approach rather than the traditional standard deviation approach for testing herd behaviour in the Indian Stock Market.

Despite the breadth of research, inconsistencies and debates persist. Some studies find evidence of herding during market downturns (Chang et al., 2000; Christie & Huang, 1995), while others observe herding during calm periods (Hwang et al., 2001), reflecting the complex interplay of factors shaping investor behaviour. Moreover, studies on market efficiency and information transmission (Da & Shive, 2017; Tan & Chiang, 2005) highlight the role of herding in price formation and market efficiency, with implications for asset pricing models and investment strategies. Studies from emerging markets provide valuable insights into herding behaviour across different economic contexts. Tauseef (2023) explores herding behaviour in the Pakistan Stock Exchange, highlighting its prevalence during crises and calendar events, while Bui et al. (2015) examine Southeast Asian markets, emphasizing the role of institutional investors in driving herding behaviour and the need for regulatory measures.

Moreover, empirical evidence challenges conventional perceptions and sheds light on unique market dynamics. Rubbaniy et al. (2012) challenge the notion of passive trading among Dutch pension funds, revealing significant herding behaviour and feedback trading strategies. Similarly, studies on Latin American (Vieito et al., 2022) and Vietnamese (Tessaromatis & Thomas, 2009) markets uncover strong herding tendencies and market-specific influences on herding behaviour. Kumar and Bharti (2017) investigate herding behaviour in the Indian equity market, specifically in the IT sector. Their findings challenge prior assumptions, indicating a lack of conclusive evidence of herding in Indian IT sector stocks. Similarly, Kanojia et al. (2020) explore herd behaviour in the Indian Stock Market, revealing no discernible evidence of herding over a decade-long period, attributed to the dominance of institutional investors. Even, Javaira & Hassan (2015) found no evidence for herd behaviour in Pakistan markets except during the liquidity crisis.

Moving to Latin American markets, Lavin and Magner (2013) delve into Chilean equity mutual funds, uncovering intentional herding effects attributed to agency problems and investor biases. Additionally, Vieito et al. (2022) investigate herding behaviour in the Latin American Integrated Market (MILA), highlighting its prevalence under specific market conditions and its sensitivity to time-varying volatilities. Exploring Asian markets, Yao et al. (2013) examine herding behaviour in Chinese A and B stock markets, revealing varying levels of herding across market segments and industries. Furthermore, Medhioub and Chaffai (2017) focus on Islamic stock markets in the Gulf Cooperation Council (GCC), identifying significant herding behaviour in Saudi and Qatari markets during downturns, Ah Mand et al. (2023) observed herd behaviour between Islamic and conventional markets.

Studies also delve into the theoretical underpinnings of herding behaviour and its implications for market dynamics. Shapira et al. (2014) propose a novel model treating stock markets as networks of investors, capturing key characteristics of market behaviour and correlations. Additionally, Wang and Sun (2014) provide competitive models explaining investors’ use of technical analysis, shedding light on rational information discovery versus irrational herding behaviour. Further, exploring unique market conditions and events, Shantha (2019) investigates herding behaviour in the Colombo Stock Exchange of Sri Lanka, revealing evolving patterns influenced by political instability and speculative bubbles. Similarly, Gavriilidis et al. (2007) examine herding behaviour during the Argentine financial crisis, offering insights into its evolution amidst market turmoil.

Lastly, studies on investor behaviour and decision-making dynamics contribute to our understanding of herding phenomena. Sachdeva et al. (2021) identify key motivators for herding behaviour among Indian stock investors, offering practical implications for informed decision-making and policymaking. Moreover, Stavroyiannis and Babalos (2018) uncover negative herding behaviour in Eurozone markets, with implications for portfolio diversification strategies.

Herd behaviour was observed during market crisis of 1999 and surprisingly investors became cautious after 2002. Studies investigated the linkage between volatility and herding (Blasco et al., 2012) in Spanish markets with intraday samples. Results indicated a direct linear effect of herding on volatility (realized and implied). Herding measurement variables need to be considered, while predicting volatility. Studies conducted on Indian bourses (Madaan & Shrivastava, 2022; Sahoo et al., 2023) revealed a positive and significant association between herding and volume turnover, volatility, information asymmetry. Further studies examined herding in two different shades as value-based herding and count-based herding. Both separate herding ratio, as buy side and sell side based on the positive and negative values of the ratio as well as to investigate their impact on asset prices. Often studies observed herding in investment houses (both domestic and foreign) recommendations (Ahluwalia et al., 2017) relating to specific stocks. Explored the behaviour by applying event study methodologies and found that CAAR is negative, insignificant for large cap, mid-cap stocks.

Herding by the institutional investors like mutual funds, venture capital firms, hedge fund houses in bond market is higher than equities. In US bond markets (Cai et al., 2019), sell-side herding is more prevalent than buy-side herding. Impact of this herding on prices is also highly asymmetric in nature. Generally, in equity markets institutional herding is low and evidences are presented in small stocks and growth funds.

Traces of herding by pension funds and mutual funds in stocks are lower, but in small-cap stocks it is higher (Lakonishok et al., 1992; Wermers, 1999) and in low-rating bonds like junk bonds category, herding is substantially higher. Few studies examined industry herding, FIIs herding in association with stock market returns, trading volume (displayed an inverse relationship with herding) and volatility periods (Choudhary et al., 2022; Madaan & Panda, 2023; Sahoo et.al., 2023) revealed a positive relationship between FIIs, lagged market returns and herding. Presence of close nexus is evident between stock market returns and herding in India. Cumulative returns response to buy-side and sell-side herding is contrasting. Sell-side herding of FIIs producing return reversals and cumulative returns are decreasing in a short period. Stock prices are falling below their intrinsic values in case of sell-side herding.

Chinese stock markets displayed that COVID-19 pandemic (Fei & Zhang, 2023) related herd behaviour has negative effect on stock market stability. Significant presence of herd behaviour is observed during COVID-19. There is also an asymmetry exits in herd behaviour between bull and bear markets. Herd behaviour affects the market volatility negatively (Choudhary et al., 2022).

After major economic turbulences like financial crisis, pandemic and sub-prime crisis, current research works on herding, isolating the behaviour of institutional investors at individual level and investigating the influence of individual institutional investors on the market. Till date, research experienced a combined effect of domestic and foreign institutional investors. FIIs exhibits (Sahoo et al., 2023) a tendency to reproduce the investment behaviour of their peers and this characteristic leads to herding in the financial markets. FIIs herding adversely affecting the stock prices and in energy stocks buy-side herding dominating sell-side herding (Madaan & Panda, 2023; Madaan & Shrivastava, 2022). Numerous studies found out a strong association between COVID-19 pandemic and uncertainty raised in the financial markets due to flow of herd information (Bouri et al., 2021) among investors. Specifically, emerging markets’ and European markets; response to the herding during COVID-19 is more impactful.

In conclusion, the literature on herding behaviour offers a rich tapestry of insights into the dynamics of financial markets, emphasizing the multifaceted nature of investor behaviour and its implications for market functioning and stability. While the evidence points to the presence of herding across various contexts, further research is warranted to elucidate its drivers, consequences and potential mitigation strategies, particularly in the context of evolving market structures and regulatory frameworks.

Methodology

The dataset utilized in this study encompasses firms listed in the S&P BSE 500 Index, which collectively represent more than 90% of India’s total market capitalization. Established on 9 August 1999, the index comprises 500 firms spanning across various sectors of the Indian economy. Daily data spanning from 1 January 2011 to 31 December 2020, inclusive of the volatile year of 2020, were analysed to explore investor herding behaviour, particularly during the COVID-19 period. This data period is critical for analysis due to few noteworthy events happened during this period like market recovery after the Satyam scandal (2009), NSEL scam (2013), aftermath of demonetization in the markets (2016), and COVID-19 pandemic (2020) events brought down the markets to extremely low levels. It is closely observed that every five-year cycle, these systemic risk events creating a market disturbance, which needs to be examined thoroughly with market wide herding measures. Retail investors participation increased to 45% in the year 2021 and retail accounts with NSDL (19.7 lakh new accounts added as on 2021) and CDSL (122.5 lakh new accounts added as on 2021) representing an exponential growth in terms of numbers. Buffet indicator (ratio of market capitalization to GDP) also increasing steadily in the economy during the study period, as a result, the period of the study became a key factor for analysis. The data were sourced from the S&P BSE website, ensuring the inclusion of all active firms throughout the study period to reduce survivorship bias. The study scrutinized herd behaviour within the S&P BSE 500 Index over a decade from 2011 to 2020, examining various cross-sectional dimensions, including market capitalization, industry-wise analysis, and year-wise categories such as large cap (69 stocks), mid-cap (73 stocks), small cap (200 stocks), as well as the full sample (372 stocks), across up and down markets.

To investigate herding behaviour, the study employed the Chang, Cheng and Khorana (CCK) model, chosen over the Christie and Huang model due to its capacity to capture herding across a broader spectrum of returns, encompassing normal returns, and its recognition of the linear relationship between equity return dispersion and market conditions (Chang et al., 2000). The CCK model was considered more suitable for analysing daily return data, offering insights into short-lived herding behaviour, which is particularly pertinent given the volatility and sensitivity of markets. This methodology facilitates a comprehensive understanding of investor behaviour under diverse market conditions and timeframes, thereby contributing valuable insights into the dynamics of the Indian Stock Market.

The study conducted by Chang et al. (2000) introduces rational asset pricing models suggesting a linear, increasing relationship between cross-sectional absolute dispersion (CSAD) and the absolute market return. However, in instances where investors exhibit herding behaviour, characterized by mimicking others’ actions and individual returns aligning with the overall market return, a negative, significant nonlinear relationship between CSAD and overall market return emerges, marked by a negative coefficient of (Rm,t). CSAD, representing the average dispersion of securities, is computed as the absolute average of the difference between the expected individual security return and market return.

(1)

(1)

(2)

(2)

In Equation (1), CSAD represents the average dispersion of the securities, where Rm,t denotes the absolute market return on day Ri,t represents the stock return of security at time t, and N is the number of firms in the portfolio. Moving to Equation (2), Rm,t signifies the absolute market return, while (Rm,t)2 represents the squared market return. A positive and statistically significant coefficient of β1 in Equation (2) indicates that asset pricing model predictions remain unviolated. Conversely, a significantly negative β2 suggests the presence of herding behaviour. To assess the asymmetric effects of herding in both up and down markets, the study employs the subsequent equations.

(3)

(3)

(4)

(4)

In this context, .png) and

and .png) represent the absolute value of the equally weighted portfolio return of stocks on day t for up and down markets, respectively. Here, Rm,t > 0 indicates an up market, while Rm,t < 0 indicates a down market. Negative and statistically significant coefficients of

represent the absolute value of the equally weighted portfolio return of stocks on day t for up and down markets, respectively. Here, Rm,t > 0 indicates an up market, while Rm,t < 0 indicates a down market. Negative and statistically significant coefficients of .png) and

and .png) indicate evidence of herding in up and down markets, respectively, while positive and significant coefficients of

indicate evidence of herding in up and down markets, respectively, while positive and significant coefficients of .png) and

and .png) demonstrate negative herding.

demonstrate negative herding.

Analysis and Interpretation

Table 1 presents descriptive statistics for the returns of CSAD and the S&P BSE 500 Index, providing insights into their performance characteristics. First, the mean return for CSAD stands notably higher at 0.343194 compared to the S&P BSE 500 Index’s mean return of 0.033398, indicating that CSAD has historically yielded superior average returns. Moreover, CSAD exhibits lower volatility with a standard deviation of 0.304867, contrasting sharply with the S&P BSE 500 Index’s higher standard deviation of 1.073053, implying that CSAD’s returns are less dispersed around its mean.

Table 1. Descriptive Statistics of CSAD and S&P BSE 500 Index Returns.

Additionally, the skewness of CSAD’s returns is positive (1.982013), suggesting a right-skewed distribution with a tail extending towards higher returns, while the S&P BSE 500 Index’s returns exhibit negative skewness (.png) 1.33354), indicating a left-skewed distribution with a tail towards lower returns. Both CSAD and the S&P BSE 500 Index display high kurtosis, implying heavier tails in their return distributions compared to a normal distribution. Furthermore, the range of CSAD returns (2.571757) is narrower than that of the S&P BSE 500 Index (21.28246), reflecting less variability in CSAD returns. These statistics collectively underscore the differences in distributional properties, volatility and central tendency between CSAD and the broader market represented by the S&P BSE 500 Index.

1.33354), indicating a left-skewed distribution with a tail towards lower returns. Both CSAD and the S&P BSE 500 Index display high kurtosis, implying heavier tails in their return distributions compared to a normal distribution. Furthermore, the range of CSAD returns (2.571757) is narrower than that of the S&P BSE 500 Index (21.28246), reflecting less variability in CSAD returns. These statistics collectively underscore the differences in distributional properties, volatility and central tendency between CSAD and the broader market represented by the S&P BSE 500 Index.

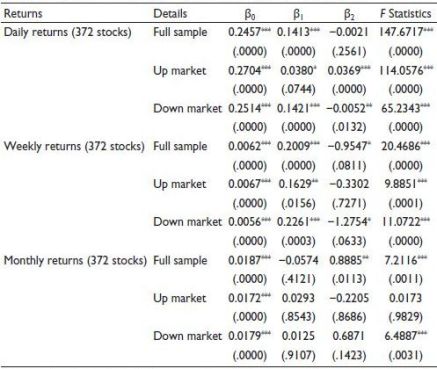

Table 2 contains regression results for CSAD returns, categorized by different market conditions (full sample, up market and down market) and different time frames (daily, weekly and monthly returns). In the case of daily returns for the full sample, β2 is not statistically significant. This suggests that there is no evidence of herd behaviour affecting daily returns in the full sample. In the up-market condition for daily returns, β2 is positive but not statistically significant. This may indicate a lack of herd behaviour during up-market conditions on a daily basis. In the down-market condition for daily returns, β2 is negative and statistically significant at the 5% level. This implies that there is evidence of herd behaviour impacting CSAD returns during down-market conditions on a daily basis. Investors may be more likely to follow the crowd when markets are performing poorly.

Table 2. CSAD Returns of the Full Sample, Up Market and Down Market.

Note: p values in parenthesis. Statistically significant *@ 10% level, **@ 5% level and ***@ 1% level.

For weekly and monthly returns, β2 is also negative in some cases but not statistically significant, except for weekly returns in the full sample and down-market, where it is significant at the 10% level. This suggests that herd behaviour might have a more noticeable impact on CSAD returns during down-market conditions over weekly time frame. It is important to consider the practical implications of these findings. The negative and significant β2 values during down-market conditions on a daily and weekly basis suggest that investors might be more prone to herd behaviour during market downturns. This behaviour could lead to greater market volatility and potentially exacerbate market declines as investors react to each other’s actions.

Table 3 depicts the full sample for large-cap stocks β2 is .png) 0.0010, and it is not statistically significant (p = .6145), there is no statistically significant evidence of herd behaviour affecting CSAD returns. In up-market conditions for large-cap stocks, β2 is positive (0.0117) and significant at the 5% level (p = .0356). This indicates that there is no evidence of herd behaviour. In down-market conditions for large-cap stocks, β2 is negative (

0.0010, and it is not statistically significant (p = .6145), there is no statistically significant evidence of herd behaviour affecting CSAD returns. In up-market conditions for large-cap stocks, β2 is positive (0.0117) and significant at the 5% level (p = .0356). This indicates that there is no evidence of herd behaviour. In down-market conditions for large-cap stocks, β2 is negative (.png) 0.0029) but not statistically significant, suggesting limited evidence of herd behaviour impacting CSAD returns during market downturns. In the full sample for mid-cap stocks β2 is

0.0029) but not statistically significant, suggesting limited evidence of herd behaviour impacting CSAD returns during market downturns. In the full sample for mid-cap stocks β2 is .png) 0.0045, and it is statistically significant at the 1% level (p = .0032), there is strong evidence of herd behaviour negatively impacting CSAD returns. In up-market conditions for mid-cap stocks β2 is 0.0024, and it is not statistically significant (p = .7081), there is no statistically significant evidence of herd behaviour affecting CSAD returns. In down-market conditions for mid-cap stocks β2 is

0.0045, and it is statistically significant at the 1% level (p = .0032), there is strong evidence of herd behaviour negatively impacting CSAD returns. In up-market conditions for mid-cap stocks β2 is 0.0024, and it is not statistically significant (p = .7081), there is no statistically significant evidence of herd behaviour affecting CSAD returns. In down-market conditions for mid-cap stocks β2 is .png) 0.0055, and it is statistically significant at the 1% level (p = .0012), there is strong evidence of herd behaviour negatively impacting CSAD returns.

0.0055, and it is statistically significant at the 1% level (p = .0012), there is strong evidence of herd behaviour negatively impacting CSAD returns.

Table 3. CSAD Daily Returns of the Stocks Segregated Based on the Market Capitalization Wise.

Note: p values in parenthesis. Statistically significant *@ 10% level, **@ 5% level and ***@ 1% level.

In the full sample for small-cap stocks β2 is 0.0002, and it is not statistically significant (p = .8657), there is no statistically significant evidence of herd behaviour affecting CSAD returns. In up-market conditions for small-cap stocks β2 is 0.0127, and it is statistically significant at the 5% level (p = .0079). This indicates that there is no evidence of herd behaviour. In down-market conditions for small-cap stocks, β2 is negative (.png) 0.0004) and it is not statistically significant (p = .7121), suggesting limited evidence of herd behaviour impacting CSAD returns during market downturns. In mid-cap stocks, there is strong evidence of herd behaviour, particularly in full sample and down markets, negatively impacting returns. Large-cap stocks show some evidence of herd behaviour in full sample and down markets, but the effect is less pronounced. Small-cap stocks exhibit less evidence of herd behaviour in down markets, negatively affecting returns, but the effect is not statistically significant. These findings suggest that the impact of herd behaviour varies by market capitalization and market conditions, with mid-cap stocks being most affected by herd behaviour, particularly during market downturns. Investors in small-cap stocks tend to follow the crowd in down markets, leading to negative returns, but the effect is less significant during up markets.

0.0004) and it is not statistically significant (p = .7121), suggesting limited evidence of herd behaviour impacting CSAD returns during market downturns. In mid-cap stocks, there is strong evidence of herd behaviour, particularly in full sample and down markets, negatively impacting returns. Large-cap stocks show some evidence of herd behaviour in full sample and down markets, but the effect is less pronounced. Small-cap stocks exhibit less evidence of herd behaviour in down markets, negatively affecting returns, but the effect is not statistically significant. These findings suggest that the impact of herd behaviour varies by market capitalization and market conditions, with mid-cap stocks being most affected by herd behaviour, particularly during market downturns. Investors in small-cap stocks tend to follow the crowd in down markets, leading to negative returns, but the effect is less significant during up markets.

Table 4 provides the analysis of CSAD daily returns across different industry sectors in reveals distinct patterns of investor behaviour, shedding light on the presence of herd behaviour in the Indian Stock Market. Notably, the banking industry stands out as a sector where investors seem to act independently, as indicated by a positively significant β2 coefficient. This suggests that during the daily trading of banking stocks, investors do not tend to follow the crowd, making decisions that are more individualistic. In contrast, the capital goods industry presents a striking example of herd behaviour, with a negatively significant β2. In this sector, investors exhibit a propensity to imitate the actions of others, potentially leading to suboptimal investment decisions. This divergence in behaviour across industries underscores the impact of sector-specific factors, market dynamics and investor sentiment in shaping trading decisions.

While herd behaviour is evident in the capital goods sector, other industries such as IT and Utilities also show positively significant β2 coefficients. These findings imply that herd behaviour, where investors collectively influence returns, is not confined to a single direction. Rather, it can manifest as both positive and negative influences on CSAD returns within different industry contexts. Furthermore, the absence of statistically significant β2 coefficients in the FMCG and healthcare sectors indicates that, in these industries, investor decisions appear to be driven by factors other than herding behaviour. This underscores the multifaceted nature of financial markets, where the interplay of industry-specific variables and investor sentiment leads to varying degrees of herding or independent decision-making.

Table 4. CSAD Daily Returns of Stocks Segregated Based on Industry Wise.

Note: p values in parenthesis. Statistically significant *@ 10% level, **@ 5% level and ***@ 1% level.

The analysis of industry-wise CSAD daily returns underscores the dynamic nature of investor behaviour in the Indian Stock Market. The presence and direction of herd behaviour vary across sectors, with the banking industry characterized by independent decision-making, the capital goods sector exhibiting strong herd behaviour, and others displaying a mix of both positive and negative influences. These results emphasize the crucial role of sector-specific dynamics, market conditions, and individual investor sentiment in shaping investment choices, providing valuable insights for market participants and policymakers.

Table 5 provides data on CSAD weekly returns for stocks segregated based on year wise (from 2011 to 2020) in the Indian Stock Market. The table includes coefficients β0, β1, and β2, along with F statistics, with p values indicating statistical significance. In 2020, there is clear and statistically significant evidence of herd behaviour. The β2 coefficient is negatively significant, indicating that investors exhibited herd behaviour. This suggests that during 2020, investors collectively influenced stock returns by moving along with the prevailing sentiment. This herd behaviour may have been driven by factors unique to that year, such as the COVID-19 pandemic and economic uncertainty.

Table 5. CSAD Values of Full Sample Segregated Based on Year Wise.

Note: p values in parenthesis. Statistically significant *@ 10% level, **@ 5% level and ***@ 1% level.

In the years 2013, 2014, 2015, 2016 and 2017, there is no statistically significant evidence of herd behaviour. During these years, β2 is positively significant, suggesting that investors were not significantly influenced by the actions of others, and market dynamics were driven by factors other than traditional herd behaviour. These years represent periods where investors may have made decisions independently or reacted to market conditions based on factors other than following the crowd. In the remaining years, 2011, 2012, 2018 and 2019, there is also no statistically significant evidence of herd behaviour. β2 is not significantly negative, indicating that herd behaviour, as defined by negatively significant β2, was not observed. These findings highlight the complex and dynamic nature of investor behaviour over the years, where herd behaviour can manifest differently in different periods, driven by a variety of market dynamics and sentiment factors.

Scope and Limitations of the Study

The study tested herd behaviour in S&P BSE 500 Index across various segments ranging from industry to stock classification along with different phases in the market. Future studies can be further extended to explore the presence of herd behaviour in sectoral, thematic and innovative indices so that regulators may caution the market participants, namely retail investors, institutional investors and government about the abnormalities. Herd behaviour can be further tested across various markets like Emerging VS Developed, BRICS VS MENA, G7 VS G20, Asian Economies and so on to explore the risk spill overs to sensitize about asset bubbles, market crashes. Research delineated towards market wide herding, than institutional investors herding. More research needs to happen in the area of institutional investors herding like mutual funds, pension funds, insurance companies and so on. This is one of the shortcomings of this research. As herding measures are innate in nature, there may be a chance that results are affected by the outliers.

This study helps the policy makers in fixing the market-wide circuit breakers during extreme market moments. Retail investors’ participation in stock markets soaring to new heights in the recent past, there is also possibility of dominating non-fundamental herding patterns. As herding is a relative concept and a phenomenon of social contagion, it needs to be monitored and controlled.

Conclusion

Based on an empirical investigation spanning from 2011 to 2020, this study delves into herd behaviour in the Indian Stock Market, focusing on the daily returns of stocks listed in the S&P BSE 500 Index. Employing the CCK model, the research scrutinizes herd behaviour across diverse market conditions, industry sectors and timeframes. Results unveil nuanced patterns, with herd behaviour notably pronounced during down-market conditions, especially evident through negative and statistically significant coefficients of CSAD returns. A sector-specific analysis further reveals varying degrees of herd behaviour, with strong evidence observed in capital goods and IT sectors, while banking displays a propensity for independent decision-making. Moreover, the study identifies market capitalization and year-wise variations in herd behaviour, emphasizing the dynamic nature of investor sentiment and its implications for market functioning and stability.

This comprehensive empirical analysis contributes significantly to understanding herd behaviour in the Indian Stock Market, offering valuable insights for investors, policymakers and market participants. The study underscores the importance of considering contextual factors such as market conditions and industry dynamics when analysing investor behaviour and its impact on market dynamics. Practical implications highlight the need for informed decision-making and regulatory interventions aimed at enhancing market efficiency and resilience. By elucidating drivers and consequences of herd behaviour across different dimensions, this research enhances knowledge of investor behaviour and lays the groundwork for further studies in this area, emphasizing the ongoing need for research to navigate financial market complexities and ensure stability and integrity.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iDs

Kompalli Sasi Kumar  https://orcid.org/0000-0003-3816-1793

https://orcid.org/0000-0003-3816-1793

Nagendra Marisetty  https://orcid.org/0000-0003-3939-5794

https://orcid.org/0000-0003-3939-5794

Abeysekera, S. M., Wijesinghe, D. C., & Weligamage, S. S. (2020). An examination of herd behaviour: Evidence from Colombo Stock Exchange. SSRN Electronic Journal, 197–209. https://doi.org/10.2139/ssrn.3889078

Ah Mand, A., Janor, H., Abdul Rahim, R., & Sarmidi, T. (2023). Herding behaviour and stock market conditions. PSU Research Review, 7(2), 105–116. https://doi.org/10.1108/PRR-10-2020-0033

Ahluwalia, N. S., Gupta, M., & Aggarwal, N. (2017). Stock buy recommendations and their impact: Evidence from Indian capital markets. Abhigyan, XXXV(2), 28–41.

Ahmad, M., & Wu, Q. (2022). Does herding behaviour matter in investment management and perceived market efficiency? Evidence from an emerging market. Management Decision, 60(8), 2148–2173. https://doi.org/10.1108/MD-07-2020-0867

Ansari, A., & Ansari, V. A. (2021). Do investors herd in emerging economies? Evidence from the Indian equity market. Managerial Finance, 47(7), 951–974. https://doi.org/10.1108/MF-06-2020-0331

Azofra, V., Fernández., B., & Vallelado., E. (2006). An experimental study of herding and contrarian behavior among financial investors. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.932928

BenMabrouk, H. (2018). Cross-herding behaviour between the stock market and the crude oil market during financial distress: Evidence from the New York Stock Exchange. Managerial Finance, 44(4), 439–458. https://doi.org/10.1108/MF-09-2017-0363

Bernales, A., Verousis, T., & Voukelatos, N. (2015). Do investors follow the herd in option markets? https://doi.org/10.2139/ssrn.3336268

Blasco, N., Corredor, P., & Ferreruela, S. (2012). Does herding affect volatility? Implications for the Spanish stock market. Quantitative Finance, 12(2), 311–327. https://doi.org/10.1080/14697688.2010.516766

Bouri, E., Demirer, R., Gupta, R., & Nel, J. (2021). COVID-19 pandemic and investor herding in international stock markets. Risks, 9, 168. https://doi.org/10.3390/risks9090168

Brahmana, R., Hooy, C. W., & Ahmad, Z. (2012). The role of herd behaviour in determining the investor’s Monday irrationality. Asian Academy of Management Journal of Accounting and Finance, 8(2), 1–20.

Brendea, G., & Pop, F. (2019). Herding behaviour and financing decisions in Romania. Managerial Finance, 45(6), 716–725. https://doi.org/10.1108/MF-02-2018-0093

Buchner, A., Mohamed, A., & Schwienbacher, A. (2020). Herd behaviour in buyout investments. Journal of Corporate Finance, 60(August). https://doi.org/10.1016/j.jcorpfin.2019.101503

Bui, N. D., Nguyen, L. T. B., & Nguyen, N. T. T. (2015). Herd behaviour in Southeast Asian Stock Markets—An empirical investigation. Acta Oeconomica, 65(3), 413–429. https://doi.org/10.1556/032.65.2015.3.4

Cai, F., Han, S., Li, D., & Li, Y. (2019). Institutional herding and its price impact: Evidence from the corporate bond market. Journal of Financial Economics, 131, 139–167.

Caporale, G. M., Economou, F., Philippas, N., & London, W. (2008). Herd behaviour in extreme market conditions. Economics Bulletin, 7(17), 1–13. https://bura.brunel.ac.uk/handle/2438/3462%0A

Chang, E.C., Cheng, J.W., & Khorana, A. (2000). An examination of herd behaviour in equity markets: An international perspective. Journal of Banking and Finance, 24(10), 1651–1679.

Chiang, T. C., & Zheng, D. (2010). An empirical analysis of herd behaviour in global stock markets. Journal of Banking and Finance, 34(8), 1911–1921. https://doi.org/10.1016/j.jbankfin.2009.12.014

Choudhary, K., Singh, P., & Soni, A. (2022). Relationship between FIIs’ herding and returns in the Indian equity market: Further empirical evidence. Global Business Review, 23(1), 137–155. https://doi.org/10.1177/0972150919845223

Christie, W. G., & Huang, R. D. (1995). Following the pied piper: Do individual returns herd around the market? Financial Analysts Journal, 51(4), 31–37. https://doi.org/10.2469/faj.v51.n4.1918

Da, Z., & Shive, S. (2017). Exchange traded funds and asset return correlations. European Financial Management, 24(1), 136–168. https://doi.org/10.1111/eufm.12137

Demirer, R., Kutan, A. M., & Chen, C. D. (2010). Do investors herd in emerging stock markets? Evidence from the Taiwanese market. Journal of Economic Behaviour and Organization, 76(2), 283–295. https://doi.org/10.1016/j.jebo.2010.06.013

Fei, F., & Zhang, J. (2023). Chinese stock market volatility and herding behaviour asymmetry during the COVID-19 pandemic. Cogent Economics & Finance, 11, 2203436. https://doi.org/10.1080/23322039.2023.2203436

Filip, A., Pochea, M., & Pece, A. (2015). The herding behaviour of investors in the CEE stocks markets. Procedia Economics and Finance, 32(15), 307–315. https://doi.org/10.1016/s2212-5671(15)01397-0

Ganesh, R., Gopal, N., & Thiyagarajan, S. (2018). Bulk and block holders herding behaviour. South Asian Journal of Business Studies, 7(2), 150–171. https://doi.org/10.1108/SAJBS-12-2017-0139

Gavriilidis, C., Kallinterakis, V., & Micciullo, P. (2007). The Argentine crisis: A case for herd behaviour? SSRN Electronic Journal. https://doi.org/10.2139/ssrn.980685

Henker, J., Henker, T., & Mitsios, A. (2006). Do investors herd intraday in Australian equities? International Journal of Managerial Finance, 2(3), 196–219. https://doi.org/10.1108/17439130610676475

Hirshleifer, D. A., & Teoh, S. H. (2001). Herd behaviour and cascading in capital markets: A review and synthesis. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.

4380872

Hudson, Y. B., Yan, M., Zhang, D., & Hudson, Y. (2018). Herd behaviour & investor sentiment: Evidence from UK mutual funds provisional draft: Not for quotation. https://ssrn.com/abstract=3222312

Hwang, S., & Salmon, M. (2001). A new measure of herding and empirical evidence, C.U. School (Éd.) [CUBS Financial Econometrics Working Paper No. WP01-12].

Javaira, Z., & Hassan, A. (2015). An examination of herding behaviour in Pakistani stock market. International Journal of Emerging Markets, 10(3), 474–490. https://doi.org/10.1108/IJoEM-07-2011-0064

Jirasakuldech, B., & Emekter, R. (2021). Empirical analysis of investors’ herding behaviours during the market structural changes and crisis events: Evidence from Thailand, Global Economic Review, 50(2), 139–168. https://doi.org/10.1080/1226508X.2020.

1821746

Kanojia, S., Singh, D., & Goswami, A. (2020). Impact of herding on the returns in the Indian Stock Market: An empirical study. Review of Behavioural Finance, 14(1), 115–129. https://doi.org/10.1108/RBF-01-2020-0017

Khan, H., Hassairi, S. A., & Viviani, J.-L. (2011). Herd behaviour and market stress: The case of four European countries. International Business Research, 4(3), 53–67. https://doi.org/10.5539/ibr.v4n3p53

Koetsier, I., & Bikker, J. A. (2023). Herd behaviour of pension funds by asset class. International Journal of Economics and Finance, 15(2), 26. https://doi.org/10.5539/ijef.v15n2p26

Kumar, A. Bharti. (2017). Herding in Indian Stock Markets: An evidence from information technology sector. IOSR Journal of Economics and Finance, 1–7. https://www.iosrjournals.org/iosr-jef/papers/(SIFICO)-2017/Volume-1/1.%2001-07.pdf

Lakonishok, J., Shleifer, A., & Vishny, R. W. (1992). The impact of institutional trading on stock prices. Journal of Financial Economics, 31

Lavin, J. F., & Magner, N. S. (2013). Herding in the mutual fund industry: Evidence from Chile. Academia Revista Latinoamericana de Administracion, 27(1), 10–29. https://doi.org/10.1108/ARLA-09-2013-0137

Litimi, H. (2017). Herd behaviour in the French stock market. Review of Accounting and Finance, 16(4), 497–515. https://doi.org/10.1108/RAF-11-2016-0188

Madaan, V., & Panda, L. (2023). Determinants of industry herding in the Indian Stock Market. Business Perspectives and Research. https://doi.org/10.1177/22785337231176870

Madaan, V., & Shrivastava, M. (2022). FIIs herding in energy sector of Indian Stock Market. South Asian Journal of Business Studies, 11(2), 174–194. https://doi.org/10.1108/SAJBS-02-2020-0033

Medhioub, I., & Chaffai, M. (2017). Islamic finance and herding behaviour: An application to Gulf Islamic stock markets. Review of Behavioural Finance, 10(2), 192–206. https://doi.org/10.1108/RBF-02-2017-0014

Mobarek, A., Mollah, S., & Keasey, K. (2014). A cross-country analysis of herd behaviour in Europe. Journal of International Financial Markets, Institutions and Money, 32(1), 107–127. https://doi.org/10.1016/j.intfin.2014.05.008

Musah, G., Domeher, D., & Alagidede, I. (2022). Effect of presidential elections on investor herding behaviour in African stock markets. International Journal of Emerging Markets, 19(5), 1157–1177. https://doi.org/10.1108/IJOEM-06-2021-0960

Prosad, J. M. P., Kapoor, S., & Sengupta, J. (2012). An examination of herd behaviour: An empirical evidence from Indian Equity Market. International Journal of Trade, Economics and Finance, 3(2), 2–5.

Ramadan, I. Z. (2015). Cross-sectional absolute deviation approach for testing the herd behaviour theory: The case of the ASE Index. International Journal of Economics and Finance, 7(3), 188–193. https://doi.org/10.5539/ijef.v7n3p188

Rubbaniy, G., van Lelyveld, I., & Verschoor, W. (2012). Herding behaviour and trading among Dutch pension funds. Mimeo, Erasmus School of Economics.

Sachdeva, M., Lehal, R., Gupta, S., & Garg, A. (2021). What make investors herd while investing in the Indian Stock Market? A hybrid approach. Review of Behavioural Finance, 15(1), 19–37. https://doi.org/10.1108/RBF-04-2021-0070

Sahoo, G. S., Rajvanshi V., Syamala, S. R. (2023). Herd behaviour of institutional investors: Evidence from an emerging market. Working Paper-IIM Kozhikode.

Sarpong, P. K. (2014). Against the herd: Contrarian investment strategies on the Johannesburg Stock Exchange. Journal of Economics and Behavioural Studies, 6(2), 120–129. https://doi.org/10.22610/jebs.v6i2.475

Saumitra, B., & Sidharth, M. (2012). Applying an alternative test of herding behaviour: A case study of the Indian Stock Market. MPRA Munich Personal RePEc Archive. https://mpra.ub.uni-muenchen.de/38014/

Shantha, K. V. A. (2019). The evolution of herd behaviour: Will herding disappear over time? Studies in Economics and Finance, 36(3), 637–661. https://doi.org/10.1108/SEF-06-2018-0175

Shapira, Y., Berman, Y., & Ben-Jacob, E. (2014). Modelling the short-term herding behaviour of stock markets. New Journal of Physics, 16. https://doi.org/10.1088/1367-

2630/16/5/053040

Stavroyiannis, S., & Babalos, V. (2018). Time-varying herding behaviour within the Eurozone stock markets during crisis periods: Novel evidence from a TVP model. Review of Behavioural Finance, 12(2), 83–96. https://doi.org/10.1108/RBF-07-

2018-0069

Steen, M., & Gjolberg, O. (2013). Are commodity markets characterized by herd behaviour? Applied Financial Economics, 23(1), 79–90. https://doi.org/10.1080/09603107.2012.707770

Tan, L., & Chiang, T. (2005). Empirical analysis of Chinese stock market behavior: Evidence from dynamic correlations, herding behavior, and speed of adjustment [PhD thesis, Drexel University].

Tauseef, S. (2023). Herd behaviour in an emerging market: An evidence of calendar and size effects. Journal of Asia Business Studies, 17(3), 639–655. https://doi.org/10.1108/JABS-10-2021-0430

Tessaromatis, N., & Thomas, V. (2009). Herding behaviour in the Athens Stock Exchange. Investment Management and Financial Innovations, 6(3), 156–164.

Vieito, J. P., Espinosa, C., Wong, W. K., Batmunkh, M. U., Choijil, E., & Hussien, M. (2022). Herding behaviour in integrated financial markets: The case of MILA. International Journal of Emerging Markets. https://doi.org/10.1108/IJOEM-08-

2021-1202

Wang, T., & Sun, Q. (2014). Why investors use technical analysis? Information discovery versus herding behaviour. China Finance Review International, 5(1), 53–68. https://doi.org/10.1108/CFRI-08-2014-0033

Wermers, R. (1999). Mutual fund herding and the impact on stock prices. The Journal of Finance, 54(2), 581–622. http://www.jstor.org/stable/2697720

Yao, J., Ma, C., & He, W. P. (2013). Investor herding behaviour of Chinese stock market. International Review of Economics and Finance, 29, 12–29. https://doi.org/10.1016/j.iref.2013.03.002